| ||

| 3rd September 2025 | view in browser | ||

| Dollar roars back, gold to fresh record high | ||

| The FX market experienced a wild day on Tuesday as the U.S. dollar regained strength on return from the US long weekend. Volatility surged with the dollar rising against G10 currencies, equities and bonds declining, and gold hitting a record high. | ||

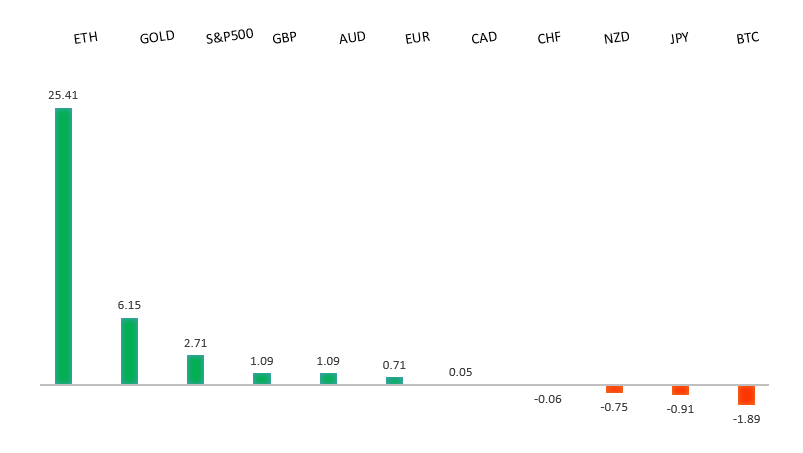

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

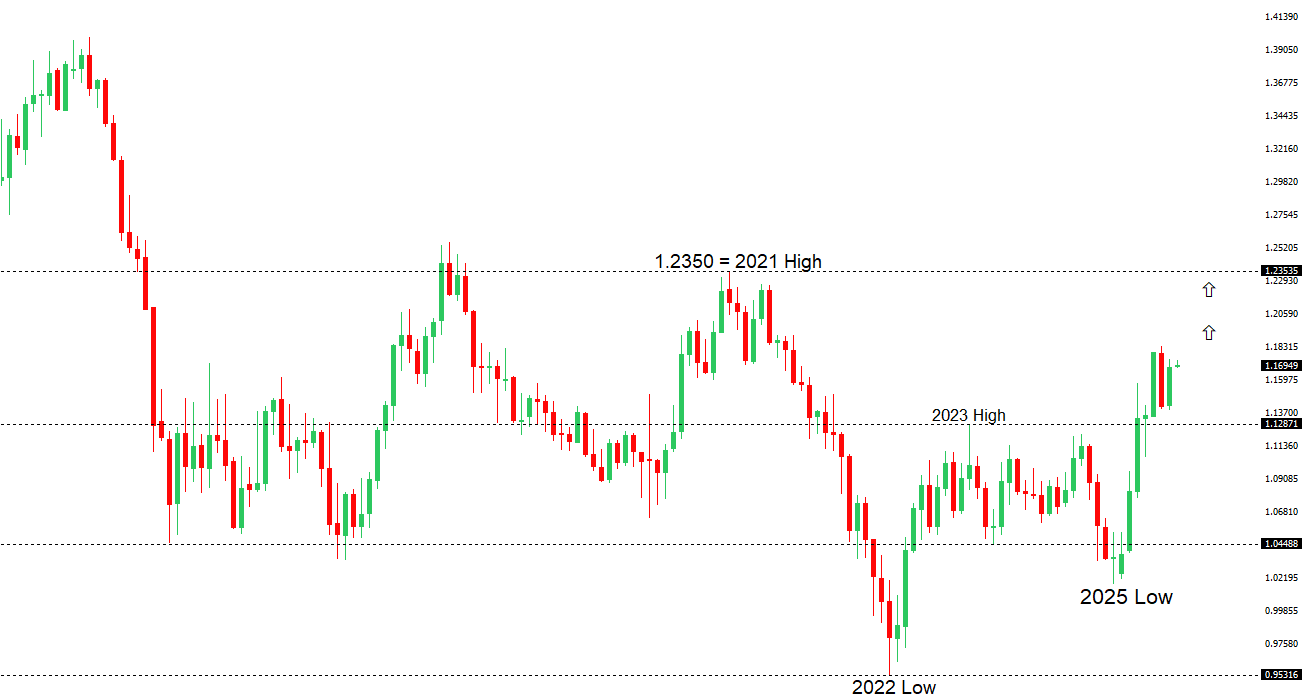

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1743 - 22 August high - Medium S1 1.1583 - 22 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro dipped toward $1.16 as European bond yields surged, driven by fiscal concerns reminiscent of the 2011 eurozone debt crisis, with German and French 30-year yields hitting decade highs. Germany plans €500 billion in new borrowing by 2029 for infrastructure and defense, while France faces a growing debt burden ahead of a key confidence vote. Eurozone inflation rose to 2.1% in August, above the ECB’s 2% target, fueling expectations of steady interest rates, while European stock markets, especially banks and tech, fell sharply amid global selloffs. | ||

