| ||

| 3rd December 2025 | view in browser | ||

| Dovish drift lifts markets | ||

| Financial markets open the day with the primary focus on next week’s Fed meeting, where investors assign a roughly 90% chance of a 25bp rate cut, though major banks still frame it as a cautious “risk-management” move rather than the start of aggressive easing. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

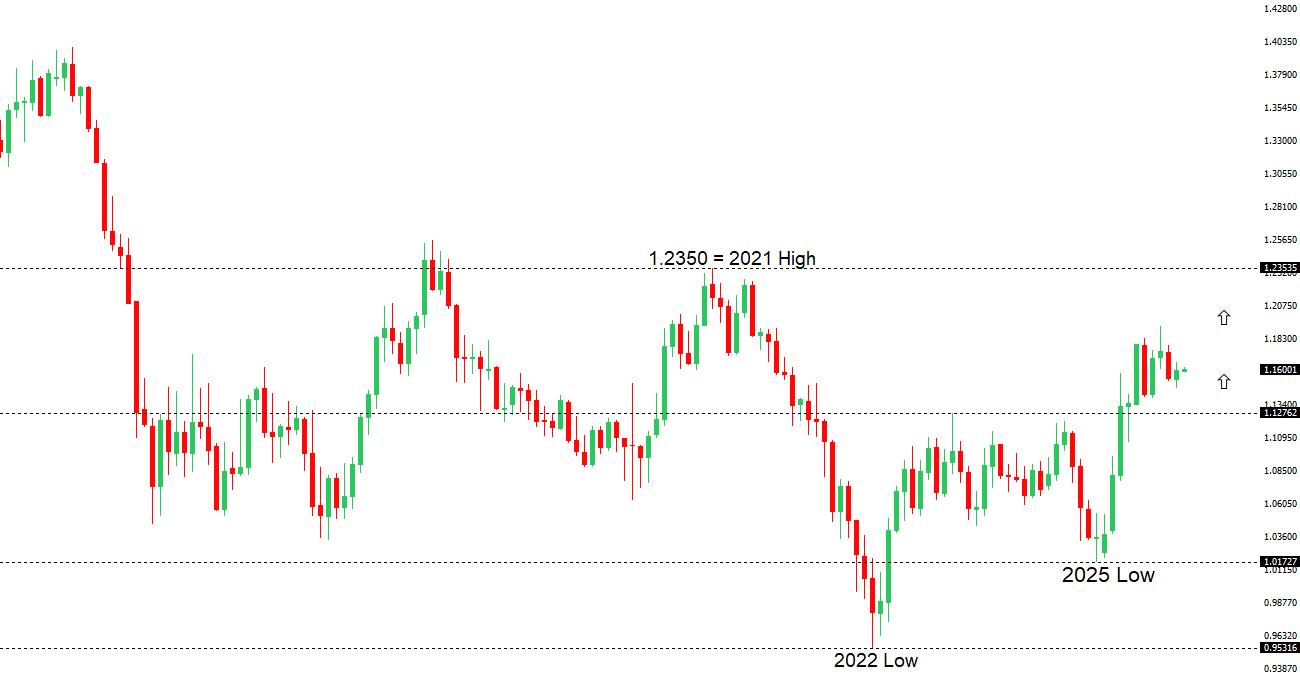

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone inflation ticked up to 2.2% in November—slightly above the ECB’s target—driven mainly by rising service prices, while unemployment held steady at 6.4%. Despite this, the ECB is expected to keep its key rate at 2% for the foreseeable future, with policymakers confident that slower wage growth will eventually bring inflation back below target. The OECD projects modest eurozone growth through 2027, though one European bank offers a more optimistic outlook, citing potential fiscal stimulus in Germany and forecasting a stronger euro, albeit with limited upside due to continued support for the U.S. dollar. On the geopolitical front, tensions remain high as the U.S. envoy visits Moscow amid disputed Russian claims of capturing Pokrovsk—developments that could strengthen Russia’s leverage in peace negotiations if confirmed. | ||

