|

|

17 September 2024 Waiting on the next big breakout |

| LMAX Digital performance |

|

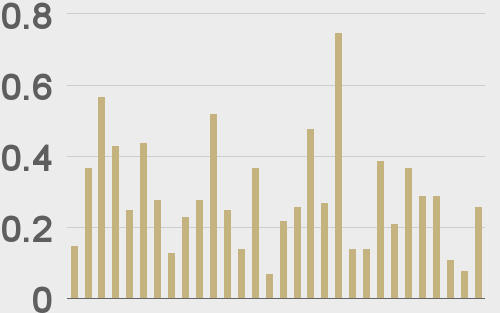

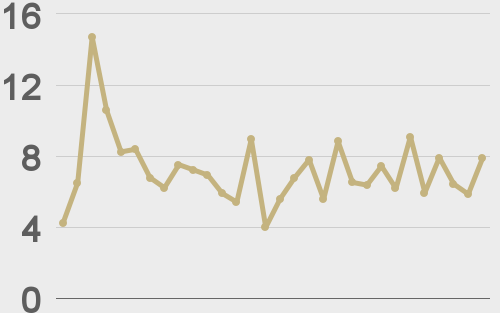

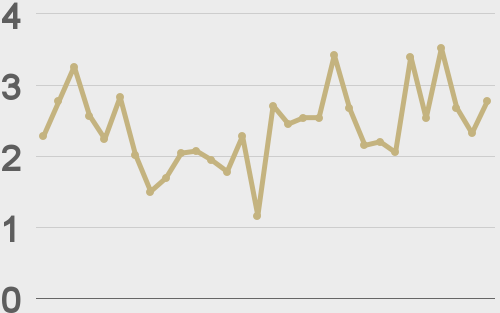

LMAX Digital volumes were mixed as the week got going. Total notional volume for Monday came in at $255 million, 12% below 30-day average volume. Bitcoin volume printed $101 million on Monday, 43% below 30-day average volume. Ether volume came in at $109 million, 55% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,525 and average position size for ether at $2,456. Market volatility has cooled off dramatically in recent weeks. We’re looking at average daily ranges in bitcoin and ether of $2,186 and $115 respectively. Bitcoin volatility is the lowest since early July, while ETH volatility is trading back down at yearly low levels. |

| Latest industry news |

|

Price action in crypto markets remains quite choppy. Ultimately, it comes down to a bitcoin market confined to some very tight consolidation, waiting for that next big range break. Technically speaking, that breakout should be to the topside with the market trading within a clearly defined longer-term uptrend. Interestingly enough, all of the macro fundamentals are quite supportive despite the recent choppy trade. Investors are welcoming the prospect of a larger, more investor friendly Fed rate cut at tomorrow’s meeting, and yield differentials have moved out of the US Dollar’s favor as a consequence. Meanwhile, crypto flows have also been looking up. Crypto flows turned net positive last week, led by over $400 million of inflows into the bitcoin spot ETFs. And while ETH ETFs continued to see some outflows, there has been a clear decline in the pace of those outflows, with just under $13 million in ETH ETF outflows last week. We still believe we are in a post ETH ETF adjustment period in which the market has yet to get into a real groove, which means a lot of the outflows we have seen had been well telegraphed given a similar pattern that had been seen post bitcoin ETF launches. Looking ahead, a lot of the focus will be around positioning into tomorrow’s highly anticipated Fed event risk. |

| LMAX Digital metrics | ||||

|

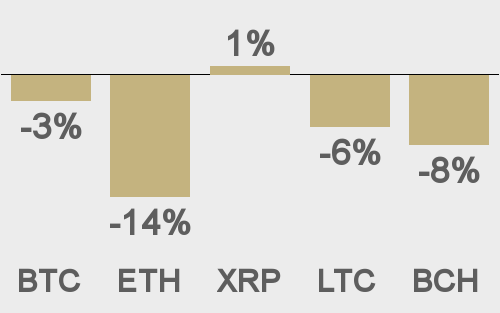

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||