| ||

| 19th June 2025 | view in browser | ||

| Fed holds rates, Dollar wobbles | ||

| The Federal Reserve maintained its benchmark interest rate as anticipated, with the dot plot indicating two rate cuts for the year, though nearly as many members projected none, showing a close split. | ||

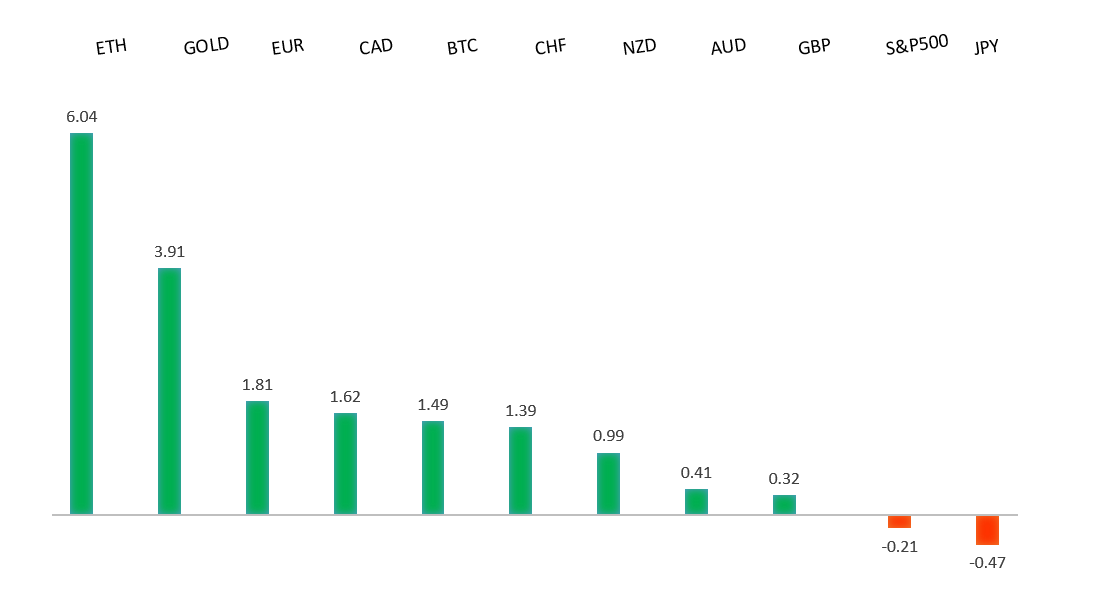

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1632 - 12 June/2025 high - Strong R1 1.1600 - Figure - Medium S1 1.1373 - 10 June low - Medium S2 1.1210 - 29 May low - Strong | ||

| EURUSD: fundamental overview | ||

| European ministers will meet Iran’s counterpart in Geneva on Friday, alongside EU diplomat Kaja Kallas, to discuss Iran’s nuclear program, with U.S. coordination but without Trump’s hardline influence, potentially easing compromise. The ECB, after a June rate cut, is cautious, with markets expecting just one more cut in 2025, while the U.S. anticipates two, supporting the euro. The EU plans to boost defense spending by cutting regulations, aiming to speed up project approvals and stimulate the economy, further strengthening the euro. ECB President Lagarde promotes the euro as a global reserve currency alternative, while ECB members Villeroy and Panetta emphasize stable 2% rates, controlled inflation, and risks from U.S. trade policies and Middle East tensions, with July’s ECB meeting hinging on U.S. trade talks. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan will release its inflation data early Friday, with core CPI expected to hit 3.7%, marking three months of rising inflation, driven by higher service and food prices as companies pass on increased labor costs. Persistent high inflation may push the Bank of Japan to raise interest rates, though concerns about U.S. tariffs impacting growth remain. Japan’s failure to secure a trade deal with the U.S. at the G7 summit raises recession risks, but President Trump hinted at a possible agreement before the July 9 tariff deadline, aiming to score economic wins ahead of the 2026 midterms. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6546 - 11 June/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| At the G7 summit, Australian Prime Minister Anthony Albanese met with EU leaders Ursula von der Leyen and Antonio Costa to discuss strengthening trade and security ties, emphasizing their importance amid global protectionism. Despite a failed 2018-2023 free trade agreement attempt, Albanese remains optimistic about reaching a new deal. Australia’s May employment data showed a surprising dip of -2.5k jobs against a forecast of 21.2k, but full-time jobs rose, and the unemployment rate held steady at 4.1%, signaling labor market resilience. The Reserve Bank of Australia expects unemployment to peak slightly higher at 4.3%, with no significant shift in monetary policy easing expectations. | ||

| Suggested reading | ||

| Gut Feelings & Headline Chasing Are Not Good Investing, J. Spittler, RiskHedge (June 16, 2025) Worried About Everything? What To Do To Ease Your Mind, J. Ho, Marketwatch (June 18, 2025) | ||