|

|

18 January 2024 Waiting for the next shoe to drop |

| LMAX Digital performance |

|

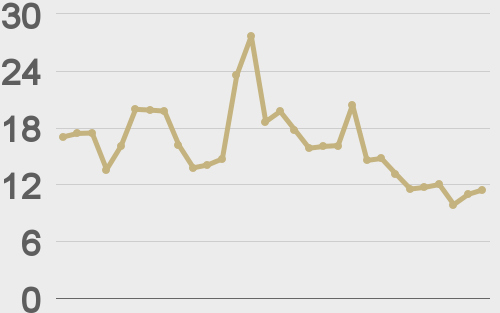

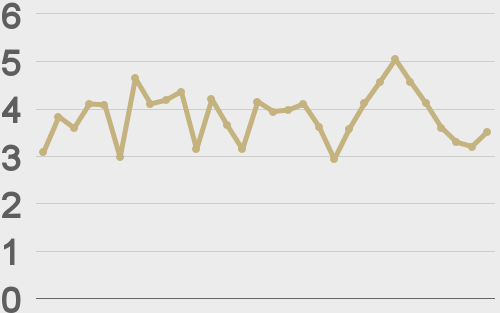

LMAX Digital volumes have been light this week on account of some very tight trade. Total notional volume for Wednesday came in at $464 million, 43% below 30-day average volume. Bitcoin volume printed $308 million on Wednesday, 51% below 30-day average volume. Ether volume came in at $93 million, 22% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $15,720 and average position size for ether at $4,021. Volatility has cooled off from multi-month highs set in the previous week. We’re looking at average daily ranges in bitcoin and ether of $1,908 and $115 respectively. |

| Latest industry news |

|

Overall activity in the crypto market has been rather anemic this week. We’ve seen a mild wave of profit taking in the aftermath of the bitcoin spot ETF news, but otherwise, not much at all is going on. There have been some sources attributing setbacks to the recent rally in the US Dollar, though already into Thursday, with the US Dollar selling off, there isn’t much to talk about on this front. On Wednesday, Ethereum developers deployed the Dencun upgrade to testnet. The upgrade is a part of a three phased process before going to mainnet. The purpose of the upgrade is to add capacity for data storage by way of a process called danksharding. In other news, JP Morgan’s CEO was back on the wires, this time from Davos, offering up another scathing opinion of bitcoin. It was however interesting to see that he took the time to qualify this was just his opinion and that he supported peoples’ desire to transact in bitcoin if they so desired, seemingly stepping back from a full on assault now that his bank has taken a more active role in cryptocurrencies. Dimon also added he supported blockchain technology, smart contracts and the tokenization of digital assets. So on net, the comments could have been construed as somewhat bullish coming from someone like Dimon. Technically speaking, bitcoin is in a well defined uptrend, in search of the next higher low ahead of a bullish continuation. Look for setbacks to hold up well ahead of $40k, with the market seen pushing to fresh multi-month highs and beyond $50k. |

| LMAX Digital metrics | ||||

|

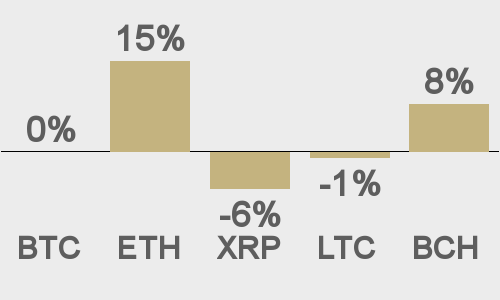

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||