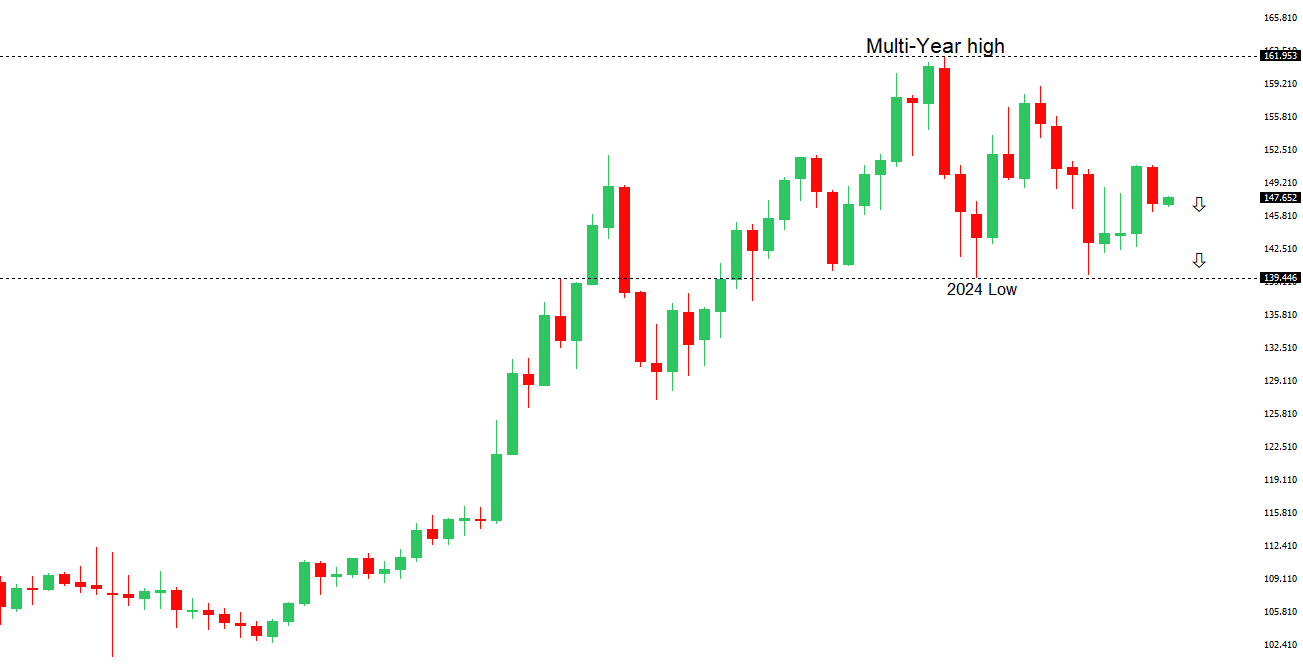

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 148.95 - 2 September high - Medium S1 146.21 - 14 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The Yen has come under pressure in recent sessions, driven by political uncertainty in Japan that’s weakening the yen, with former Prime Minister Aso Taro reportedly pushing for a new Liberal Democratic Party leadership election, pressuring Prime Minister Shigeru Ishiba. The Bank of Japan’s Deputy Governor Ryozo Himino reiterated gradual rate hikes but avoided specific timing, lowering market expectations for a year-end hike. In the US, a court ruling declared Trump’s “reciprocal” tariffs illegal, with an appeal deadline looming, adding uncertainty to the dollar. Japan’s economy grew steadily in August, with the services sector driving the Composite PMI to 52.0, though export orders dropped sharply and inflation eased, with businesses cautious on hiring and price increases. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6569 - 14 August high - Medium S1 0.6414 - 22 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar ended a five-session rally as markets grappled with mixed economic signals. While Q2 2025 showed a smaller-than-expected current account deficit and manufacturing hit a near three-year high, other indicators like a contracting Ai Group Industry Index and a drop in dwelling approvals painted a less rosy picture. The S&P/ASX 200 fell 0.3% to a two-week low, reflecting uncertainty, while rising bond yields and steady job ads reduced expectations for near-term rate cuts. Attention now turns to Australia’s Q2 GDP data and an upcoming speech by RBA Governor Michele Bullock for clues on future monetary policy. | ||

| Suggested reading | ||

| Technology and demographics are driving the uptake of medical robots, M. Peel, Financial Times (September 2, 2025) Ken Griffin On Markets, Fed, Building the Tomorrow’s Citadel, A. Serwer, Barron’s (August 29, 2025) | ||