| ||

| 30th October 2025 | view in browser | ||

| Fed cuts, Powell pumps brakes on December | ||

| The Federal Reserve cut its benchmark interest rate for the second straight time to 3.75–4%, the lowest in three years, though Chair Powell warned against expecting another reduction in December, emphasizing data-dependent decisions amid internal divisions. | ||

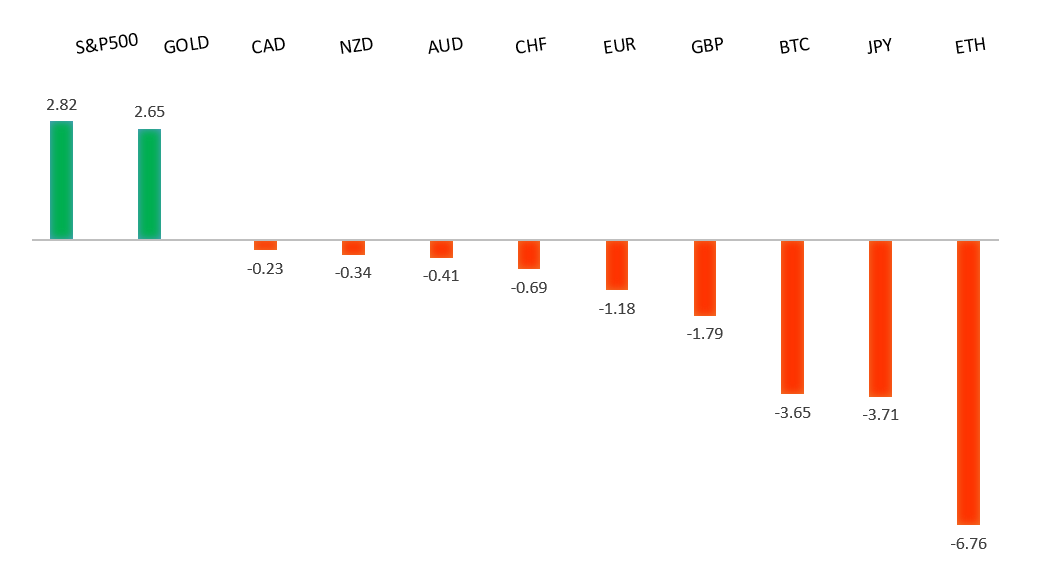

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

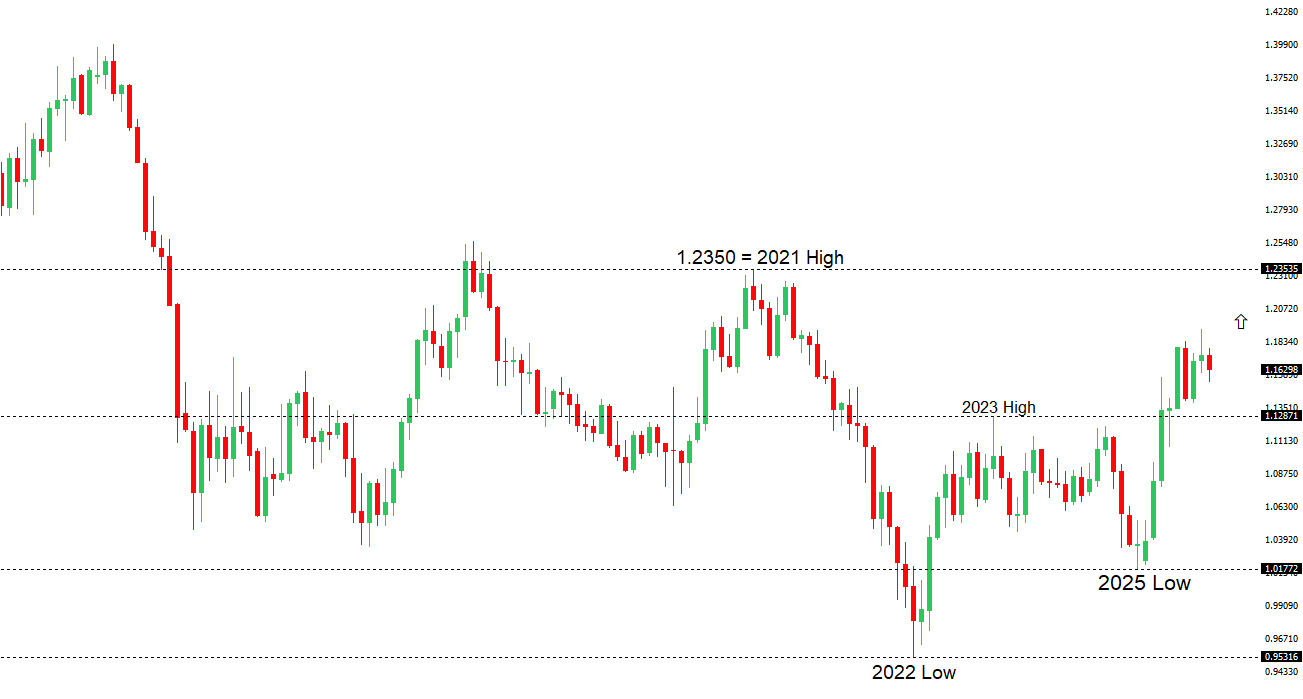

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The ECB’s upcoming policy meeting is likely a non-event, with rates held steady amid a confident “Goldilocks” outlook where US tariff impacts are seen as temporary and offset by Germany’s fiscal stimulus; President Lagarde will stress policy is “in a good place,” signaling stability and muted rate-cut speculation while cautioning on geopolitical risks, bolstered by stable inflation expectations (1-year CPI at 2.7%, 3-year at 2.5%). This ECB-Fed divergence, combined with easing US-China trade tensions post-Trump-Xi talks, should curb aggressive EURUSD shorting despite Fed cut doubts, while markets eye today’s Q3 eurozone GDP (forecast: 0.1% QoQ, 1.2% YoY) and steady 6.3% unemployment, highlighting sluggish growth amid tariff pressures but potential 2026 relief from German stimulus and easier financing. Meanwhile, the ECB pushes for a 2029 digital euro launch to enhance payment autonomy and reduce reliance on US giants like Visa and PayPal, though political delays (key vote to mid-2026) limit short-term effects; longer-term, successful adoption could mildly bolster EURUSD if it strengthens eurozone prospects. