| ||

| 24th July 2025 | view in browser | ||

| Dollar dives as Fed pressure and trade noise build | ||

| The dollar fell for a fourth day as political pressure on the Fed and trade uncertainty weighed on sentiment. The euro gained on U.S.-EU tariff deal hopes, while housing data and Fed independence concerns added to market caution. | ||

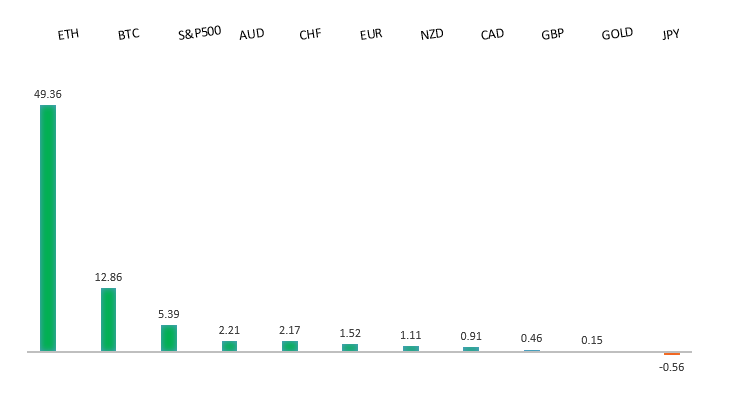

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1830 - 1 July/2025 high - Strong R1 1.1800 - Figure - Medium S1 1.1557 - 17 July low - Medium S2 1.1446 - 19 June low - Strong | ||

| EURUSD: fundamental overview | ||

| The Euro has been better bid amid rumors of a potential US-EU trade deal, similar to a recent US-Japan agreement, with the EU possibly facing 15% US tariffs instead of the threatened 30%. However, US trade advisor Peter Navarro cautioned against taking these rumors at face value. The European Central Bank is expected to pause its rate-cutting cycle today, maintaining the main rate at 2.15% and the deposit rate at 2%, as inflation hits the 2% target and the strong Euro curbs imported inflation. Eurozone economic data, including manufacturing and services PMIs, will be closely watched for signs of resilience amid trade uncertainties, with GDP growth projected to remain weak at 0.1% in Q3 2025 and 0.2% in Q4. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.00 - Psychological - Strong R1 149.19 - 16 July high - Medium S1 146.11 - 23 July low - Medium S2 145.75 - 10 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Rumors of Prime Minister Ishiba resigning by August have surfaced, despite his denials, following his coalition’s loss of the upper house majority. Japanese markets, however, are thriving, with the Nikkei surging 3.5% to a one-year high and Toyota shares soaring 14%, boosted by a favorable US-Japan trade deal reducing tariffs from 25% to 15% and Japan pledging $550 billion in US investments. The Yen strengthened against the dollar, though bond markets showed strain with 10-year JGB yields hitting a 2008 peak of 1.59%. Economic indicators are mixed. The Japan Composite PMI held steady at 51.5, signaling modest growth, but manufacturing contracted (PMI 48.8), while the services sector expanded strongly (PMI 53.5). Political uncertainty and trade developments could further influence Japan’s economic outlook. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6688 - 7 November 2024 high - Strong R1 0.6602 - 23 July/2025 high - Medium S1 0.6454 - 17 July low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is gaining strength for the fourth consecutive session, driven by improved global trade sentiment following a tariff deal with Japan and progress in US-China trade talks. Australia’s economy is showing positive signs, with the Composite PMI rising to 53.6 in July, reflecting strong growth in both manufacturing and services sectors. However, caution persists due to a slowdown in the Westpac Leading Index, weaker commodity prices, and declining business confidence, while the Reserve Bank of Australia remains cautious, favoring gradual policy easing as inflation trends are monitored. | ||

| Suggested reading | ||

| Tariffs Are Here To Stay, Even After Trump, C. Smart, Barron’s (July 22, 2025) The Money Fight That Will Shape Europe’s Future, C. Bildt, Project Syndicate (July 23, 2025) | ||