| ||

| 21st May 2025 | view in browser | ||

| Dollar under pressure as trade tensions rise | ||

| As global markets navigate heightened uncertainty, the U.S. dollar faces pressure from multiple fronts. Anticipation surrounds talks between U.S. Treasury Secretary Bessent and Japan’s Finance Minister Kato at the G7 Finance Ministers meeting, with speculation of dollar-negative outcomes tied to President Trump’s push against undervalued Asian currencies, seen as fueling trade surpluses. | ||

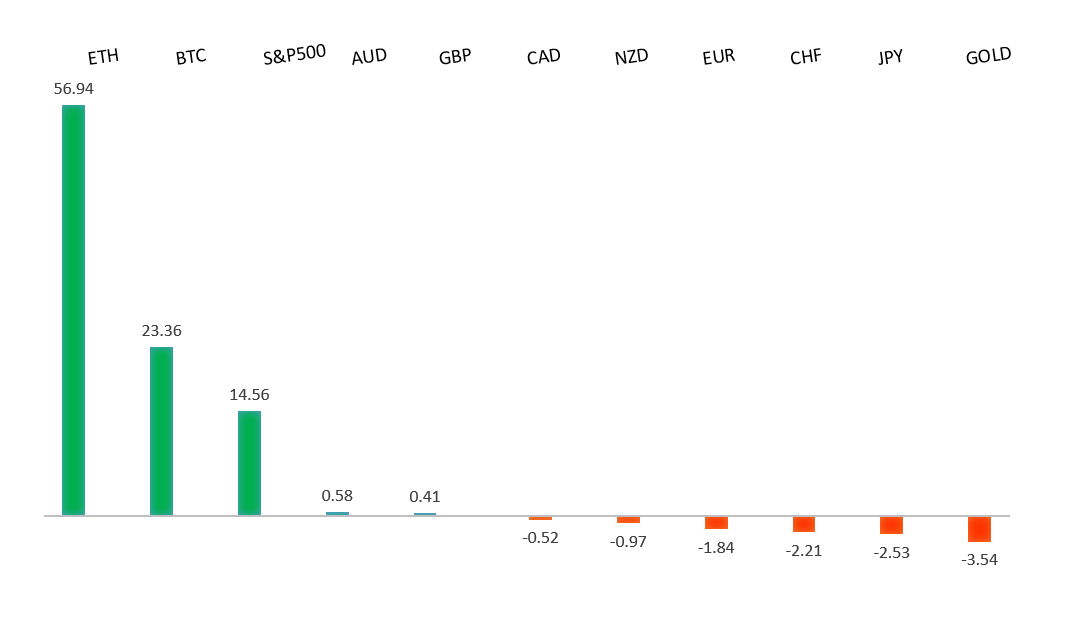

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1474 - 11 April high - Medium R1 1.1382 - 6 May high - Medium S1 1.1131 - 16 May low - Medium S2 1.1065 - 12 May low - Medium | ||

| EURUSD: fundamental overview | ||

| The European Central Bank views the euro’s recent strength as an opportunity, potentially tolerating further appreciation toward the 1.20 mark, as suggested by historical regression analysis. ECB Governing Council Member Pierre Wunsch indicated that cutting the main deposit rate to just below 2% by year-end could support the economy and prevent inflation from falling below target, amid risks from trade tensions and despite no immediate recession concerns. Increased government spending, such as Germany’s €500 billion infrastructure plan, may bolster recovery. Despite expectations of sustained U.S. Federal Reserve rates and further ECB cuts, narrowing yield differentials between Eurozone and U.S. 10-year bonds, alongside rising gold and yen, suggest a shift away from U.S. assets. Recent Eurozone data shows a rising current account surplus (€50.924 billion in March), slightly improved consumer confidence (-15.2 in May), and a modest 0.1% increase in construction output, signaling cautious economic improvement. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.19 - 9 May high - Medium S1 143.44 - 8 May low - Medium S2 142.35 - 6 May low - Medium | ||

| USDJPY: fundamental overview | ||

| As President Trump’s Tax Cuts and Spending Bill approaches a House vote, markets are on edge, with the U.S. 10-year Treasury yield nearing 4.6%—a level that previously prompted Trump to ease reciprocal tariffs—potentially signaling volatility if breached, driving safe-haven flows to the yen. Ahead of the G7 Finance Ministers meeting in Canada, traders favor long yen positions, anticipating remarks from U.S. Treasury Secretary Scott Bessent and Japan’s Finance Minister Katsunobu Kato, though Tokyo sources suggest currency discussions will be minimal, potentially triggering short covering in USDJPY if no significant news emerges, given the high cost of holding short carry trades. A sell-off in the dollar, U.S. equity futures, and Treasuries reflects capital repatriation to Asia, with the yen benefiting amid reluctance to fund U.S. deficits. Japan’s April trade data reveals a deficit of ¥115.8 billion, below forecasts, with exports (2.0% YoY) and imports (-2.2% YoY) underperforming, driven by a 1.8% drop in shipments to the U.S., Japan’s top export market. U.S. auto tariffs threaten Japan’s economy, which produces 9 million cars annually, exporting 1.5 million to the U.S. and 1.4 million via Mexico and Canada, contributing to Q1 GDP contraction and complicating the Bank of Japan’s monetary normalization plans amid trade policy uncertainty. | ||