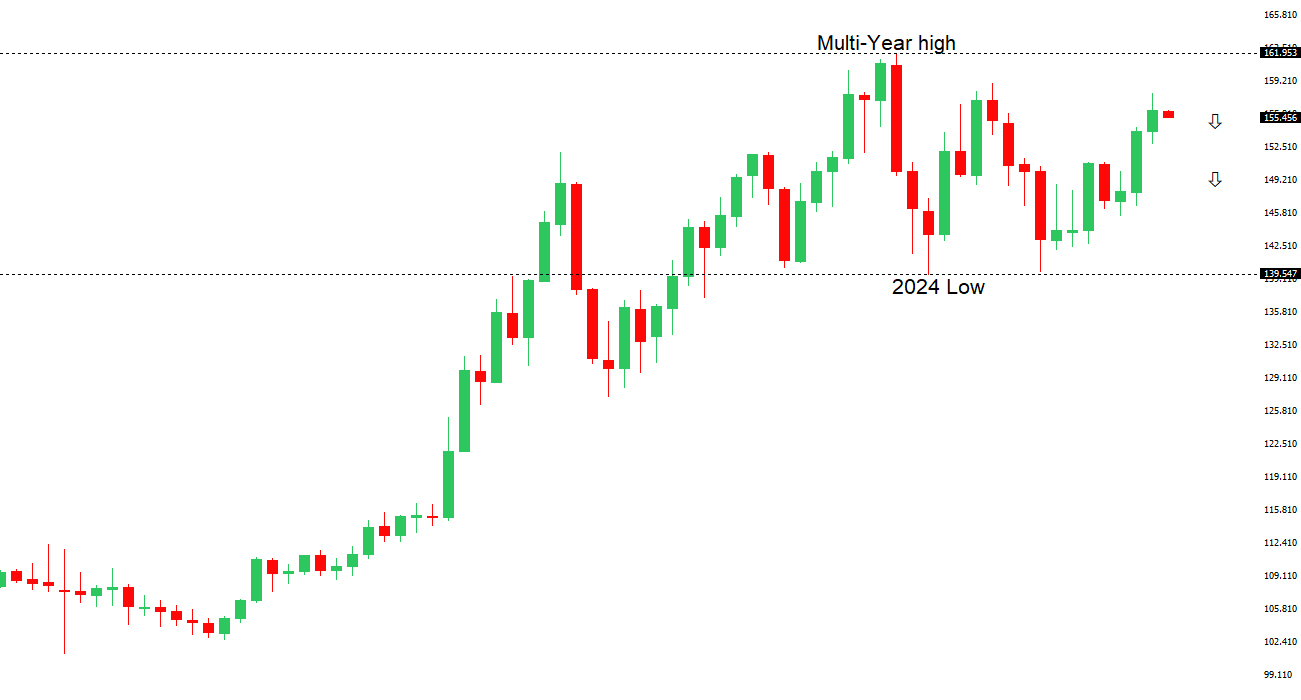

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.90 - 20 November/2025 high - Strong R1 156.59 - 28 November high - Medium S1 154.66 - 1 December low - Medium S2 153.61 - 14 November low - Strong | ||

| USDJPY: fundamental overview | ||

| Japan’s recent political and economic signals point to a cautiously improving outlook, but with plenty of caveats. Finance Minister Satsuki Katayama’s comments suggest the government is comfortable with a near-term BOJ rate hike as the weak yen fuels inflation, though any tightening beyond December remains doubtful given BOJ caution and the government’s expansionary fiscal stance. While global FX remains driven by expectations of future Fed cuts—tilting medium-term sentiment toward a stronger yen—Japan still faces external risks from U.S. tariffs and strained China relations, which could dent growth. Domestically, the government’s new “DOGE-style” efficiency office looks more symbolic than transformative, arriving alongside a massive stimulus that likely outweighs any savings. Still, fresh data—from rising consumer confidence to resilient services-led PMI readings—shows gradual economic recovery and supports the BOJ’s slow, measured path toward policy normalization. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6600 - Figure - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Recent data suggest Australia may be entering a cyclical upswing, supporting the RBA’s decision to stay on hold, and prompting some analysts to expect rate hikes in 2026. That outlook, combined with already high yields, positions the AUD as one of the most attractive G10 currencies. Still, capacity constraints, stagnant productivity, and soft 3Q GDP figures show the economy isn’t overheating, keeping the RBA cautious for now. Stable real incomes, rising household savings, and expected AUKUS-driven investment offer medium-term support, while China’s slowdown poses risks—though potential stimulus from Beijing could lift sentiment and provide an additional boost to the Aussie. | ||

| Suggested reading | ||

| The Greatest Investing Tip I Took From Charlie Munger, S. McBride, RiskHedge (December 1, 2025) Extraordinary Results On a Rather Erratic Path, J. Calhoun, Alhambra (November 30, 2025) | ||