|

|

1 August 2022 Week in review, month in review |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital cooled off a bit in the previous week. Total notional volume from Monday through Friday came in at $2.5 billion, 11% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.4 billion in the previous week, off 17% from a week earlier. Ether volume came in at 822 million, off just 3% from the week earlier. Total notional volume over the past 30 days comes in at $11 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,222 and average position size for ether at $2,303. Volatility has been showing signs of picking up from yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $1,176 and $118 respectively. |

| Latest industry news |

|

Finally, a positive month for crypto assets after some intense downside price action in the months of April, May, and June. Both bitcoin and ether held up above their respective yearly lows from June, while also closing a good deal higher in July. Ether was the star performer, up 54% in July. Bitcoin also performed well, up 16% in July. Still, year-to-date, bitcoin is down 52%, while ether is down 58%. The bullish July performance in crypto assets was largely attributed to global macro fundamentals and central bank policy, with the market’s pricing of a less aggressive Federal Reserve rate hike path reassuring investors and fueling a rebound in risk assets. As things stand, crypto assets including bitcoin, are still very much correlated to global sentiment, and the recovery on that front has helped to drive demand for bitcoin and ether. Given that ether is even more sensitive to risk appetite, it’s made sense to see ether solidly outperforming bitcoin over this period. Another driver of crypto strength in July was the cessation of tension around fallout in the space associated with the blowups at the likes of Terra, Celsius, and Three Arrows Captial. In July, crypto assets were relieved to see those stories mostly in the rear-view mirror, allowing participants to get back to focusing on all the positives around the tremendous potential for decentralized assets. There was also a lot of optimism around the news of the timeline of Ethereum’s merge upgrade, which will see the protocol move from proof-of-work to proof-of-stake. The long-awaited upgrade, expected to happen in September, promises to deliver a more scalable, secure network. We believe this will help to drive increased adoption of crypto assets, and offer more reassurances to larger, institutional players looking to expand their exposure beyond bitcoin. Looking ahead, we believe additional downside in bitcoin and ether should be limited. At the same time, there is still plenty of risk out there and we’re not convinced the bottom is in just yet. Our primary concern is the global economic outlook and prospect that higher inflation and slower growth will lead to more of a shakeup in risk assets, which will open more downside pressure in crypto. We’re also concerned regulatory uncertainty will continue to weigh on the market. But we do believe we are getting closer to levels where the longer-term value proposition of crypto will be too difficult to ignore at such discounted prices. |

| LMAX Digital metrics | ||||

|

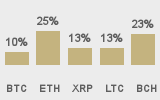

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

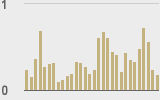

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

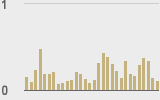

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

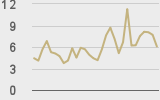

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinCornerDanny |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||