|

|

22 November 2021 Will volume decline in Thanksgiving week? |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was robust in the previous week. Total notional volume from Monday through Friday came in at $8 billion, up 23% from a week earlier. Breaking it down per coin, Bitcoin volume was up more impressively, coming in at $4.5 billion in the previous week, up 42% from the week earlier. Ether volume was even more impressive week over week, coming in at $2.4 billion, up 48% from the week earlier. Total notional volume over the past 30 days comes in at $36 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,843 and average position size for ether at $7,363. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,828 and $242 respectively. |

| Latest industry news |

|

Last week we highlighted the possibility that there could be some corrective pullbacks ahead for the crypto market. Indeed, we are seeing this play out into the new week, with the triggered double top on the bitcoin chart strengthening the short-term bearish outlook. As per the technical overview, we now see risk for bitcoin weakness towards $48,000, which should open broad based selling pressure across the entire crypto market. We’re also concerned about fallout from any pullback in the US equities market, which we believe will add additional strain to cryptocurrencies. There have also been some less crypto friendly headlines. These include comments from Hilary Clinton that cryptocurrencies pose risk of destabilizing nations, and headlines out of Norway that the country is considering a crypto mining ban proposal. Of course, there’s the ongoing worry around US regulatory action, with plenty of chatter around crackdowns around the corner on stablecoins. We have a short week as far as market participation is concerned, which is something that should be paid attention to. US markets will be heading off the desks early to celebrate the Thanksgiving holiday. |

