| ||

| 2nd July 2025 | view in browser | ||

| Dollar steadies as Powell hints at rate cut delay | ||

| Strong economic data, including ISM prices paid and JOLTS job openings, briefly bolstered the U.S. dollar, along with comments from Federal Reserve Chair Jerome Powell who indicated uncertainty around the Trump administration’s trade and tariff policies was delaying a potential rate cut. | ||

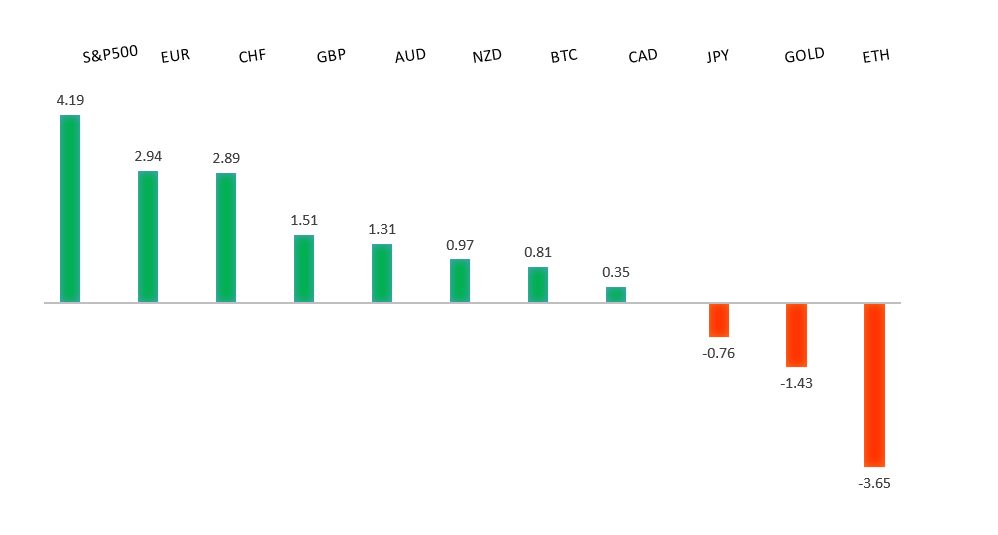

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1500. | ||

| ||

| R2 1.1900 - Figure - Medium R1 1.1830 - 1 July/2025 high - Medium S1 1.1708 - 30 June low - Medium S2 1.1654 - 26 June low - Medium | ||

| EURUSD: fundamental overview | ||

| Eurozone inflation rose to 2.0% in June, meeting the ECB’s target, while core inflation held steady at 2.3% and services inflation edged up to 3.3%, reflecting persistent price pressures. Despite Germany’s softer inflation, the ECB is likely to keep rates unchanged in July, with President Lagarde emphasizing vigilance due to risks like U.S. tariffs. A stronger euro, lower energy prices, and easing wage growth may pave the way for a rate cut later this year, contrasting with markets expecting more aggressive Fed cuts, boosting euro bullishness. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming weeks, exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 146.19 - 24 June high - Medium R1 145.27 - 26 June high - Medium S1 143.00 - Figure - Medium S2 142.68 - 1 July low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s June Consumer Confidence Index rose to 34.5, surpassing expectations and marking a second month of gains, signaling a broadening economic recovery alongside positive manufacturing sentiment from the Tankan survey. Despite looming 25% auto tariffs, the weak yen at 144 supports Japan’s auto exports, while large firms plan an 11.5% capex increase, bolstering GDP growth. However, markets remain skeptical about a near-term Bank of Japan rate hike, and with Trump’s July 9 tariff deadline approaching, Japan faces pressure to secure a favorable trade deal amid threats of higher duties and tensions over U.S. rice exports, especially with a national vote on July 20. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Medium - Strong R1 0.6591 - 1 July/2025 high - Medium S1 0.6484 - 25 June low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s retail sales and household spending data, due today and July 4, could confirm expectations for an RBA rate cut on July 8, with markets pricing in three additional cuts this year to a terminal rate of 3.10%, though some economists predict 2.85%. Despite this, the Australian dollar holds strong against the U.S. dollar, driven by expectations of the Fed’s easing cycle resuming and a positive market mood fueled by easing Middle East tensions and optimism for new U.S. and global trade deals. | ||

| Suggested reading | ||

| How Denmark learned to love a plant-based diet, S. Savage, Financial Times (July 1, 2025) How Uncertainty Rules Everything Around Me, J. Calhoun, Alhambra Investments (June 29, 2025) | ||