| ||

| 21st October 2025 | view in browser | ||

| Markets eye US inflation and Fed moves | ||

| Global market sentiment is cautiously optimistic as investors await key corporate earnings and U.S. inflation data due Friday, with one major investment house predicting stable core inflation around 3.1% through year-end, driven by cooling car prices and airfares but offset by tariff-related price increases in trade-sensitive sectors. | ||

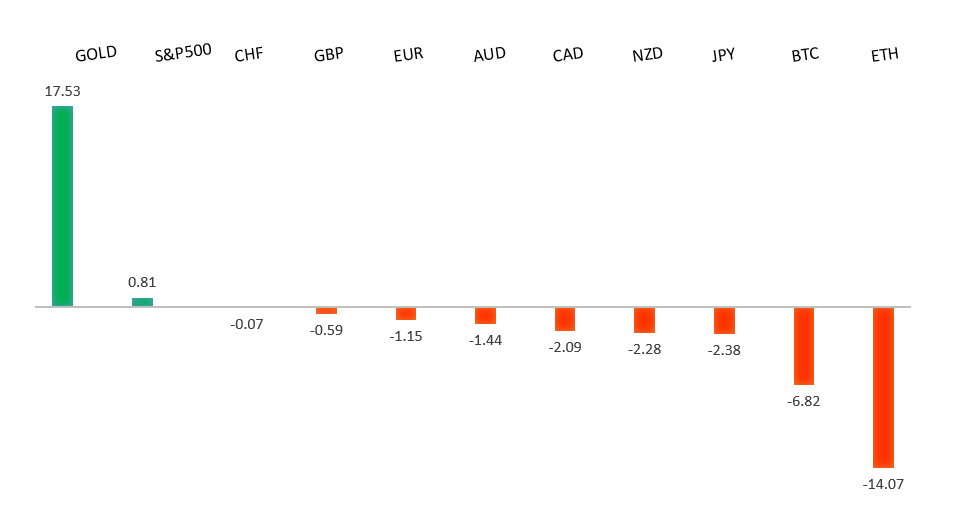

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

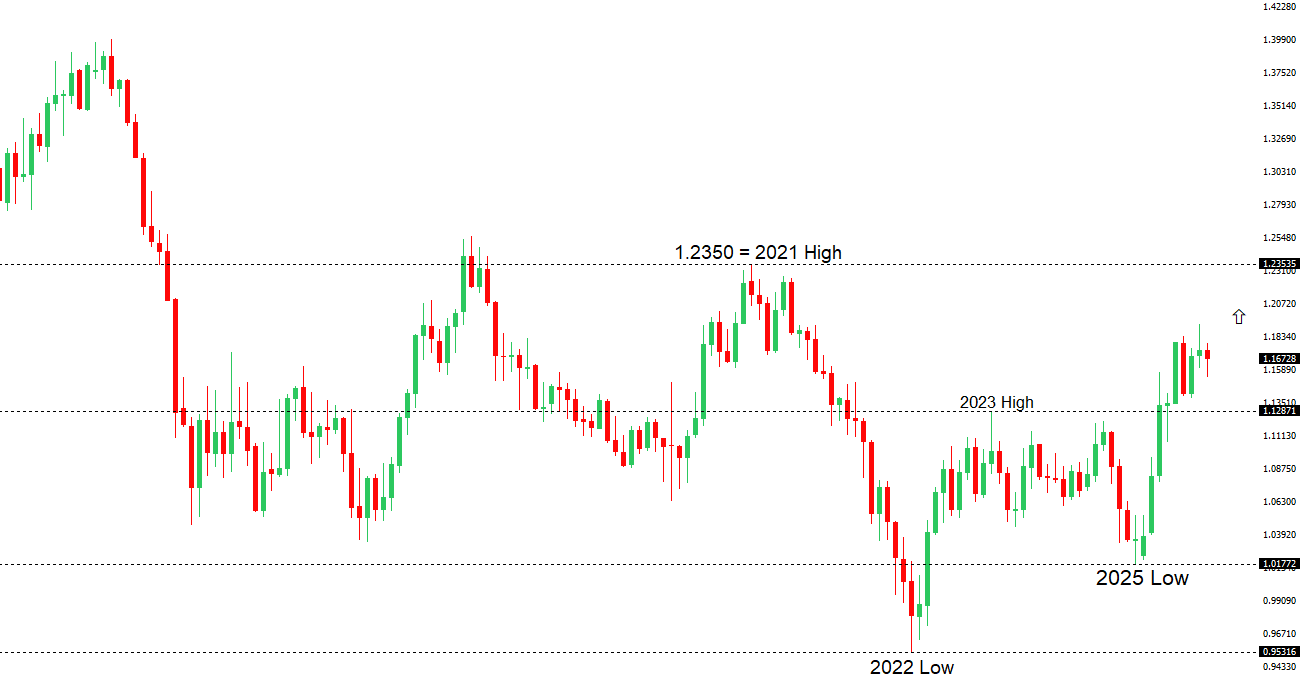

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1779 - 1 October high -Strong R1 1.1729 - 17 October high - Medium S1 1.1542 - 9 October low - Medium S2 1.1528 - 5 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Last Friday, S&P Global Ratings downgraded France’s credit rating from AA- to A+ due to fiscal uncertainty and political fragmentation, raising concerns about rising debt levels, though analysts believe France’s solvency and ECB support limit systemic risks. Eurozone inflation rose slightly to 2.2% in September, aligning with ECB targets, while officials signaled no further rate cuts, supporting the euro. Optimism for EURUSD recovery is boosted by a potential US-China trade thaw ahead of the Trump-Xi meeting, but persistent Eurozone growth concerns and fiscal challenges cap gains, unless stronger European or weaker US data emerges. ECB’s Isabel Schnabel emphasized enhancing the euro’s role through a larger, more liquid European bond market. | ||