| LMAX Digital metrics | ||||

|

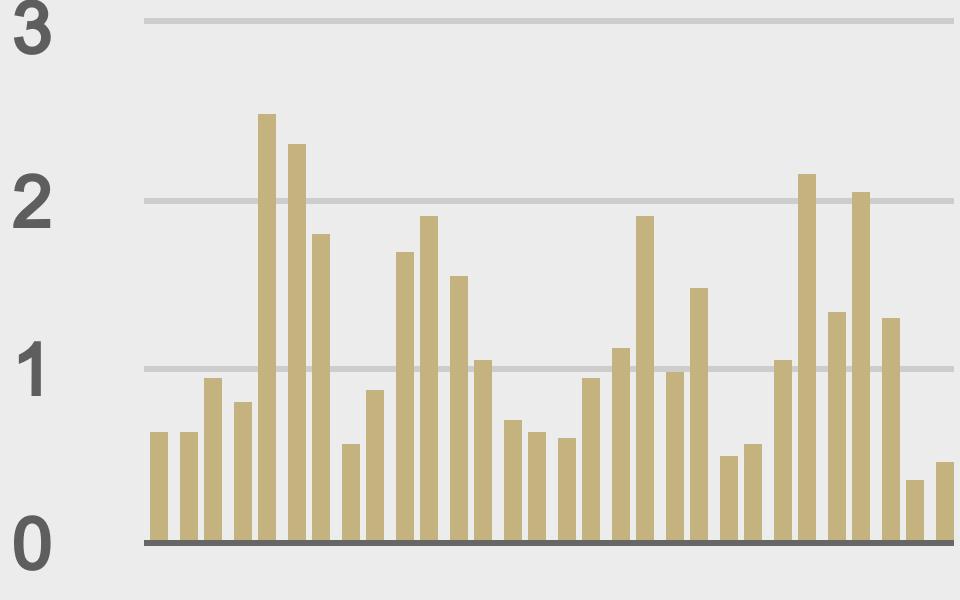

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

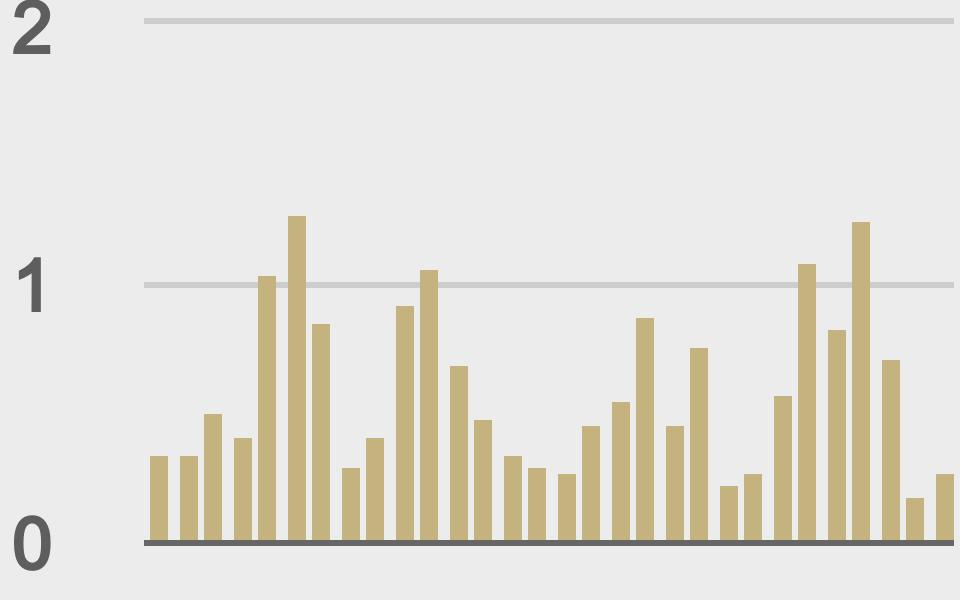

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

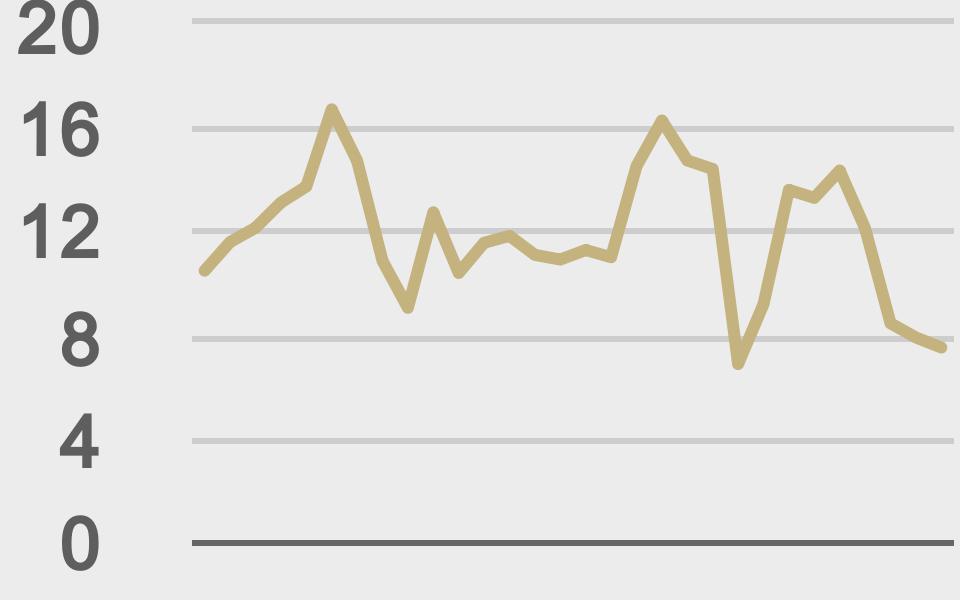

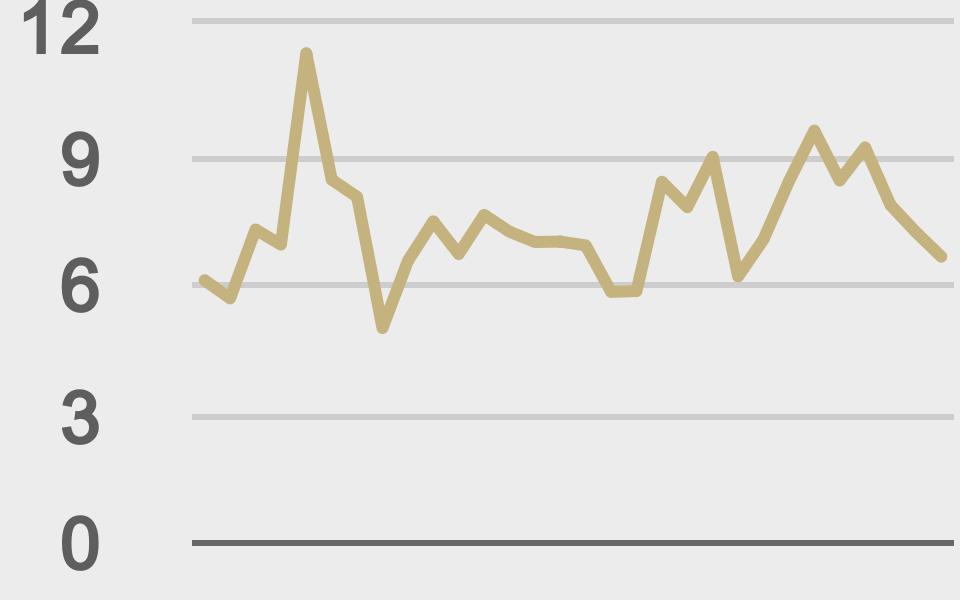

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||