|

|

4 March 2025 Why the jackknife reversal? |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a strong start this week. Total notional volume for Monday came in at $843 million, 61% above 30-day average volume. Bitcoin volume printed $356 million on Monday, 53% above 30-day average volume. Ether volume came in at $166 million, 54% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,724 and average position size for ether at $1,671. Bitcoin volatility has trended back towards peak levels, while ETH volatility has been more subdued. We’re looking at average daily ranges in bitcoin and ether of $4,699 and $213 respectively. |

| Latest industry news |

|

All of the euphoria around President Trump’s Sunday message of a US crypto reserve has more than faded away. The sharp reversal in price action has been exacerbated by the liquidation of leveraged long positions that were looking to get aggressively long in the aftermath of Sunday’s upbeat news. This has left the price of bitcoin gravitating back down towards the previous weekly low, and the price of ETH collapsing to its lowest level against the US Dollar since November 2023. Technically speaking, if we are to use bitcoin as a proxy for the overall direction in crypto markets, the picture hasn’t changed. We remain in the throes of an overdue correction off of the January record high, with scope for deeper setbacks towards previous resistance turned support in the $70-75k area before the market looks to put in the next major higher low ahead of a bullish continuation to fresh record highs. As far as the driving force behind this sharp reversal in sentiment goes, we believe there are three major factors playing into the weakness. The first is a lack a clarity over what exactly the US plans to do with respect to a crypto reserve. The second is some concern within the crypto community that cryptocurrencies like XRP, ADA, and SOL have no place within such a reserve, undermining the value proposition of a bitcoin only or bitcoin and ETH fund. And the final driver of recent weakness comes amidst another escalation in global trade tension as the US tariffs on Canada, Mexico, and China look to be moving forward on schedule. Ultimately, we think it’s important to stick to the technical picture mentioned above, which puts things in a better perspective and looks out beyond short-term headwinds we believe the market will be able to overcome. |

| LMAX Digital metrics | ||||

|

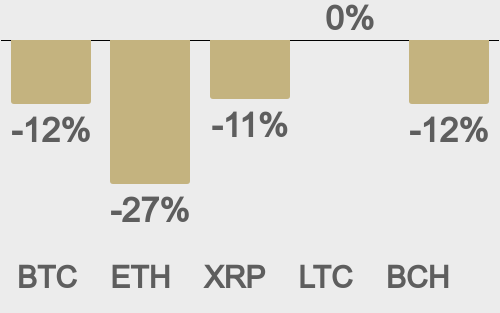

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

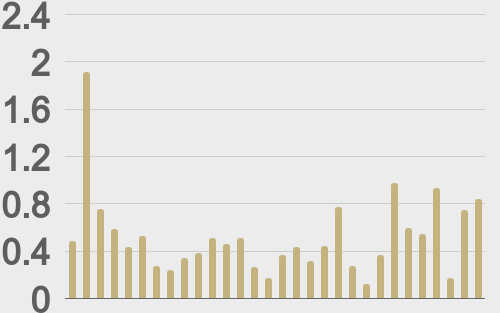

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

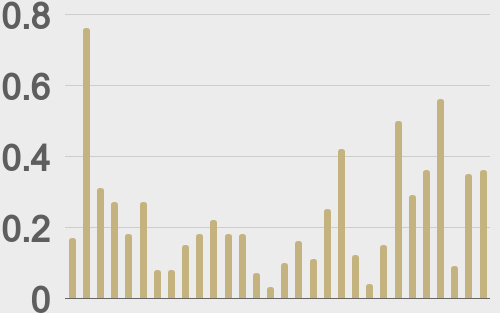

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||