|

|

9 November 2022 Volumes surge amidst latest shakeup |

| LMAX Digital performance |

|

LMAX Digital volumes were quite robust on Tuesday. Total notional volume for Tuesday came in at $1.9 billion, 366% above 30-day average volume. Bitcoin volume printed $1.1 billion on Tuesday, 409% above 30-day average volume. Ether volume came in at $566 million, 288% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,774 and average position size for ether at 2,889. Volatility has picked up in recent sessions, with the market surging out from yearly and multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $837 and $103 respectively. |

| Latest industry news |

|

The year of 2022 has been a year where for the most part, much of the direction in crypto markets has been predicated on developments on the global macro front. That is to say, crypto direction has been largely influenced by rising inflation, central bank response, and overall risk sentiment. But there have been some exceptions in 2022, exceptions where crypto markets have suffered on account of discouraging industry specific fundamentals. We saw this earlier in the year around blowups at Luna, 3AC, and Celsius, and we’re seeing it again now this week with the FTX implosion. All of these cases have been about questionable operations and businesses practices, with this latest case seemingly falling under the same umbrella. The market is still trying to figure it all out, but there has been a clear reduction in appetite in the immediate aftermath of the FTX story. As we highlighted on Tuesday, the good news for crypto assets right now is that the fallout has been somewhat mitigated by the fact that traditional risk assets have been better supported of late. At the same time, there is concern that risk assets could roll over at any moment, especially if tomorrow’s US inflation reads come in above forecast. Ultimately, the setbacks we’re seeing in bitcoin and ether are viewed as compelling opportunities for medium and longer-term players to step in and build exposure at discounted prices. Technically speaking, as we’ve outlined for many weeks, the break in bitcoin below the yearly low, does however introduce the possibility for a fresh downside extension towards $10k. We’ve talked a lot about the possibility for a drop back down into the $10k area in 2022, and we’ve also highlighted our expectation that any additional setbacks below the barrier should be exceptionally short-lived ahead of the next major upside extension and bullish continuation to fresh record highs. |

| LMAX Digital metrics | ||||

|

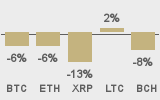

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

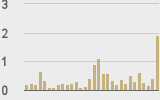

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

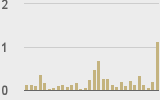

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||