| ||

| 5th January 2026 | view in browser | ||

| Geopolitics collide with softening inflation signals | ||

| Global markets open the day facing a dense mix of geopolitical and macro crosscurrents, led by a US-led intervention in Venezuela that could eventually add oil supply, soften energy prices, and ease inflation pressures in Europe and the UK, while near-term geopolitical uncertainty keeps risk sentiment fragile. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1400. | ||

| ||

| R2 1.1919 - 17 September/2025 high -Strong R1 1.1765 - 2 Janaury/2026 high - Medium S1 1.1672 - 5 January /2026 low - Medium S2 1.1615 - 9 December low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro slipped about 0.4% to 1.1675, a roughly 2½-week low, largely reflecting a stronger dollar, with near-term moves still driven more by USD dynamics ahead of upcoming euro-area data. Looking into early 2026, the outlook for EURUSD is modestly positive after strong 2025 gains, supported by expectations that ECB rates will stay on hold while the Fed may cut, alongside improving euro-area growth. With inflation near target and ECB policymakers seen as resistant to further easing, markets see policy divergence as euro-supportive. Major banks project EURUSD around 1.22–1.26 by 2026, reinforcing a constructive medium-term view despite likely near-term range trading. | ||

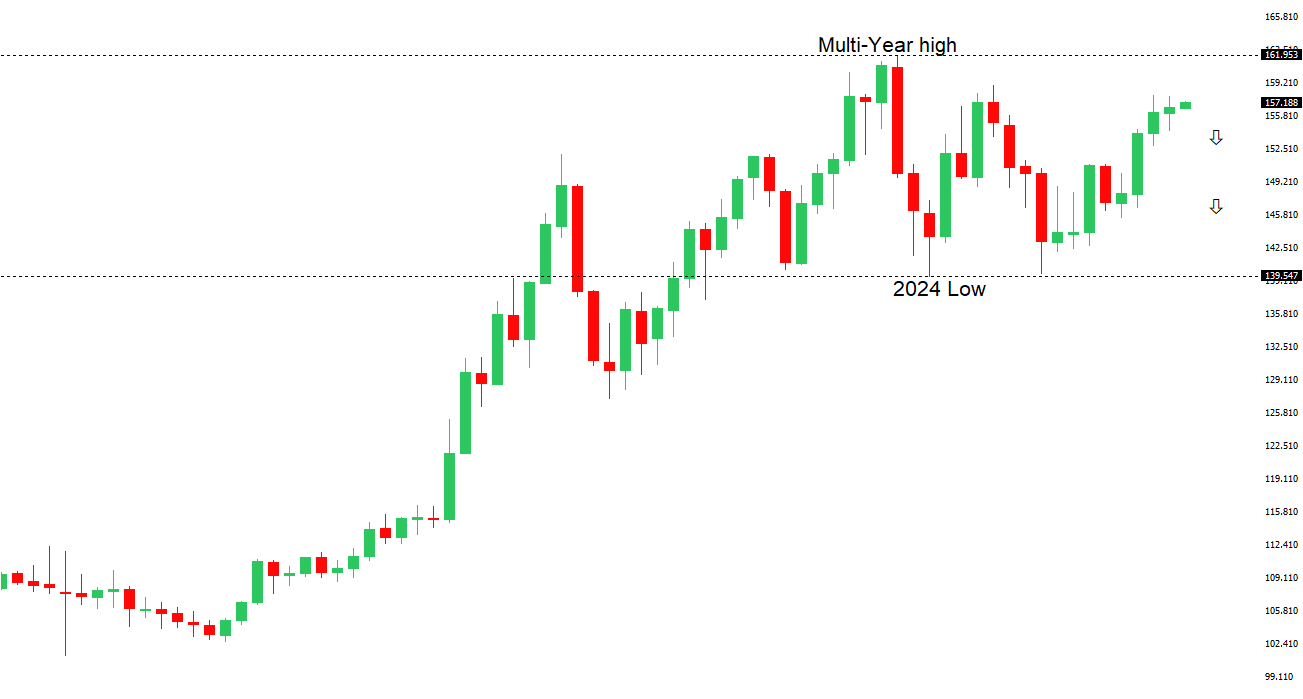

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. A break below 154.39 will strengthen the outlook. | ||

| ||

| R2 157.90 - 20 November/2025 high - Strong R1 157.30 - 5 January /2026 high - Medium S1 155.55 - 24 December low - Medium S2 154.39 - 16 December low - Strong | ||

| USDJPY: fundamental overview | ||

| The dollar is holding near a two-week high versus the yen, supported by broad USD strength and steady signals from Japan. The BOJ reaffirmed it will keep raising rates as conditions allow, while Japan’s December manufacturing PMI was revised up to 50.0, signaling a return to expansion. Looking ahead, USDJPY is likely to consolidate or see modest yen strength in the near term, though the pair remains in a high range where U.S.–Japan yield spreads can quickly favor the dollar. Over 2026, gradual yen appreciation is expected as BOJ policy normalizes and Fed rate cuts narrow yield gaps, but sharp moves above 158–160 would raise the risk of official intervention. This week’s focus is on Japan’s wage data, which may soften on a monthly basis but still reflects solid underlying wage momentum that supports the BOJ’s inflation outlook. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6800 - Figure - Medium R1 0.6728 - 29 December/2025 high - Medium S1 0.6592 - 18 December low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar slipped 0.3% to 0.6670 as a stronger US dollar and rising geopolitical risks outweighed support from firm gold prices, with tensions around US-China relations weighing on risk-sensitive currencies. Despite this near-term softness, the AUD has appreciated since mid-November on growing expectations that the RBA could shift toward rate hikes by mid-2026, supported by resilient consumer spending, wage growth, and inflation pressures. This contrasts with expectations for continued Fed easing, a backdrop many analysts see as broadly AUD-supportive. Australia also enters 2026 with solid fundamentals, helped by improving Chinese data and steady growth prospects, while speculative positioning remains net short, leaving scope for further short-covering if upcoming inflation and activity data reinforce the “higher for longer” RBA view. | ||

| Suggested reading | ||

| The blue-collar jobs revival: The skills the world needs now, I. Berwick, FT (December 30, 2025) The Challenges Facing Buffett’s Successor, R. Nagarajan, The Rational Walk (December 31, 2025) | ||