| ||

| 13th February 2026 | view in browser | ||

| CPI day: dollar on watch, volatility in play | ||

| Global markets open focused on today’s US CPI as softer inflation would cement Fed dovishness, pressure the dollar, and contrast with hawkish signals from Japan and Australia, while China’s property slump and eased US–China tech tensions shape the broader risk backdrop. | ||

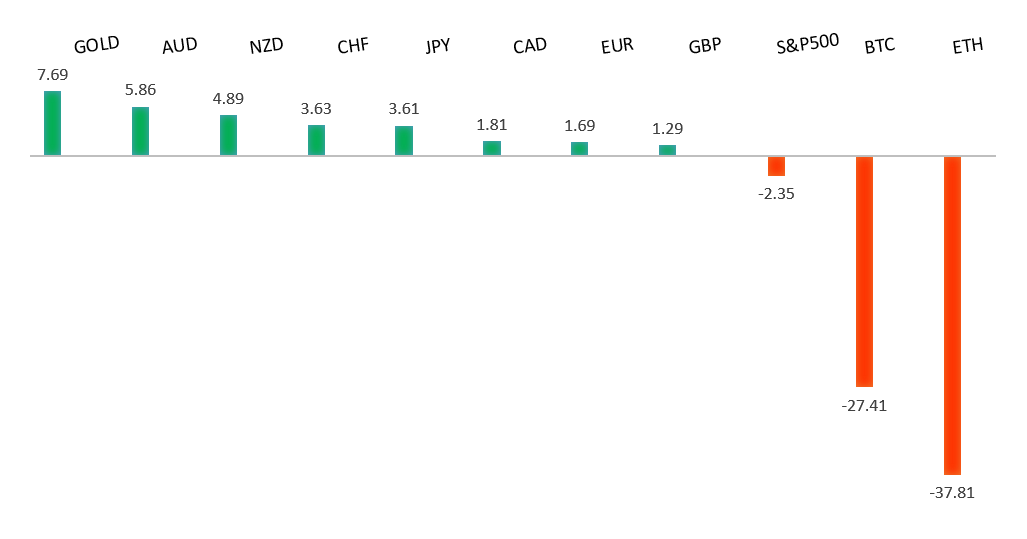

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1500. | ||

| ||

| R2 1.2083 - 27 Janaury/2026 high - Strong R1 1.1929 - 10 February high - Medium S1 1.1765 - 6 February low - Medium S2 1.1728 - 23 January low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro edged slightly lower but stayed range-bound as markets weighed a steady dollar against a stable ECB outlook. ECB President Lagarde said inflation is in a “good place,” but strong US jobs data has capped euro upside, leaving US CPI as the next key catalyst—weak data could lift EURUSD above 1.1929, while a strong print risks a move toward 1.1766. In Europe, upcoming CPI, GDP, and trade data are expected to confirm steady growth and easing price pressures, with these releases, alongside US inflation, guiding near-term direction for the euro. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 in favor of a fresh down-leg back towards the 2024 low at 139.58. The recent break below 154.39 strengthens the outlook. | ||

| ||

| R2 156.30 - 10 February high - Medium R1 154.52 - 11 February high - Medium S1 152.27 - 12 February low - Medium S2 151.97 - 28 January/2026 low - Strong | ||

| USDJPY: fundamental overview | ||

| The pair is edging toward ending a four-day slide but is still down a nice amount on the week, as markets react positively to PM Takaichi’s fiscal agenda. Her decisive election win has boosted confidence in higher government spending and tax cuts, supporting growth expectations and giving the Bank of Japan more room to gradually normalize policy. At the same time, firm rhetoric from Japanese officials on curbing FX volatility has underpinned the yen, with a break below 152.10 opening the door to further gains—especially if US CPI comes in weaker than expected. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market recovering out from a meaningful longer-term support zone. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. Setbacks should now be well supported ahead of 0.6300. | ||

| ||

| R2 0.7158 - 2023 high - Strong R1 0.7148 - 12 February/2026 high - Strong S1 0.7005 - 9 February low - Medium S2 0.6897 - 6 February low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is slightly lower, extending Thursday’s decline, but remains close to a 3.5-year high around 0.7150. The RBA struck a hawkish tone, with Governor Bullock signaling a willingness to raise rates again if inflation stays sticky, reinforced by a jump in inflation expectations to 5% in February. As a result, markets are increasingly pricing in a possible rate hike in May, pending upcoming inflation, jobs, and GDP data. | ||

| Suggested reading | ||

| How to Better View the Dollar’s Droop? Zoom Out, Fisher Investments (February 12, 2026) The AI Boom Belongs To Capital, Not Labor, N. Irwin, Axios (February 11, 2026) | ||