|

|

26 February 2024 What to look out for this week |

| LMAX Digital performance |

|

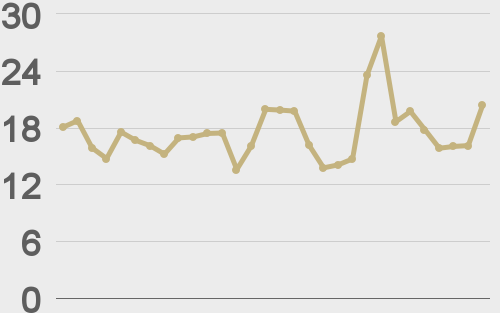

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $2.6 billion, 16% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.2 billion in the previous week, 28% lower than the week earlier. Ether volume was however impressive, coming in at $1 billion, 10% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,998 and average position size for ether at $3,701. Volatility has been trending back to the topside after cooling off from the January peak. We’re looking at average daily ranges in bitcoin and ether of $1,366 and $105 respectively. |

| Latest industry news |

|

If there’s one thing we’re going to be keeping our eye on this week, it’s going to be how crypto performs relative to US equities. The US stock market has been on fire, extending its run of record highs. But it also looks quite extended and due for a meaningful pullback. We’ve talked a lot about breakdowns in correlations between traditional markets and crypto. If we do see a sharp reversal in stocks this week, it will be interesting to see if crypto can hold up well in the face of such a move. As far as yield differentials and the US Dollar go, most of the signs from the economic data and Fed speak have been pointing to more favorable yield differentials for the Buck than what the market has been pricing. If this is the case, we should expect a run of demand for the Buck that could also offer itself up as an obstacle for crypto. And so, we will also be looking to see just how resilient crypto assets can be in the face of any US Dollar demand. Technically speaking, while bitcoin holds above $50k, the outlook remains constructive and the expectation is for a continued consolidation ahead of the next big push towards a retest of the record high from 2021. A daily close below $50k would however delay the outlook and open the door for a deeper correction back towards $45k. |

| LMAX Digital metrics | ||||

|

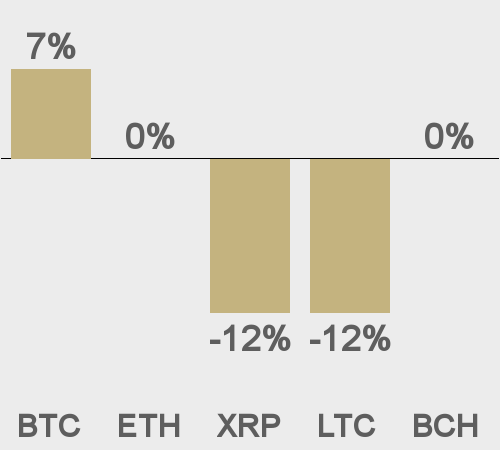

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||