|

|

18 September 2023 Volumes up big in previous week |

| LMAX Digital performance |

|

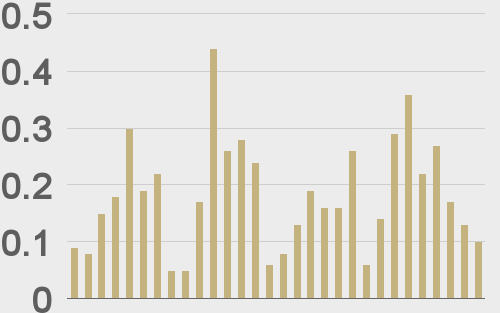

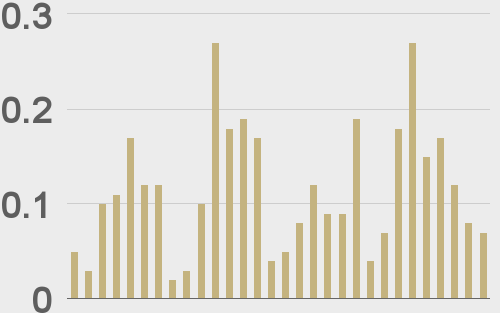

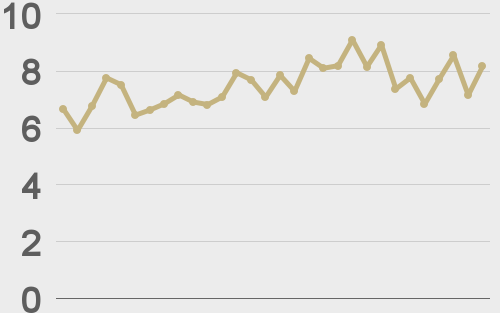

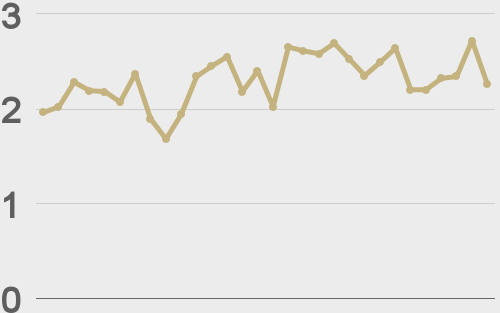

Total notional volume at LMAX Digital was impressive in the previous week. Total notional volume from last Monday through Friday came in at $1.3 billion, 45% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $889 million in the previous week, 56% higher than the week earlier. Ether volume came in at $319 million, 36% higher than the week earlier. Total notional volume over the past 30 days comes in at $5.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,480 and average position size for ether at $2,321. Volatility is moderately higher after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $648 and $42 respectively. |

| Latest industry news |

|

There isn’t a whole lot in the way of any fresh updates from the fundamental front. The big focus right now is on the SEC and the timing of an approval of a bitcoin ETF, which is expected to usher in a massive wave of institutional adoption. We have however seen plenty of demand from medium and longer-term players into recent dips. Most notably, bitcoin has been exceptionally resilient down towards the $25k area. Seasonality trends have not been bullish for crypto in the month of September. In fact, September has been the worst month of performance for crypto assets over the past decade. And so all things considered, this month’s weakness isn’t all that bad. The good news is that October is a very strong month for crypto assets, which sets the stage for some impressive performance in the weeks ahead. Technically speaking, bitcoin’s recovery in recent sessions has been impressive, with the market clearing some internal resistance and now focusing on a retest of more critical resistance from late August at $28,200. A break above $28,200 will be a constructive development and should open the door for a fresh wave of bullish momentum. Until then, there is still risk the market remains confined to a multi-day consolidation range. |

| LMAX Digital metrics | ||||

|

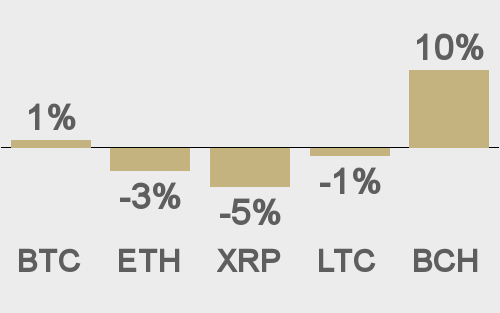

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||