|

||

| 16th September 2025 | view in browser | ||

| Dollar faces pressure amid fed easing | ||

| As the FOMC meeting approaches, expectations are for the Federal Reserve to cut its benchmark rate to around 3.6% by year-end, with three cuts projected for 2025 and gradual easing into 2026 and 2027. | ||

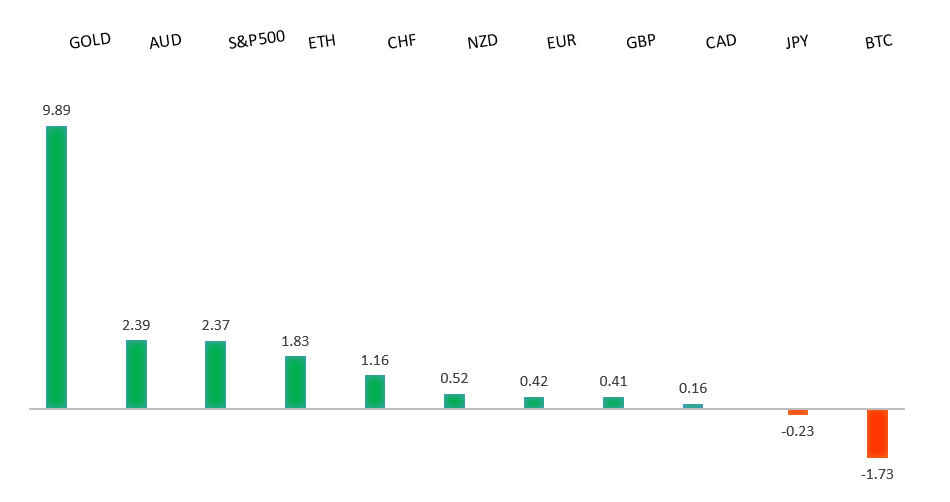

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

|

||

| R2 1.1830 - 1 July/2025 high - Strong R1 1.1789 - 24 July high - Medium S1 1.1608 - 3 September low - Medium S2 1.1574 - 27 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank is leaning toward a potential rate hike rather than further cuts, with officials like Isabel Schnabel indicating that inflation risks outweigh concerns about low prices, and rate hikes may not occur before June 2026. Inflation is expected to stay near the 2% target, supported by stable economic growth, though factors like tariffs, rising service and food costs, and government spending could drive prices higher. Some ECB members caution that further rate cuts could threaten price stability, while others remain open to reductions if conditions shift significantly. Meanwhile, the euro is projected to strengthen, potentially reaching $1.20 by year-end, driven by favorable yield differentials and expected U.S. Federal Reserve rate cuts. In Germany, the ZEW Survey Expectations for September is likely to reflect ongoing weak investor sentiment, influenced by stagnant Q2 GDP, global trade tensions, and disappointing export sector performance. | ||

