|

|

27 December 2023 What could be weighing on bitcoin this week |

| LMAX Digital performance |

|

LMAX Digital volumes recovered nicely from a light Christmas day and were up overall on Tuesday. Total notional volume for Tuesday came in at $730 million, 19% above 30-day average volume. Bitcoin volume printed $528 million on Tuesday, 12% above 30-day average volume. Ether volume came in at $62 million, 32% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $16,031 and average position size for ether at $3,462. Volatility has been correcting just off yearly high levels set the other week. We’re looking at average daily ranges in bitcoin and ether of $1,399 and $88 respectively. |

| Latest industry news |

|

There’s been some pullback in crypto assets this week, though the dips have been relatively mild and well contained thus far. As per our technical insights, the bitcoin uptrend is firmly intact and current setbacks are viewed as a minor correction ahead of the next run higher. Rising trend-line support on the bitcoin daily chart currently comes in around $40k, so if we do see setbacks extend further, the $40k area is where we expect a fresh wave of sizable demand will resurface. Fundamentally, we suspect some of the weakness we’ve been seeing could be coming from the updates out from the bitcoin spot ETF applications storyline. While it does look like the SEC will finally move forward and approve bitcoin spot ETF applications in early January, the regulatory authority is making demands around the structure of these ETFs that will be more of a headache for participants. In a nutshell, the SEC is demanding the bitcoin ETFs use in-cash creation for redemption over what would be the more attractive in-kind creation for redemption. In-cash creation is more complicated for the ETFs as it means rather than putting in and taking out the asset the ETF is tracking, in this case bitcoin, the ETF will need to use cash on the way in and out of bitcoin. Ultimately, the in-cash structure creates the headache of triggering an ongoing taxable event, while also being less efficient, and more costly. But overall, we believe it’s important to take it with a grain of salt. Indeed, this may make the process a little less smooth, but we don’t expect it to be disruptive to the point where it would make much of a difference and act as a disincentive for investors to participate. In the end, the big regulatory battle for bitcoin and crypto finally came into the spotlight in 2023, and the emerging asset class has done a very good job navigating through some tough waters. This should set up an exciting year ahead. |

| LMAX Digital metrics | ||||

|

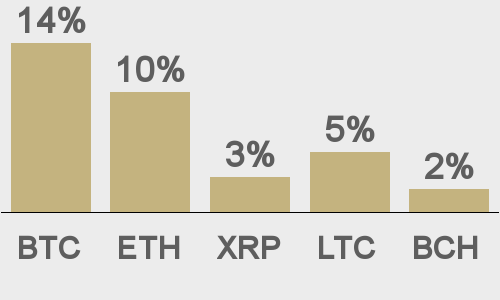

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

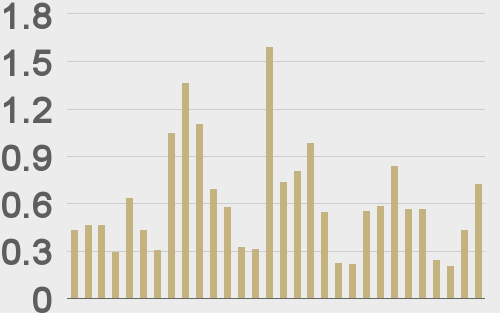

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

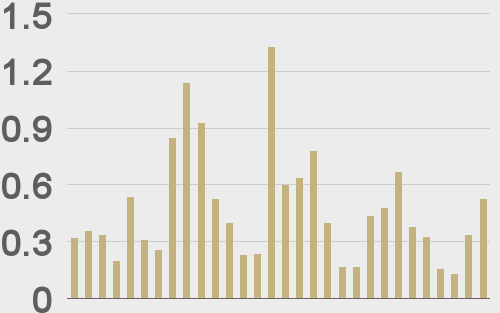

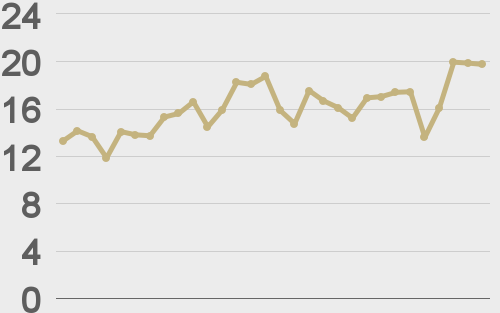

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

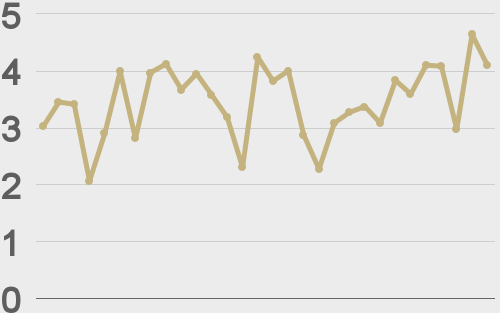

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||