|

|

28 August 2023 Waiting for the next catalyst |

| LMAX Digital performance |

|

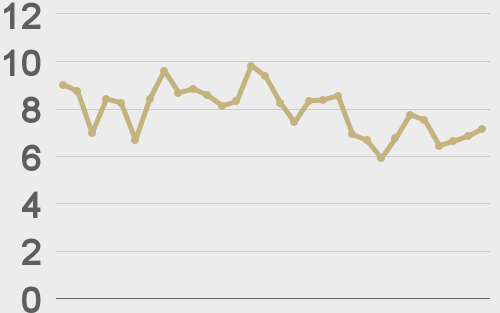

Total notional volume at LMAX Digital was down moderately in the previous week. Total notional volume from last Monday through Friday came in at $1.04 billion, 15% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $610 million in the previous week, 15% lower than the week earlier. Ether volume came in at $306 million, just 2% lower than the week earlier. Total notional volume over the past 30 days comes in at $5.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,791 and average position size for ether at $2,811. Volatility is trending back to cycle lows after a healthy run higher the other week. We’re looking at average daily ranges in bitcoin and ether of $622 and $45 respectively. |

| Latest industry news |

|

It’s been nothing but tight consolidation in crypto markets over the past couple of weeks. Absence of fresh fundamental catalysts and lighter summer trade are mostly responsible for the lackluster price action. Traditional risk assets were mildly supported on Friday, after investors chose to focus more on the part of the Fed Chair’s message that talked about the possibility for rate cuts. This perhaps helped to offer some mild support for crypto into dips. However, in the end, the bottom line is that the Fed is still concerned about inflation risk and is not ready to rule out additional rate hikes. This could add more downside pressure on stocks and weigh on crypto assets as a consequence. Otherwise, we continue to wait on additional clarity from the courts and the SEC for a better handle on the outlook for crypto in the months ahead. There hasn’t been much in the way of headline updates, though there was some attention given to the story that Mastercard will be terminating its crypto card partnership with Binance in Argentina, Brazil, and Colombia, presumably on the back of all of the scrutiny Binance has come under in recent months. |

| LMAX Digital metrics | ||||

|

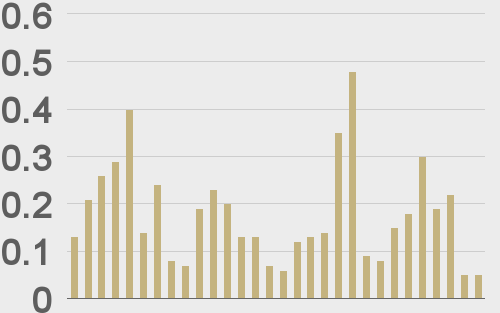

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

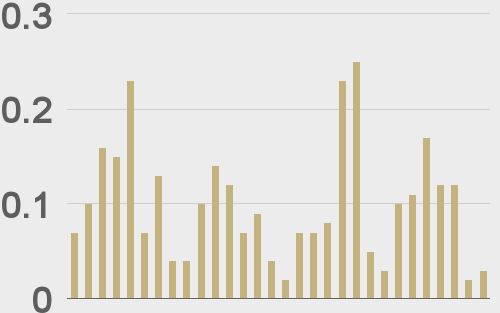

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

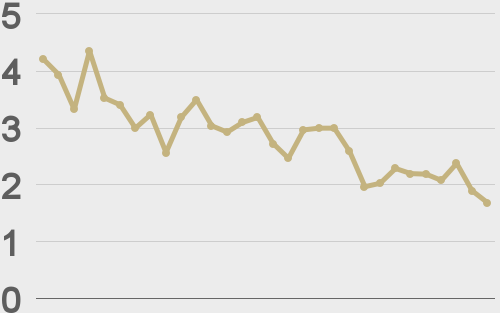

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||