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.27 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan held its policy rate steady at 0.5%, with two board members dissenting for a hike, aligning with most economists’ expectations in the first meeting under new Prime Minister Sanae Takaichi, a monetary easing supporter. Governor Kazuo Ueda’s cautious stance amid political shifts suggests a potential rate increase as soon as December, with his upcoming press conference likely to address yen weakness and adopt a hawkish tone. USDJPY is pushing toward the October high of 153.27, buoyed by possible positive US-China trade talks from the Trump-Xi meeting, though over the medium term, markets may overestimate fiscal expansion under Takaichi, as her coalition partner Ishin pushes for spending discipline to curb yen depreciation. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6608 - 28 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s hotter-than-expected Q3 CPI data, with annual inflation rising to 3.2% and core measures exceeding forecasts, has shifted market expectations toward the RBA holding rates steady at its November 4 meeting rather than cutting. The Australian dollar initially surged to three-week highs but later eased below 0.6600 after Fed Chair Powell tempered expectations for a December U.S. rate cut. RBA Governor Bullock had flagged a 0.9% quarterly core reading as concerning, making the 1.0% result likely to prompt a “wait-and-see” approach, with rate cuts now pushed to 2026 unless inflation or labor markets soften significantly. Separately, President Trump’s positive comments on his meeting with President Xi and planned April visit to China are supporting risk-on sentiment, benefiting cyclical currencies like the AUD and NZD. | ||

| Suggested reading | ||

| The Dollar’s Down & These 3 Investments Are Way Up, D. Lefkovitz, Morningstar (October 29, 2025) There May Be A Stock Market Bubble….Next Year, M. Hulbert, MarketWatch (October 29, 2025) | ||