| ||

| 10th July 2025 | view in browser | ||

| Fed split on tariffs, Dollar dips | ||

| The release of the June FOMC minutes revealed a divided Federal Reserve, concerned about tariff-related uncertainties impacting inflation, though data has yet to confirm these effects. | ||

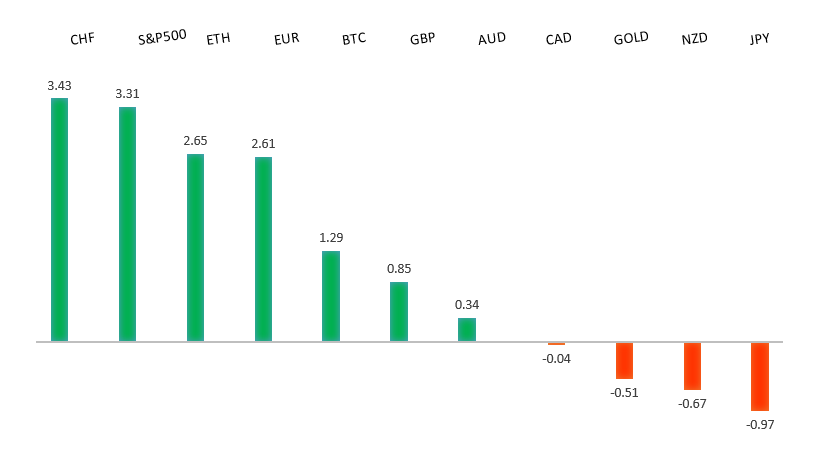

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1500. | ||

| ||

| R2 1.1900 - Figure - Medium R1 1.1830 - 1 July/2025 high - Medium S1 1.1682 - 8 July low - Medium S2 1.1654 - 26 June low - Medium | ||

| EURUSD: fundamental overview | ||

| ECB Governing Council members Robert Holzmann and Joachim Nagel expressed caution on further interest rate cuts, with Holzmann suggesting current rates may suffice for economic stimulus and Nagel advocating for a flexible, data-driven approach amid global uncertainties like trade tensions and geopolitical risks. Meanwhile, France and the UK signed a historic declaration to coordinate their nuclear deterrents, signaling deeper European integration and a potential shift from U.S. reliance. Markets anticipate limited ECB rate cuts this year, expect two from the Fed, and see a favorable euro outlook due to monetary policy divergence, potential U.S. trade deals, and seasonal dollar weakness, supporting a bullish stance on EURUSD. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming weeks, exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.03 - 23 June high - Strong R1 147.19 - 9 July high - Medium S1 144.18 - 4 July low - Medium S2 142.68 - 1 July low - Strong | ||

| USDJPY: fundamental overview | ||

| Japanese officials are frustrated with the US administration’s tariff strategy, as Japan’s restrained response contrasts with the EU, Canada, and China’s threats of countermeasures. A former official suggested Japan might reconsider its tariff concessions on US goods, noting that diplomacy may not sway the White House, which seems to respond only to leverage. Meanwhile, Japan’s bond market anticipates increased government spending after the July 20 upper house election, reducing expectations for a rebound in longer-dated Japanese Government Bonds. The Bank of Japan is cautious about raising interest rates due to rising long-term yields and potential US tariffs, despite inflation exceeding the 2% target, leading markets to doubt policy normalization in 2025. Japan’s producer price inflation slowed to 2.9% in June, signaling easing cost pressures, though consumer prices remain elevated due to factors like service inflation and tourism demand. With negative real interest rates and widening US-Japan yield differentials, USDJPY is likely to test higher levels, with markets eyeing upcoming US CPI data. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Medium - Strong R1 0.6591 - 1 July/2025 high - Medium S1 0.6484 - 25 June low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Markets are increasingly viewing the August 1 deadline as an extension, with the U.S. administration leaning toward trade deals rather than reverting to high tariffs, fostering a risk-on trading environment that supports the Australian dollar above its 50-day moving average. The Reserve Bank of Australia unexpectedly kept the Official Cash Rate at 3.85%, boosting AUD optimism, as it awaits quarterly CPI data to ensure inflation is sustainably nearing the 2.5% target amid global and domestic uncertainties, including trade policy risks. With Australia’s robust labor market and low unemployment reducing the need for immediate rate cuts, the RBA noted that the effects of this year’s 50 basis points of cuts are still unfolding, with markets now expecting two rate cuts in 2025 instead of three. | ||

| Suggested reading | ||

| How Inflation Is Eating The Labor Market, A. Bustamante, Barron’s (July 9, 2025) This Indicator Says Recession Risks Are Rising, M. Hulbert, MarketWatch (July 9, 2025) | ||