| ||

| 30th December 2025 | view in browser | ||

| Global tensions steady as Fed Minutes loom | ||

| Global markets remain focused on contained geopolitical tensions—from China–Taiwan military drills to ongoing Ukraine peace negotiations—while navigating diverging central bank paths, mixed economic data, and resilient equity performance across Asia and parts of Europe. Near-term event risk centers on today’s FOMC minutes, which could clarify the Fed’s internal policy divide and shape expectations around the timing and scale of rate cuts priced into 2026. | ||

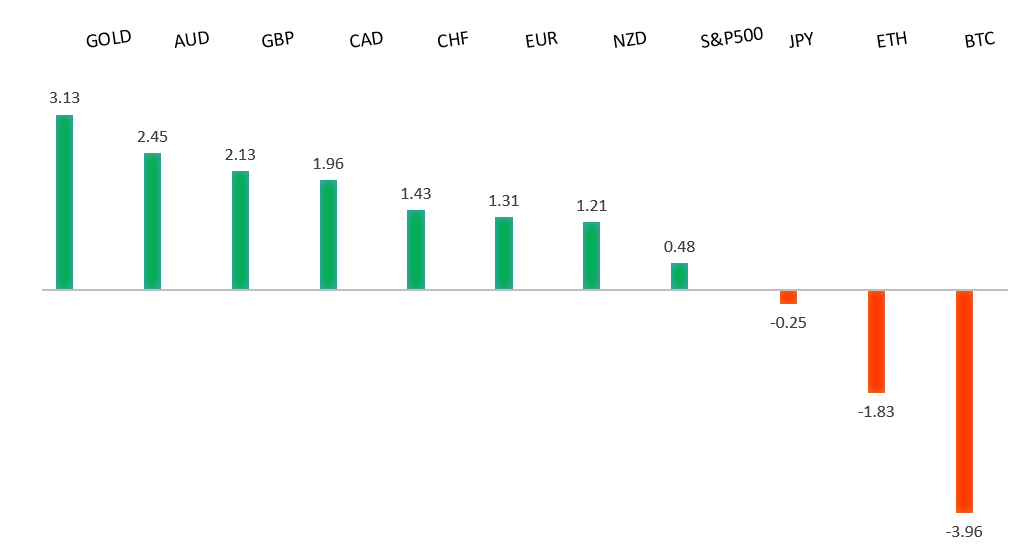

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1400. | ||

| ||

| R2 1.1919 - 17 September/2025 high -Strong R1 1.1809 - 24 December high - Medium S1 1.1703 - 19 December low - Strong S2 1.1615 - 9 December low - Strong | ||

| EURUSD: fundamental overview | ||

| The euro remains up 13.7% year-to-date, with near-term price action driven more by the US dollar and a general risk-on mood than by Eurozone data. But for the moment, thin holiday liquidity limits conviction. Some strategists note EURUSD is closely tracking patterns seen during Trump’s first presidency, suggesting upside targets for 2026 could be reached as early as Q1 if the analogy holds. Geopolitically, Ukraine’s push for long-term US-backed security guarantees is modestly supportive for the euro over the medium term, though recent setbacks in peace efforts and lingering war risk cap near-term optimism. Positioning data show elevated long euro exposure, but not yet at levels that typically signal an imminent reversal. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 157.90 - 20 November/2025 high - Strong R1 157.00 - Figure - Medium S1 154.39 - 16 December low - Strong S2 153.61 - 14 November low - Medium | ||

| USDJPY: fundamental overview | ||

| The yen edged slightly lower as markets remain focused on Japan’s very loose fiscal policy and cautious monetary outlook. While the BOJ is debating gradual rate hikes and sees room to tighten further, softer Tokyo inflation data has reinforced a slower pace of tightening, limiting yen support. Authorities have signaled readiness to intervene if USDJPY breaks above 158, a level that would significantly raise pressure for action. Although a combination of gradual BOJ tightening and eventual Fed easing could support yen appreciation, many banks still expect the currency to remain structurally weak for years due to wide yield gaps, negative real rates, and persistent capital outflows. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6800 - Figure - Medium R1 0.6728 - 29 December/2025 high - Medium S1 0.6592 - 18 December low - Medium S2 0.6421 - 21 November low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar edged higher as precious metals stabilized after a sharp sell-off earlier in the week. The Aussie remains one of the top three performing G10 currencies this quarter, despite recent volatility driven by profit-taking in silver and gold following higher margin requirements. We continue to view pullbacks as buying opportunities, with the currency supported by expectations that the RBA could begin tightening policy in early 2026, alongside resilient domestic economic data, strong commodity demand, improving global risk sentiment, and a broadly weaker US dollar—factors that together point to continued AUD strength into 2026. | ||

| Suggested reading | ||

| The Bear Market Nobody Sees Coming, Except This Guy, L. Lango, InvestorPlace (December 29, 2025) The Fed Was Never Steering the Ship. Evidence? The Growth, J. Tamny, Forbes (December 28, 2025) | ||