|

|

16 March 2022 Will the Fed decision inspire crypto volatility? |

| LMAX Digital performance |

|

LMAX Digital volume has been on the decline this week, victim to what has been a period of tight ranging, directionless, sideways trade. Total notional volume for Tuesday came in at $592 million, 23% below 30-day average volume. Bitcoin volume printed $400 million on Tuesday, 9% below 30-day average volume. Ether volume came in at $133 million, 48% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,718 and average position size for ether at 5,894. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,345 and $173 respectively. |

| Latest industry news |

|

We’ve been seeing a trend of investment from web 2.0 giants into web 3.0, this latest big one coming from Microsoft, Temasek, and Softbank, who have invested in ConsenSys. The investment puts ConsenSys, the leading Ethereum development company, at a $7 billion valuation. Interestingly enough, there have been many positive headlines in the space in recent days, including this latest news and earlier news around encouraging regulatory updates out of the US and Europe. And yet, we haven’t seen much movement at all in crypto, with bitcoin and ether confined to tight consolidations. It should also come as no surprise to see a drop in volume as a result. But today, we do have some risk out there that could move things. That risk comes in the form of the FOMC decision late in the day. As far as assessing the balance of risk goes, if the Fed comes out more hawkish, look for the US Dollar to rally and risk markets to come under pressure, which in turn could weigh on crypto. If on the other hand the Fed decision is perceived to be less hawkish than anticipated, we could see renewed demand for crypto assets as yield differentials move out of the Buck’s favor and stocks attempt to run higher. |

| LMAX Digital metrics | ||||

|

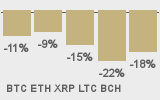

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

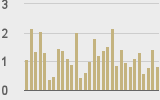

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

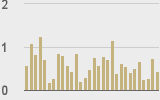

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||