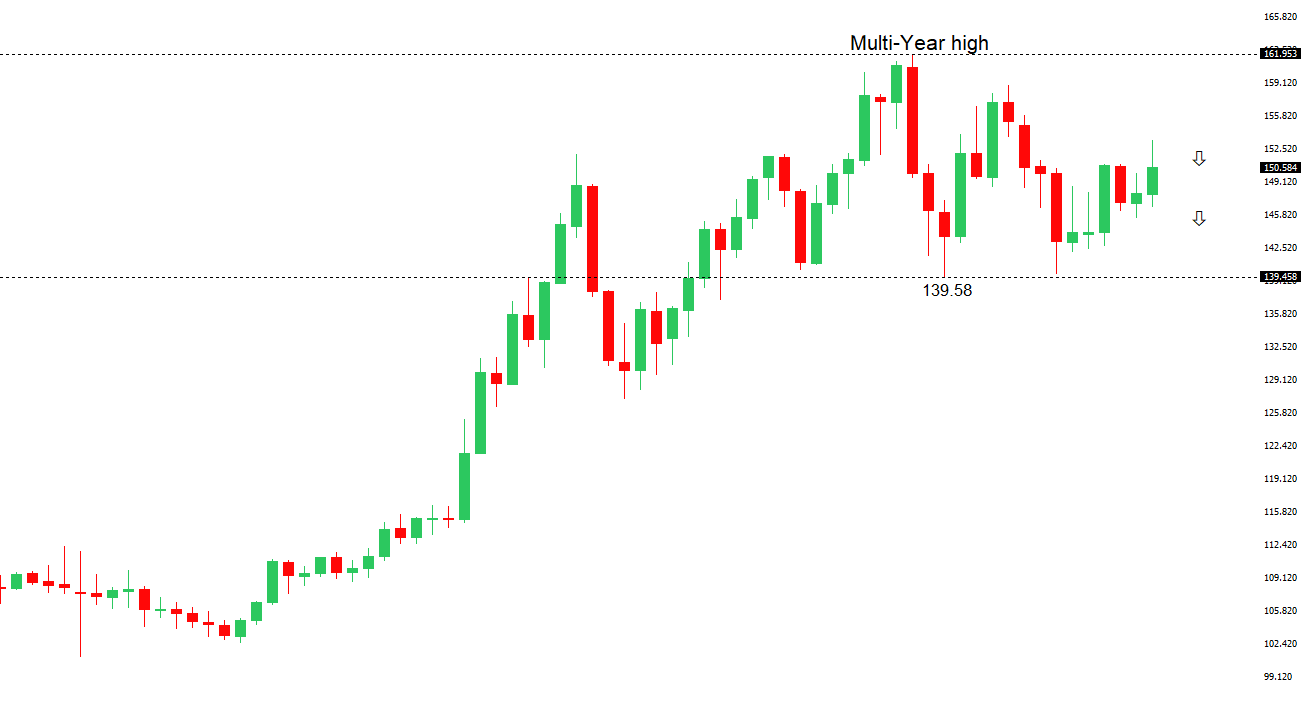

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 155.00. | ||

| ||

| R2 154.80 - 12 February high - Strong R1 153.28 - 10 October high - Medium S1 149.38 - 17 October low - Medium S2 149.03 - 6 October low - Strong | ||

| USDJPY: fundamental overview | ||

| Fears of a yen-weakening “Abenomics 2” under new Prime Minister Sana Takaichi may be exaggerated. Her coalition with the Japan Innovation Party, which favors deregulation over massive stimulus, suggests a more restrained economic policy, limiting yen depreciation. Bank of Japan board member Hajime Takata supports raising interest rates, citing sustained inflation above 2% and a weaker yen, though market expectations for an October rate hike have dropped to 25%, with December seen as more likely. Finance Minister Katsunobu Kato emphasized fiscal-monetary coordination, prioritizing inflation, wage growth, and stable fiscal policy to boost confidence in Japanese bonds. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6573 - 10 October high - Medium S1 0.6462 - 17 October low - Medium S1 0.6440 - 14 October low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s unemployment rate rose to 4.5% in September, the highest in nearly four years, increasing pressure on the Reserve Bank of Australia to consider a fourth interest rate cut in November, with market expectations for a cut jumping to over 70%. However, the RBA remains cautious due to persistent inflation, with the upcoming third-quarter inflation report on October 29 being key to future decisions. The Australian dollar could gain support from a potential US-China trade truce, stronger Chinese yuan, and a recent multibillion-dollar investment in Australia’s critical minerals sector, though its movement may depend on US economic data and trade developments. | ||

| Suggested reading | ||

| The graduate ‘jobpocalypse’, I. Berwick, Financial Times (September 29, 2025) Worries About AI Investment Risk May Be a Bit Overblown, R. Forsyth, Barron’s (October 17, 2025) | ||