| ||

| 22nd October 2025 | view in browser | ||

| Global markets eye US-China talks, Fed easing | ||

| Global markets are navigating a complex landscape shaped by shifting monetary policies, geopolitical developments, and economic data. | ||

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

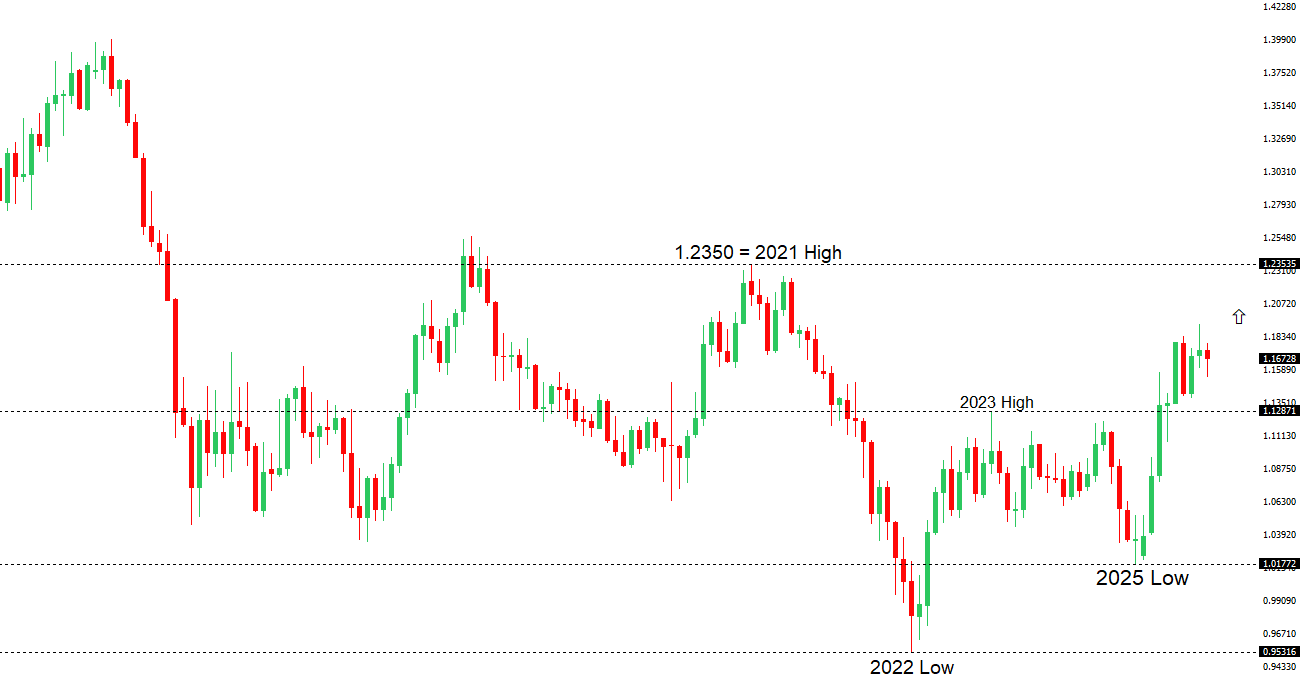

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone inflation rose slightly to 2.2% in September, aligning with the ECB’s target and suggesting easing disinflationary trends, with ECB officials indicating limited scope for further rate cuts. The euro is supported by a positive market mood ahead of the Trump-Xi meeting at the APEC Summit, where softened U.S. tariff threats signal potential trade negotiations. However, the euro’s gains are capped by concerns over sluggish Eurozone growth and fiscal challenges, with the euro likely to trade sideways for a while, unless stronger German fiscal stimulus or dovish U.S. policy shifts emerge. ECB’s Joachim Nagel emphasized the importance of independent statistics for effective monetary policy, indirectly highlighting issues with political interference in U.S. economic data and central banking. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| The election of Sanae Takaichi as Japan’s first female Prime Minister and her appointment of Satsuki Katayama as Finance Minister have driven the USDJPY exchange rate higher, fueled by expectations of expansionary fiscal policies and potential delays in interest rate hikes, weakening the yen. However, Takaichi’s coalition lacks a parliamentary majority, which may limit bold stimulus measures, and her recent comments suggest she will not pressure the Bank of Japan, causing a slight easing in USDJPY strength. The BOJ sees no urgent need for an October rate hike but may consider one by December or January 2026, depending on economic data and yen movements, with recent export growth providing some optimism despite U.S. tariff impacts. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6471 - 16 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s unemployment rate rose to 4.5% in September, a near four-year high, increasing pressure on the Reserve Bank of Australia to consider a fourth interest rate cut in November, with market expectations for a cut jumping to 66%. However, the RBA remains cautious due to persistent inflation, with the upcoming third-quarter inflation report on October 29 being pivotal for further rate decisions. The Australian dollar may gain support from a potential US-China trade truce at the APEC summit, alongside strengthening Chinese yuan and a recent Australia-US critical minerals investment deal, though the latter’s impact is limited by long project timelines and China’s dominance in processing. | ||

| Suggested reading | ||

| Investing Is Not Making Big, Dramatic Moves, J. Calhoun, Alhambra Investments (October 19, 2025) Profit With a Pivot In the Artificial Intelligence Value Chain, C. Reilly, RiskHedge (October 20, 2025) | ||