| ||

| 24th October 2025 | view in browser | ||

| CPI report looms large before Fed’s October meeting | ||

| Amid a U.S. government shutdown limiting economic data, markets are using resilient corporate earnings as a gauge for U.S. economic strength, bolstering the dollar as weaker euro and yen face pressure from short-position squeezes. | ||

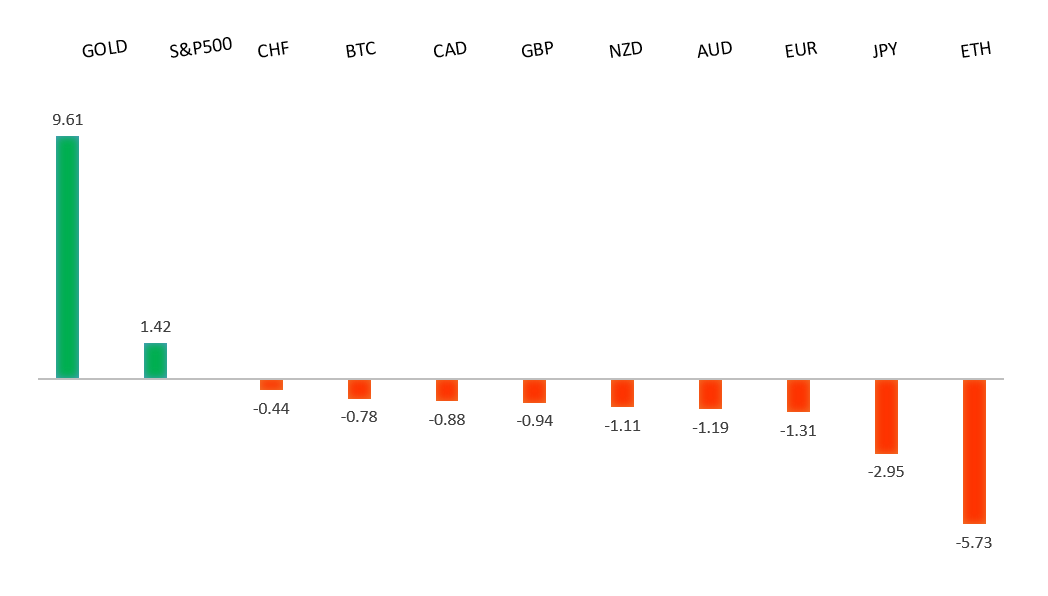

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

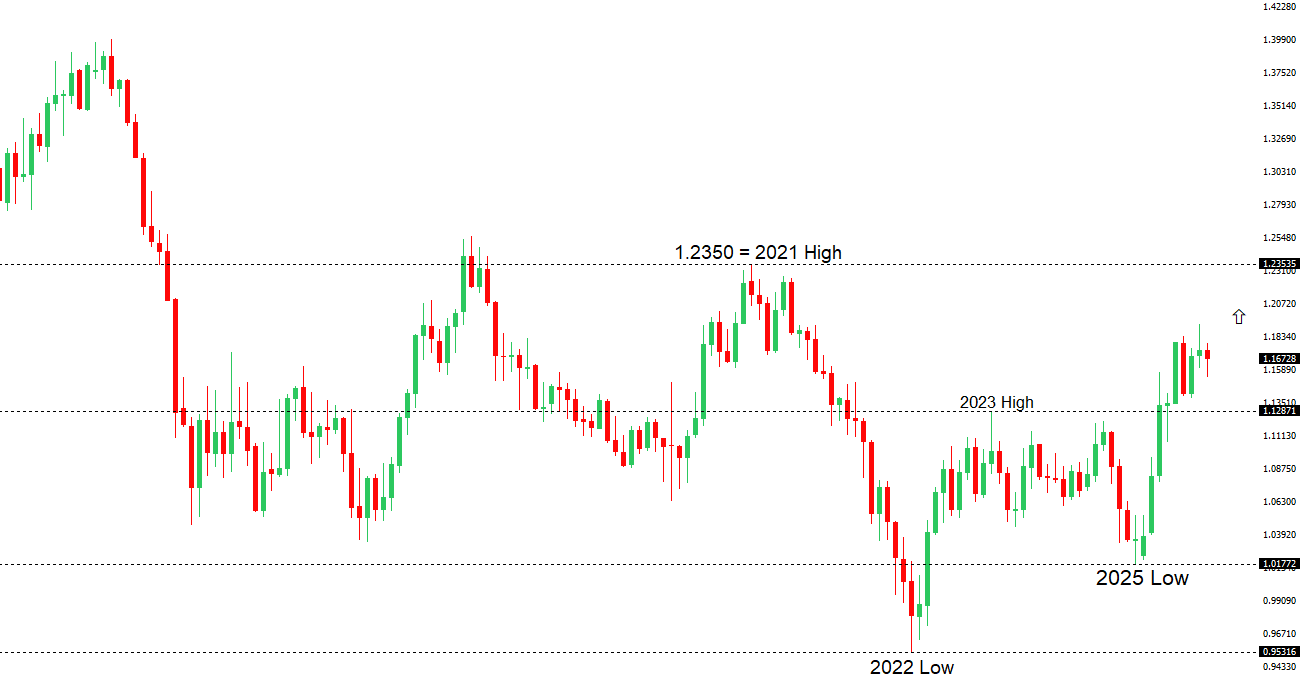

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank remains optimistic about a “Goldilocks” economic scenario, expecting U.S. tariff effects to be short-lived and offset by Germany’s fiscal stimulus, supporting its decision to maintain interest rates at 2% in October. Despite forecasts of growth returning by early 2026 and inflation nearing 2% by 2027, risks like expanding U.S. tariffs, a stronger euro, and slower German fiscal measures could lead to lower-than-expected inflation, potentially sparking discussions of monetary easing in 2026. Germany’s October PMI data suggests ongoing economic stabilization, with manufacturing steady at 49.5 and services slightly down at 51.0, reflecting a fragile recovery driven by resilient services amid industrial and trade challenges. | ||

