|

|

31 January 2024 What to look for as we settle into 2024 |

| LMAX Digital performance |

|

LMAX Digital volumes improved nicely from Monday’s anemic showing but were still off overall from 30-day average volumes. Total notional volume for Tuesday came in at $470 million, 38% below 30-day average volume. Bitcoin volume printed $308 million on Tuesday, 46% below 30-day average volume. Ether volume came in at $110 million, 7% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,398 and average position size for ether at $3,513. Volatility remains elevated overall, but has been in the process of cooling off multi-month highs set earlier in January. We’re looking at average daily ranges in bitcoin and ether of $1,538 and $94 respectively. |

| Latest industry news |

|

As we come into the final day of trade for January, market participants have begun to start looking ahead to the remainder of 2024 and what lies on the horizon for crypto assets. Looking out, we see three major events that could open the door for another big surge in prices this year. The first is the start of the promotion of the bitcoin ETF products to traditional market investors. Now that the ETFs have been approved, these efforts will ramp up in the weeks and months ahead, which should translate to plenty of demand. The second driver will likely come from anticipation and excitement around the next big batch of ETF approvals in the form of the ether spot ETFs. Given how things have played out and given the precedent that’s already been set, it would be hard to see a scenario where this doesn’t happen. Finally, we expect there to be a good deal of demand as we get closer to the bitcoin halving event. There is a positive correlation between price and the halving events and with the next halving event due in April, we expect this will start to factor into demand. Bitcoin’s tokenomics are built to support higher prices through its mechanics in which the number of bitcoin entering circulation shrinks with each halving event, which occurs every four years. On the ETF front, we continue to get positive news. On Monday, Fidelity’s bitcoin spot ETF saw $208 million of daily inflows, which more than offset outflows from GBTC sales. The GBTC sales were also the lowest since the day of the re-launch. Looking to today’s calendar, the key focus will be on month-end flow and the Fed decision. Whatever the outcome of the Fed decision, we’re likely to get a wave of volatility that could very well spill over into crypto assets. |

| LMAX Digital metrics | ||||

|

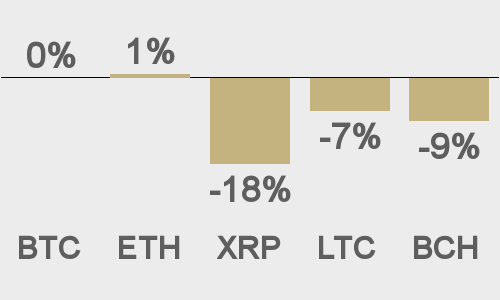

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

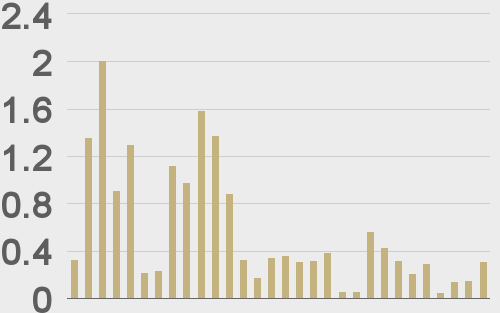

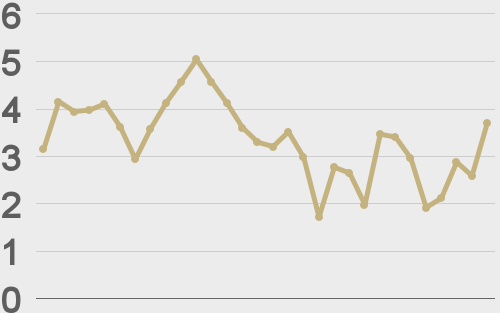

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

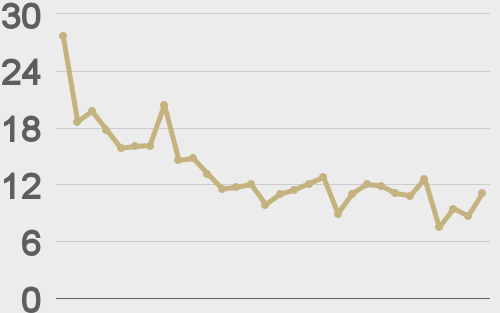

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@NTmoney |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||