|

|

3 December 2024 What to expect in December |

| LMAX Digital performance |

|

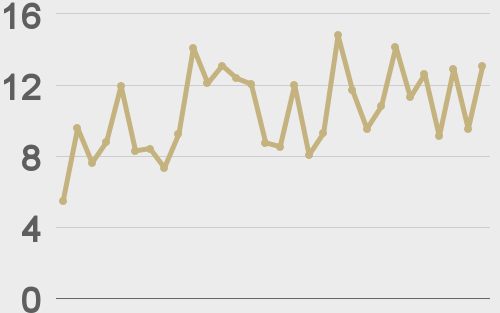

LMAX Digital volumes got off to a slower start this week. Total notional volume for Monday came in at $547 million, 34% below 30-day average volume. Bitcoin volume printed $181 million on Monday, 65% below 30-day average volume. Ether volume came in at $127 million, 3% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,265 and average position size for ether at $3,118. Market volatility has cooled off in recent sessions after an impressive recovery from yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $3,246 and $170 respectively. |

| Latest industry news |

|

There’s been a clear wave of selling as December gets going, though the downside pressure feels more like it’s about trepidation around bitcoin breaking $100k than anything else. Seasonal trends have been the name the game in Q4 and after those trends delivered as expected in October and November, we will be looking for the same in December. If we look at bitcoin performance from 2016 to present, December is the third best performing month, producing average returns of 12.5%. And so if bitcoin decides to keep with the trend, it should take us up towards $110k before the year is out. What’s even more interesting and encouraging with respect to the outlook for December is the fact that in the previous two halving years (2016, 2020), December returns were even more impressive at 28% (2016) and 50% (2020). The record monthly net inflows for both bitcoin and ETH ETFs in November should also be sending a message about the market’s appetite for crypto assets. And all of this comes at a time when the incoming US administration is expected to be crypto friendly. On this topic, interestingly enough, the President-elect’s warning to the BRICS nations against the use of an alternative currency to the US Dollar could ultimately invite that much more demand for crypto assets over the coming months. |

| LMAX Digital metrics | ||||

|

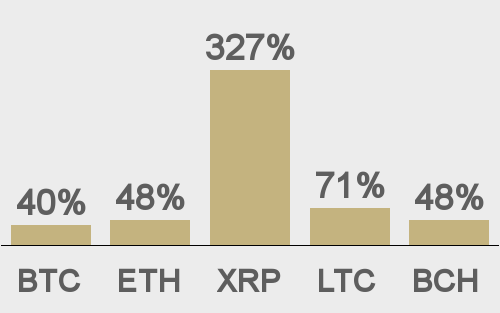

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

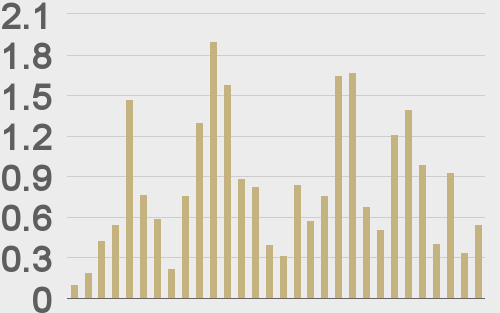

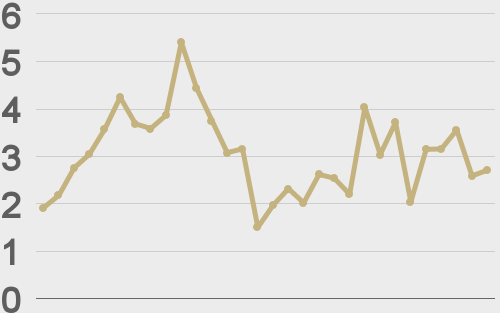

Total volumes last 30 days ($bn) |

||||

|

||||

|

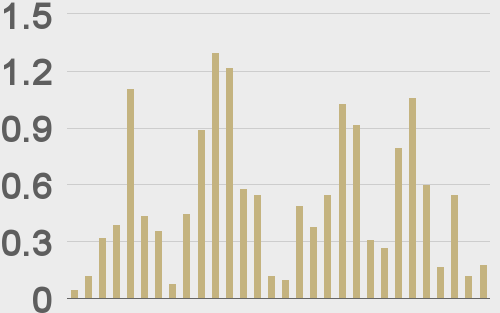

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||