| ||

| 23rd October 2025 | view in browser | ||

| Global banks’ moves sway Dollar’s path | ||

| Financial markets are shifting as investors move away from yen and gold, favoring the U.S. dollar due to squeezed short positions and renewed confidence in U.S. corporate earnings, signaling broader economic strength. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

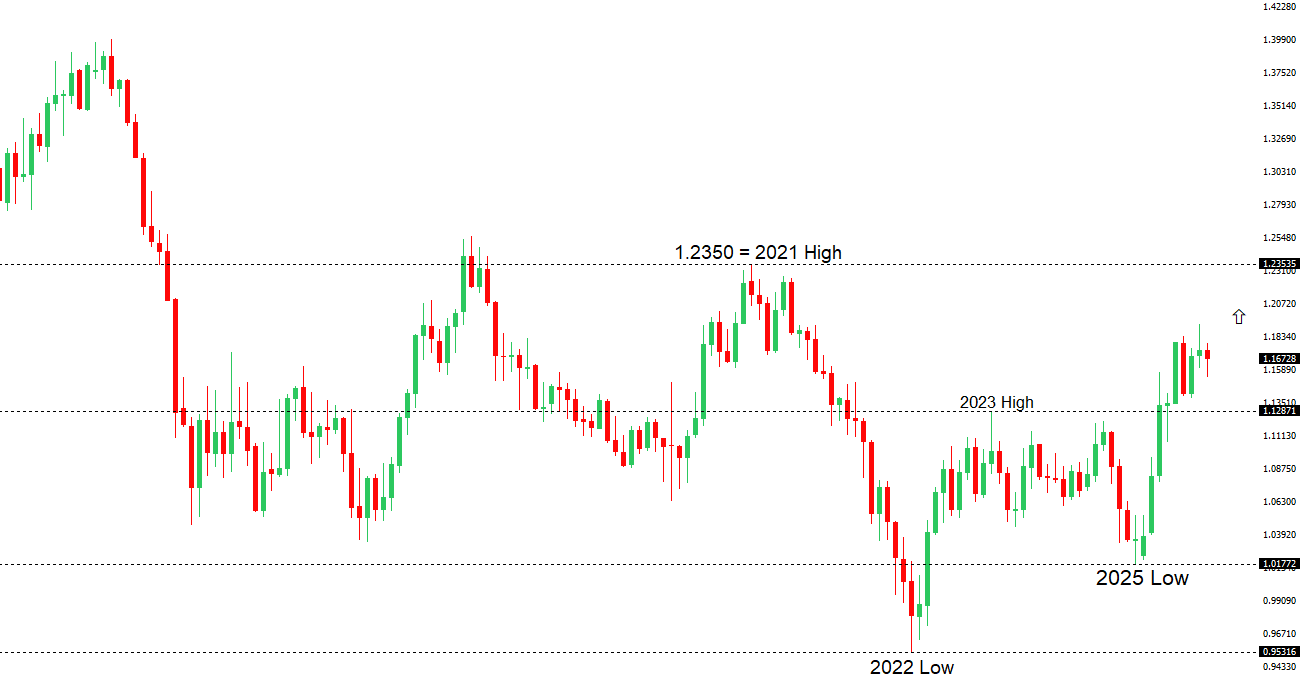

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone inflation rose slightly to 2.2% in September, aligning with the ECB’s target, but disinflation may be slowing, reducing the likelihood of further rate cuts as ECB officials view current policy as supportive. The euro is somewhat bolstered by this stance, though its gains are limited by the region’s weak growth and fiscal challenges, with markets needing stronger German stimulus or improved Eurozone growth for a confident euro rally. A potential Trump-Xi meeting at the APEC Summit could ease trade tensions, supporting risk-on sentiment and EURUSD, while geopolitical risks, like Russia’s attacks on Ukraine and new EU sanctions, weigh on the euro. ECB Chief Economist Philip Lane highlighted risks to eurozone banks from tighter U.S. dollar funding, and consumer confidence remains fragile, with October’s reading expected to hold at -14.9, reflecting cautious sentiment and weak domestic demand. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Prime Minister Takaichi’s new economic package, emphasizing targeted support over large-scale spending, suggests a cautious fiscal approach that could mildly support the yen and keep USDJPY stable or slightly lower, provided aggressive deficit financing is avoided. However, uncertainty about the package’s size and funding could drive USDJPY higher if significant bond issuance is announced. The Bank of Japan sees no urgent need for an interest rate hike at its October 30, 2025, meeting, with a possible hike eyed for December or January 2026, depending on economic data and yen movements. One major US investment house notes that Japan’s stronger economic conditions reduce the need for extensive monetary easing, though Takaichi’s Abenomics support adds some uncertainty to the BOJ’s gradual tightening path. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar may gain support from widening AUD10yr-US10yr yield spreads and China’s efforts to strengthen the yuan. Australia’s unemployment rate rose to 4.5% in September, the highest in nearly four years, increasing pressure on the Reserve Bank of Australia for a potential interest rate cut in November, with market expectations for a cut rising to 66%. However, the RBA remains cautious due to persistent inflation, with the upcoming third-quarter inflation report on October 29 being key to further rate decisions. AUDUSD movement may depend on U.S. data signaling a dovish Federal Reserve, while economists predict the RBA’s rate at 3.35% by Q4 2025, with CPI at 2.6% in 2025 and GDP growth of 1.7%. | ||

| Suggested reading | ||

| Singapore prime minister warns of turbulence ahead, R. Khalag, Financial Times (October 23, 2025) Fear Of a Market Correction Is Good Barrier To Corrections, R. Forsyth, Barron’s (October 17, 2025) | ||