|

|

8 August 2024 Volumes up, headlines looking good |

| LMAX Digital performance |

|

LMAX Digital volumes remained firm on Wednesday. Total notional volume for Wednesday came in at $413 million, 7% above 30-day average volume. Bitcoin volume printed $222 million on Wednesday, 2% above 30-day average volume. Ether volume came in at $115 million, 8% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,144 and average position size for ether at $3,630. Market volatility has jumped up in recent sessions, now back to about halfway between yearly high and low levels. We’re looking at average daily ranges in bitcoin and ether of $3,150 and $190 respectively. |

| Latest industry news |

|

Crypto assets have been well supported into Thursday on the back of a number of positive catalysts. We believe a lot of the recovery has come from crypto specific headlines, though the fact that US equity futures have turned back up on this Thursday is also helping to inspire demand. As far as crypto specific headlines go, crypto market participants are feeling better about what appears to be a more crypto friendly campaign coming out of the Kamala Harris camp. Meanwhile, MicroStrategy’s Michael Saylor has disclosed that he continues to add to his personal bitcoin holdings, which total 17,732. This is in addition to MicroStrategy holdings of 226,500 bitcoin reported in the second quarter. Moving on, ETF inflows have picked back up in recent sessions, with both bitcoin and ETH ETFs producing solid inflow numbers. Finally, the crypto market is getting an added boost on the news of the favorable court ruling in the Ripple case. The judge imposed a much smaller fine than what had been anticipated, and there are no signs suggesting XRP will be classified as a security. The court decision also reflects a growing sense of a system that both recognizes the value this new asset class has to offer, and is more inclined to work with the crypto space rather than fight against it. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

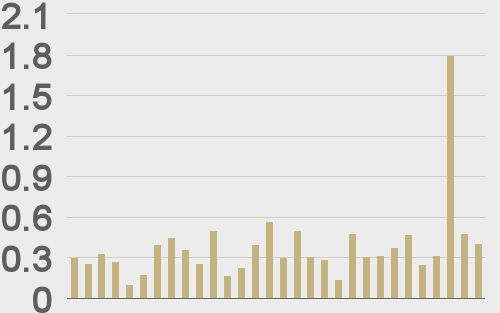

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

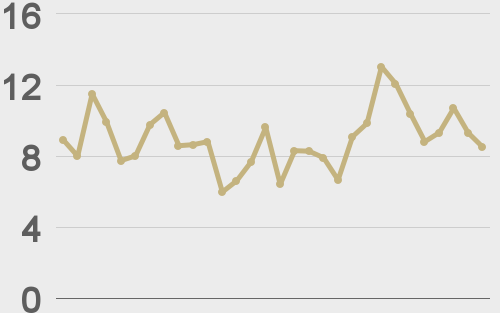

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@presto_labs |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||