|

|

4 September 2024 What’s been behind the weakness? |

| LMAX Digital performance |

|

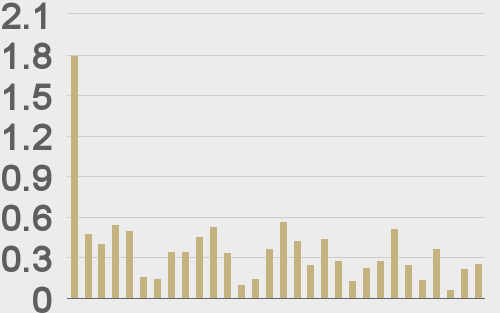

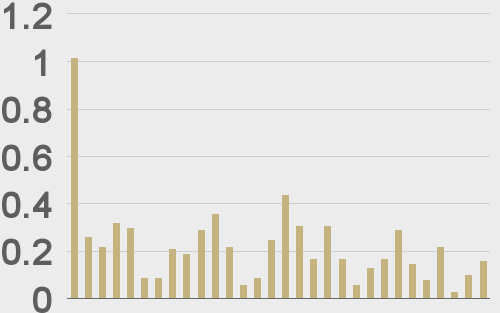

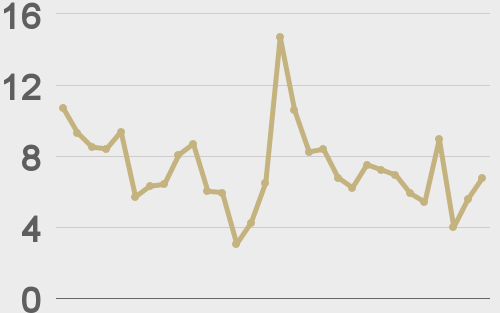

LMAX Digital volumes improved from Monday but were still well off 30-day average volume levels. Total notional volume for Tuesday came in at $256 million, 31% below 30-day average volume. Bitcoin volume printed $163 million on Tuesday, 28% below 30-day average volume. Ether volume came in at $53 million, 42% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,826 and average position size for ether at $2,636. Market volatility has cooled off dramatically after an impressive run higher in early August. We’re looking at average daily ranges in bitcoin and ether of $2,505 and $136 respectively. |

| Latest industry news |

|

There have been a number of developments in recent sessions contributing to the latest slide in crypto assets. On the crypto front, we’ve just seen some of the largest daily outflows in the bitcoin ETFs since May. Meanwhile, Ethereum on-chain lending markets have been hit hard with liquidations. On the macro front, sentiment has soured towards the global outlook. China property market woes, the news around Volkswagen possibly closing factories for the first time in history, and a Nvidia price plunge have all factored into this downbeat mood. And of course, seasonality trends are not leaning in the market’s favor. September is not only the worst month for bitcoin performance, it also happens to be the worst month of performance for US equities. The silver lining investors have been leaning on is that all of this will inspire the Fed to consider a larger, investor friendly 50-basis point rate cut when it meets this month. Odds for a 50-basis point cut have now ramped up to 40%. Technically speaking, there hasn’t been anything going on that would threaten the bigger picture constructive outlook for bitcoin and ETH. When we look at the weekly charts, both markets are seeing setbacks within clearly defined consolidations. |

| LMAX Digital metrics | ||||

|

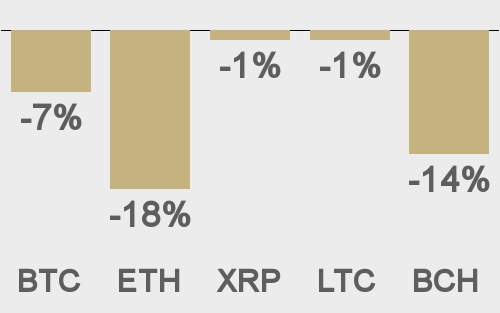

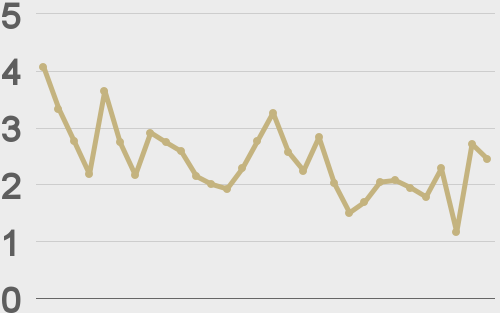

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||