| ||

| 6th July 2025 | view in browser | ||

| Dollar faces pressure from tariffs, political gridlock | ||

| Last week’s strong Non-Farm Payroll report and the Fourth of July holiday prompted markets to reduce some dollar short positions, though the recovery remains cautious. | ||

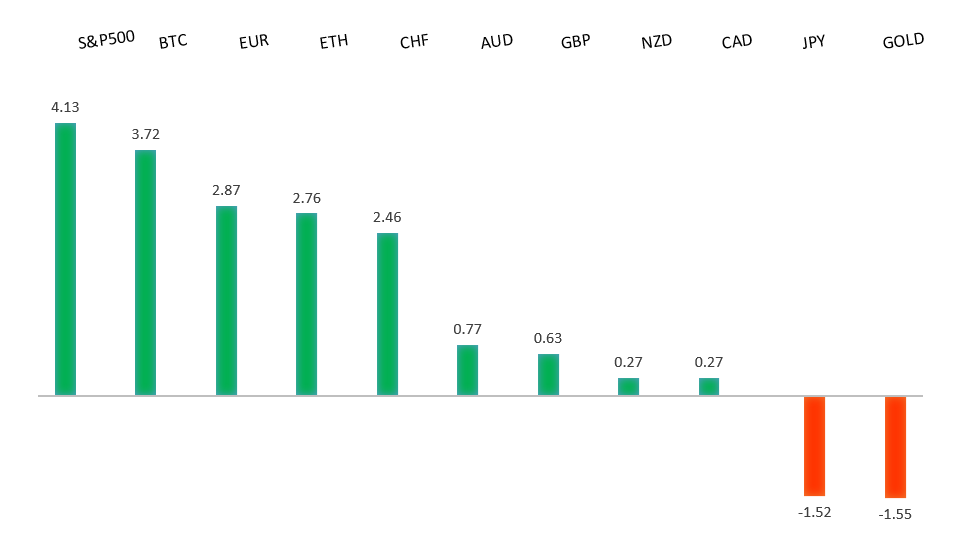

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1500. | ||

| ||

| R2 1.1900 - Figure - Medium R1 1.1830 - 1 July/2025 high - Medium S1 1.1708 - 30 June low - Medium S2 1.1654 - 26 June low - Medium | ||

| EURUSD: fundamental overview | ||

| ECB’s Makhlouf predicts a long-term decline in the US dollar’s dominance but notes the euro isn’t ready to replace it due to Europe’s lack of financial and economic integration. He attributes the euro’s recent rise against the dollar to concerns about US rule of law, not euro strength, and urges Europe to enhance its security, market integration, and sovereignty. This week, focus is on whether the EU and US can agree on a trade framework before the July 9 deadline to avoid 50% tariffs on EU exports, with Bloomberg estimating a 0.3-1.4% GDP hit to the euro area depending on tariff scenarios. Optimism persists for a deal, as both sides aim to avoid a trade war, with the EU open to a 10% tariff and the US extending negotiations until August 1. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming weeks, exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 146.19 - 24 June high - Medium R1 145.27 - 26 June high - Medium S1 143.00 - Figure - Medium S2 142.68 - 1 July low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s household spending in May surged 4.7%, exceeding expectations and marking the strongest growth since 2022, potentially bolstering the economy against U.S. tariff impacts and supporting the Bank of Japan’s case for future rate hikes. Despite this, concerns linger due to volatile data, a sharp -2.9% drop in real wages, and a modest 1% rise in nominal wages, casting doubts on sustained consumption strength. However, stable full-time worker wages, up 2.4% for 21 months, signal solid underlying trends, though a favorable trade deal may be crucial for the BOJ to confidently resume rate hikes amidst U.S. policy uncertainties. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Medium - Strong R1 0.6591 - 1 July/2025 high - Medium S1 0.6484 - 25 June low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s May spending data showed mixed signals: cautious consumer spending in retail but a surge in discretionary household spending across various categories. This may reduce the urgency for immediate aggressive rate cuts by the Reserve Bank of Australia, which might wait for Q2 inflation data before deciding on further rate reductions. While markets expect a second rate cut in July to lower the cash rate to 3.6% and anticipate a terminal rate of 3.1% (or even 2.85% by some economists), one large US bank predicts the RBA will pause, citing stable inflation near the 2-3% target, a tight jobs market, expected economic growth, and a stable Chinese yuan. Upcoming ANZ-Indeed Job Advertisements data will provide further economic insights. | ||

| Suggested reading | ||

| Can Volkswagen reinvent itself for the electric era?, P. Nilsson, Financial Times (July 3, 2025) Drill, Baby, Drill: These 3 Countries Are Gushing Oil, C. Mellow, Barron’s (July 3, 2025) | ||