| ||

| 25th November 2025 | view in browser | ||

| Dollar steady ahead of key US data | ||

| A packed slate of U.S. data releases lands today, with markets steady as the dollar holds near unchanged ahead of retail sales—expected to slow slightly to 0.4% in September but supported by strong auto and EV purchases and resilient high-income spending. | ||

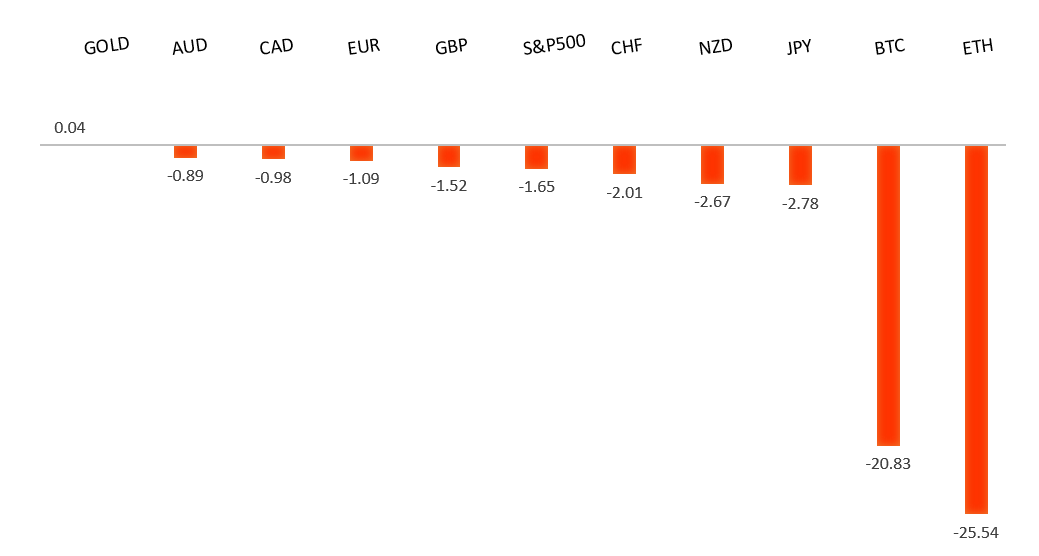

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

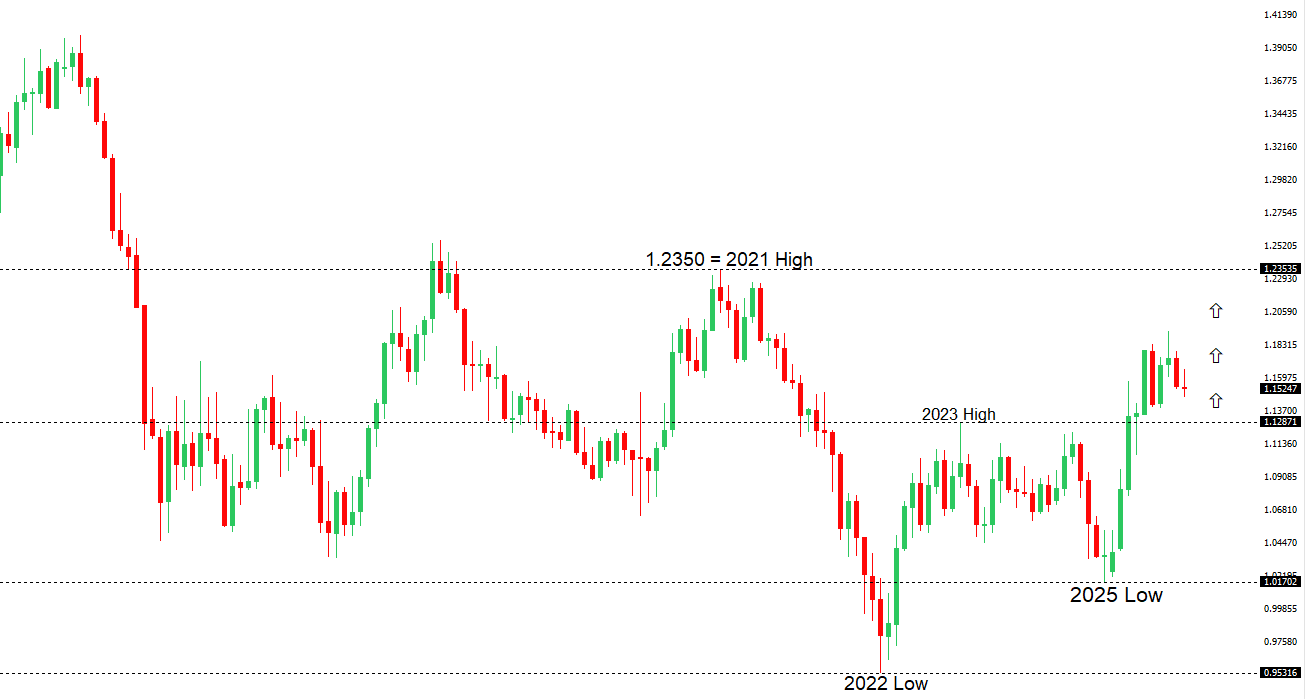

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Germany’s latest Ifo survey shows business confidence slipping again, with firms seeing little chance of a near-term recovery despite a slight improvement in current conditions. Weak expectations—especially in manufacturing—underscore doubts that government spending plans can overcome the country’s prolonged stagnation. Forecasters still see modest fourth-quarter growth, but projections are being trimmed, and advisers warn that without genuinely new, productive investment, Germany risks losing its longer-term growth momentum. Bloomberg notes the economy is “struggling to find its footing,” with industry hindered by trade disruptions while services provide what little growth there is. The European Commission remains more optimistic, expecting higher investment and private consumption to help Germany emerge from stagnation next year. On geopolitics, Trump and Ukrainian officials signaled progress on a US-backed peace framework—though renewed Russian-Ukrainian shelling quickly tempered optimism. Upcoming German data should show flat GDP and only marginal gains in consumption and investment, highlighting a fragile, stop-start recovery driven more by domestic demand than external strength. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Under the Takaichi administration, traders worry that Japan’s usual rules for intervening in USDJPY are shifting, with authorities acting earlier, at calmer moments, and around lower levels like 157–158 instead of waiting for sharp volatility or big monthly moves. Recent comments from officials hint at a more flexible, proactive doctrine, but without a meaningful BOJ policy shift, intervention alone is likely to have only temporary impact. Markets increasingly doubt the BOJ’s freedom to tighten policy, pricing in only a small chance of a December hike and viewing any eventual move as “one-and-done.” Ultimately, a lasting yen rebound may depend more on Fed rate cuts, which some expect in 2026. Meanwhile, a sensitive call between PM Takaichi and Trump—linked to messages about China and Taiwan—highlights geopolitical tensions that could still trigger Chinese retaliation and add further downward pressure on the yen. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Aussie has bounced from recent lows as improving risk sentiment and firmer equities support a recovery, though a clear break above the 200-day moving average is still needed to confirm stability. Strong labour demand, high wages, and resilient economic data have reinforced the RBA’s decision to pause further rate cuts, with some analysts suggesting the easing cycle is already over. If the RBA stays on hold while the Fed cuts rates in 2026, Australia could offer the highest yields in the G10. Meanwhile, improving exports—helped by lifted U.S. tariffs and record iron ore shipments—support Australia’s growth outlook. Tomorrow’s inflation data is expected to show only a mild easing, unlikely to shift the RBA’s steady stance at the upcoming December meeting. | ||

| Suggested reading | ||

| The CEO Crisis: how to survive the pressure, I. Berwick, FT (November 24, 2025) Patience & Discipline Are Your Friends, Fisher Investments (November 20, 2025) | ||