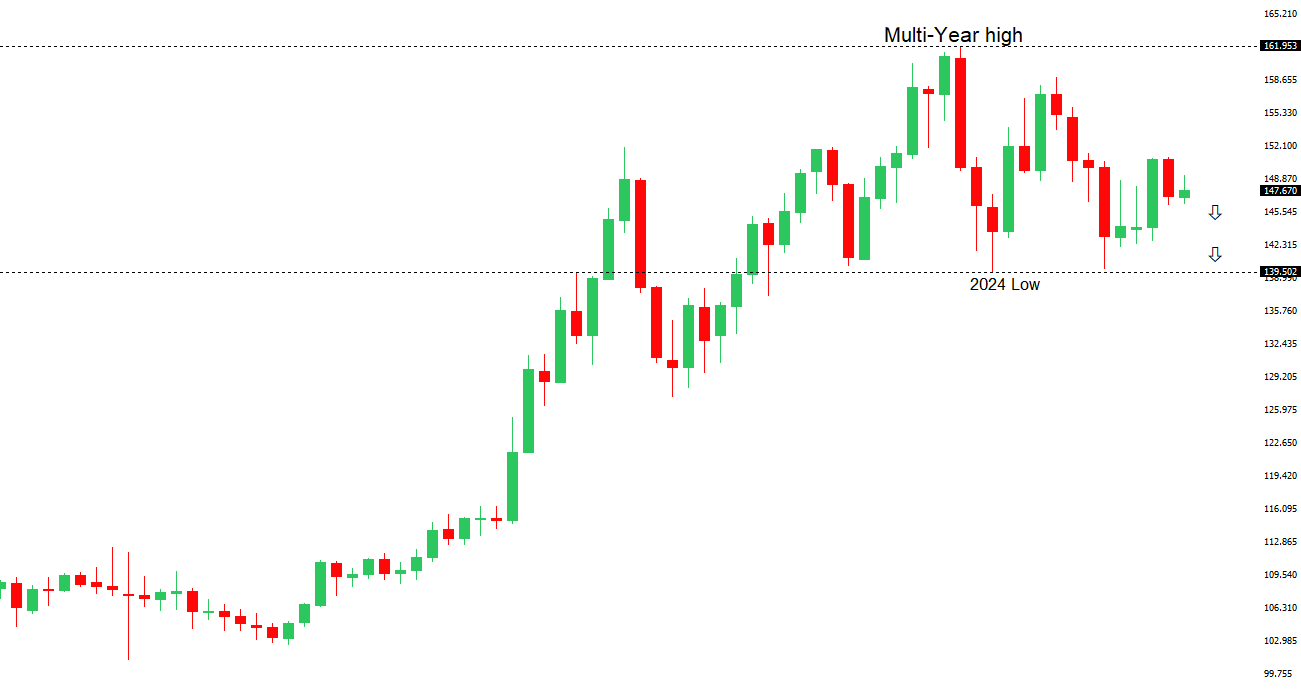

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

|

||

| R2 150.92 - 1 August high - Strong R1 149.14 - 3 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan is likely to keep its benchmark interest rate at 0.5% this Friday, awaiting clarity on leadership following Ishiba’s resignation, which has weakened investor confidence and the yen. Despite political uncertainty, economic growth, rising wages, and reduced trade risks strengthen the case for a potential rate hike by October or December, with a Bloomberg survey favoring a hike by January. The Yen is expected to remain range-bound due to anticipated Federal Reserve rate cuts and potential BOJ tightening, though political developments, including Shinjiro Koizumi’s LDP leadership bid, could influence the BOJ’s room to act. Key data releases this week, including trade balance and inflation, will also shape market expectations. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

|

||

| R2 0.6700 - Figure - Medium R1 0.6677 - 16 September/2025 high - Strong S1 0.6483 - 2 September low - Medium S1 0.6414 - 22 August low - Strong | ||

| AUDUSD: fundamental overview | ||

| Recent U.S. economic data supports expectations for a 25bps Federal Reserve rate cut at the upcoming meeting, with further cuts anticipated in October and December. In Australia, the Commonwealth Bank’s August Household Spending Insights Index shows six months of rising household spending, signaling a consumer recovery driven by growing incomes, a strong labor market, and lower interest rates, though RBA Governor Michele Bullock warns that increased spending could limit future rate cuts if inflation rises. The Australian dollar is gaining strength, hitting yearly highs, with macro hedge funds increasing bullish bets via call options, and the currency is the second-best-performing major currency this month. Despite weak Chinese data, markets remain optimistic about Chinese policy support and U.S.-China trade talks, boosting risk-on sentiment and supporting the Australian and New Zealand dollars as China-proxy currencies. Australia’s upcoming August labor data is expected to show stable unemployment at 4.2%, a 67% participation rate, and solid job growth of around 21,000. | ||

| Suggested reading | ||

| While the World’s a Mess, Markets Are Ignoring This Truth, R. Forsyth, Barron’s (September 12, 2025) Trump Thinks The Fed Can Overcome Bad Policy, J. Tamny, Forbes (September 14, 2025) | ||