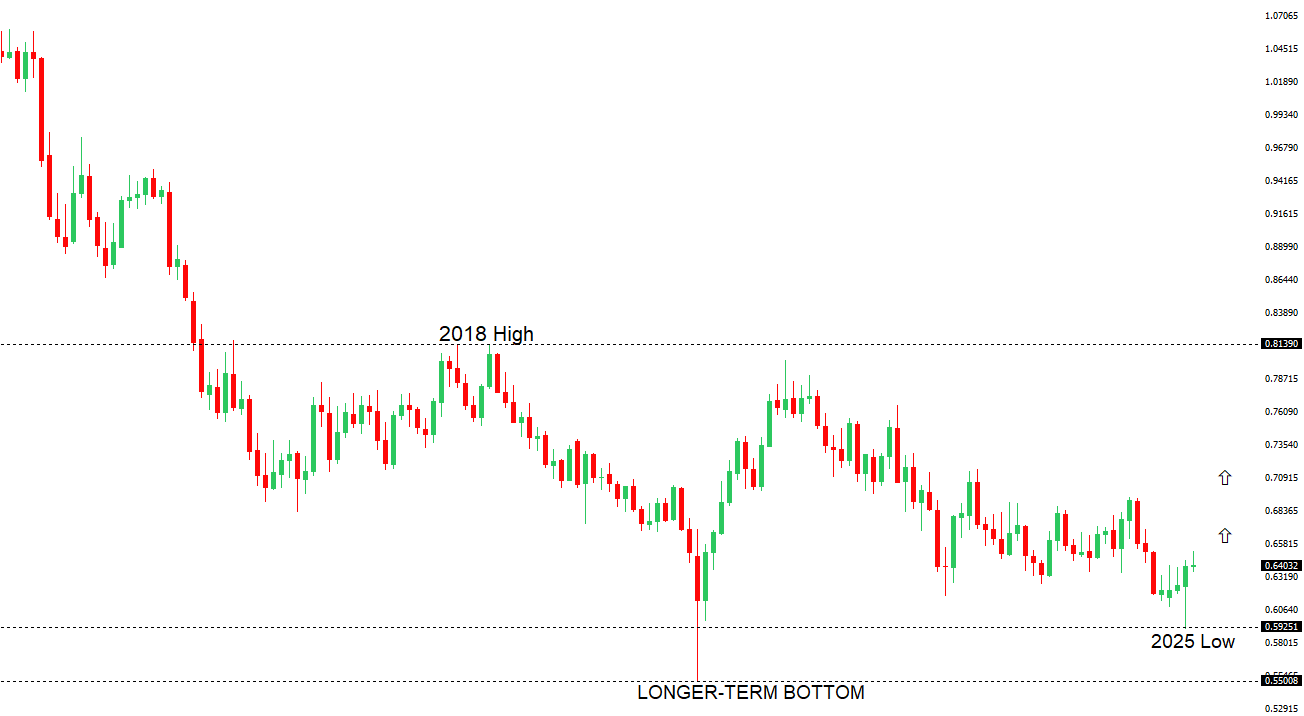

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November high - Strong R1 0.6515 - 7 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Reserve Bank of Australia cut the Official Cash Rate by 25 basis points to 3.85%, as expected, but its less hawkish-than-anticipated rhetoric led to a drop in Australian yields, narrowing the 3-year Australia-U.S. yield spread and pressuring AUDUSD downward. The RBA downgraded its forecasts, projecting 4Q25 GDP growth at 2.1% (from 2.4%), inflation peaking at 3.1% in 2Q26 (down from 3.7% in 4Q25), and unemployment rising to 4.3% by year-end (up from 4.2%), with inflation now within the 2-3% target and wage growth expected to slow. This signals a shift toward prioritizing growth and employment over inflation control, with markets anticipating 2-3 additional rate cuts and the RBA prepared to act cautiously while monitoring global developments. Market focus is on the potential impact of Trump’s Tax Cuts and Spending Bill on bond markets and discussions between U.S. Treasury Secretary Bessent and Japan’s Finance Minister Kato at the G7 Finance Ministers meeting. Ongoing sell-offs in the dollar, U.S. equity futures, and Treasuries indicate capital flows back to Asia, benefiting antipodean currencies like the AUD amid reluctance to finance U.S. deficits. | ||

| Suggested reading | ||

| Moody’s Feels Blue, Downgrades US Debt, Fisher Investments (May 19, 2025) New disruptor alert, S. McBride, RiskHedge (May 19, 2025) | ||