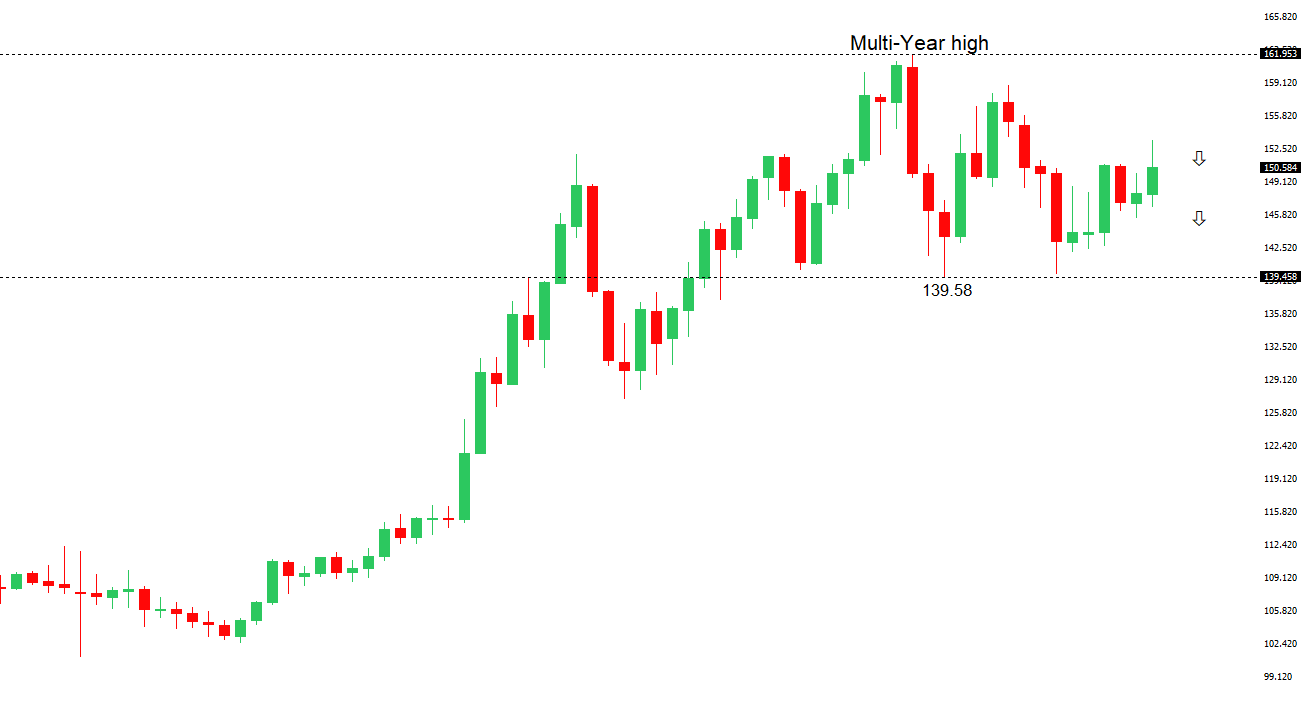

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s new government, led by Takaichi, is expected to implement a stimulus package similar to Abenomics, but with a focus on targeted support for strategic industries and inflation relief, rather than broad spending. The yen’s weakness, driven by the U.S.-Japan yield spread, may be limited by potential fiscal discipline from coalition partners and veteran policymakers like Taro Aso, who advocate prudent spending. The Bank of Japan’s upcoming meeting could signal tighter policy, potentially strengthening the yen, while recent data shows inflation meeting expectations and a slowdown in private-sector activity, with manufacturing declining but optimism for future growth. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Reserve Bank of Australia maintained its cash rate at 3.60% in September, prompting debate about whether its rate-cutting cycle has concluded. While some economists predict another cut in November due to declining inflation (2.1% annually) and rising unemployment (4.5%), major banks expect the RBA to hold rates until early 2026, awaiting clearer economic signals. Recent PMI data shows steady growth (Composite PMI at 52.6), driven by services, though manufacturing contracted (49.7), and cooling price pressures may support the RBA’s cautious stance. Markets anticipate a 63% chance of a November rate cut, with upcoming CPI data and RBA Governor Bullock’s comments likely to influence expectations. | ||

| Suggested reading | ||

| Nobels Say It Is Good That Someday NVIDIA Will Be Bad, M. Hulbert, MarketWatch (October 23, 2025) Putting Renewed Fear About Banks In Perspective, Fisher Investments (October 17, 2025) | ||