|

| 16 October 2025 Waiting for fresh set of catalysts |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off from robust Tuesday levels but were still healthy overall. Total notional volume for Wednesday came in at $731 million, 9% above 30-day average volume. Bitcoin volume printed $359 million, 25% above 30-day average volume. Ether volume came in at $214 million, 4% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,993 and average position size for ether at $3,445. Bitcoin volatility has shot up in recent days, while ETH volatility is trending back towards recent peak levels. We’re looking at average daily ranges in bitcoin and ether of $3,812 and $253 respectively. |

| Latest industry news |

|

Bitcoin has been trading with a softer bias in recent sessions, currently oscillating around recent lows while ETH slightly lags on a beta-adjusted basis. The overall tone however is consolidation rather than capitulation as participants reassess positioning into mid-October. Flows and leverage set the undercurrent. Spot ETF creations/redemptions look muted, and derivatives markets continue to clean up prior excess; liquidations are lighter, keeping price action two-sided. Geopolitics are keeping risk appetite cautious. Renewed friction between Washington and Beijing and headline sensitivity around trade policy has crypto trading more like a high-beta risk asset than a haven. Meanwhile, equities are chopping around, while the rates path and dollar impulse remain the swing factors. In the absence of decisive growth or inflation data, technicals and flow dominate tape-reading. Net-net, the market remains confined to a wait-and-see mode: residual leverage and headline risk cap topside, while resilient ETF flows and still-elevated options pricing cushion the downside. We frame the near-term setup as range-bound and macro-led, with fresh catalysts likely to come from central-bank rhetoric or a shift in the geopolitical temperature. |

| LMAX Digital metrics | ||||

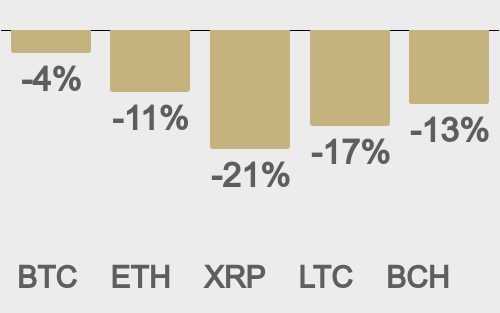

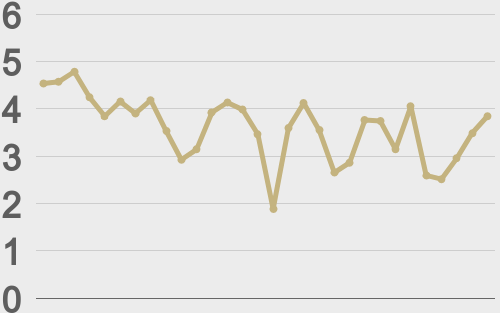

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

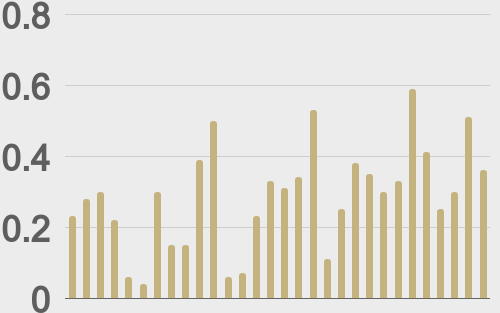

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

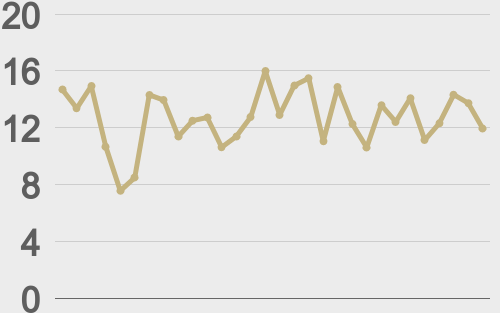

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||