| ||

| 26th November 2025 | view in browser | ||

| Policy volatility steers global narrative | ||

| Markets are navigating shifting policy signals as the UK lifts wages, U.S. rate-cut bets rise, Japan inches toward a BOJ hike, and China’s yuan strengthens despite bond-market strain. Australia’s hotter CPI dims RBA easing hopes, while New Zealand cuts rates as economic slack grows. | ||

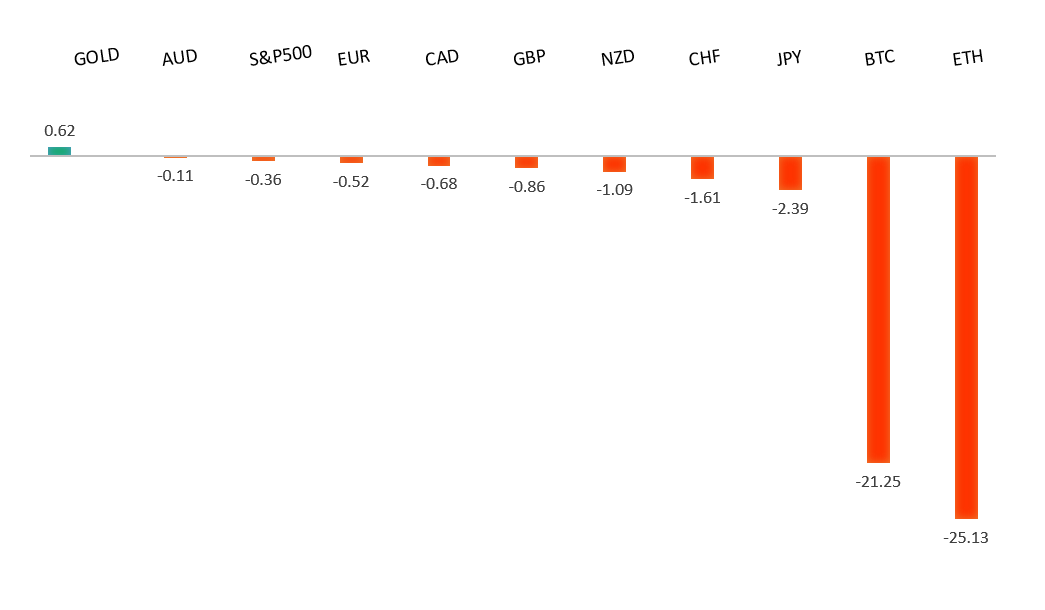

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

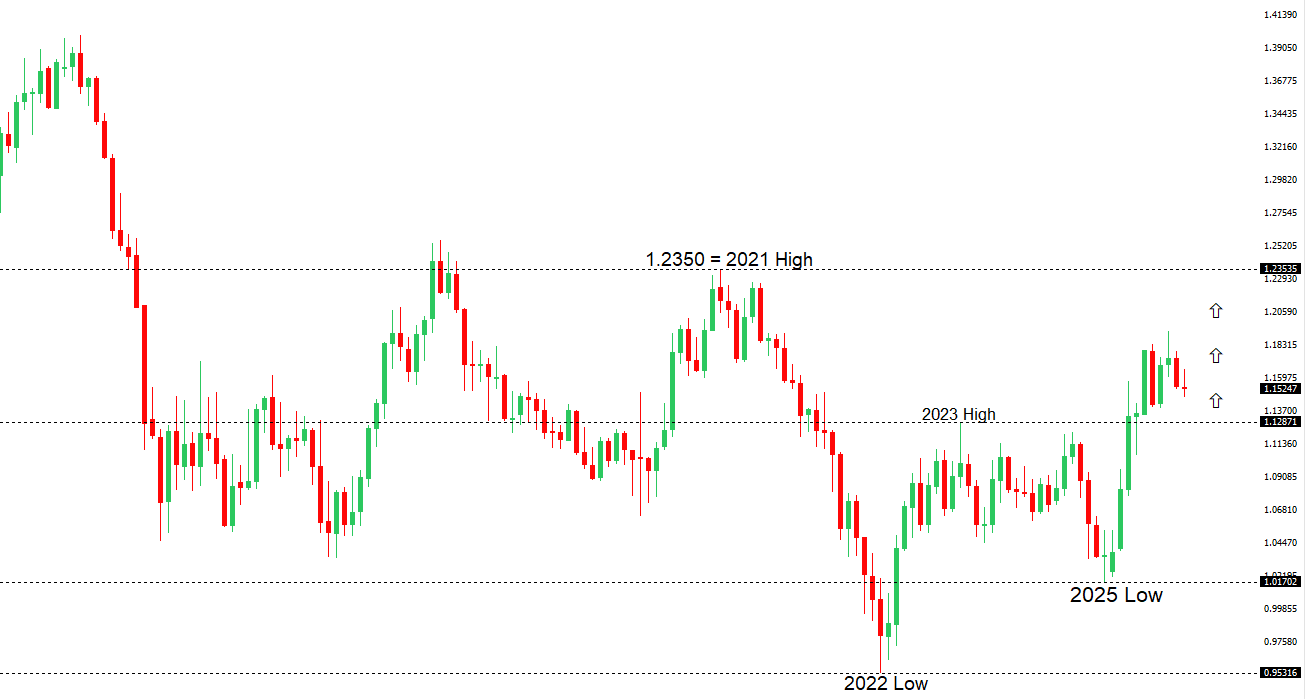

| EURUSD: technical overview | ||

| The Euro outlook remains constructive with higher lows sought out on dips in favor of the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1300. | ||

| ||

| R2 1.1729 - 17 October high -Strong R1 1.1669 - 28 October high - Medium S1 1.1469 - 5 November low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| Germany’s economy remains stuck in a period of weak growth, with recent data showing flat GDP as soft private consumption and exports weigh on activity. Economists expect conditions to improve gradually once substantial fiscal stimulus—embedded in the upcoming 2026 budget—kicks in, helping lift the country out of stagnation. The EU projects German growth of about 1.2% in both 2026 and 2027, supported by rising industrial orders and a slow economic revival. Meanwhile, many notable investors expect further ECB rate cuts as euro-area growth and wages cool, and some see U.S. monetary easing putting pressure on the ECB to follow suit—contributing to their bullish stance on the euro. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, rallies should be well capped ahead of 160.00 ahead of a fresh down-leg back towards the 2024 low at 139.58. | ||

| ||

| R2 158.88 - 10 January/2025 high - Strong R1 157.90 - 20 November high - Medium S1 156.00 - Figure - Medium S2 155.21 - 19 November low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan is stepping up verbal warnings on yen weakness, but this has only capped USDJPY temporarily as markets also price in rising odds of Fed rate cuts. Traders increasingly think Japan’s intervention “playbook” is shifting under the Takaichi administration, with officials signaling they might act more often and at lower levels—though any impact will be brief without a meaningful BOJ policy shift. Growing speculation now points to a possible BOJ rate hike as early as December or January, with several board members dropping hawkish hints, though political constraints could limit this to a “one-and-done” move. Geopolitical tensions with China and possible retaliatory actions also weigh on the yen. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6629 - 1 October high - Strong R1 0.6618 - 29 October high - Medium S1 0.6421 - 21 November low - Medium S1 0.6372 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s October inflation came in hotter than expected, with core prices rising 3.3% and headline inflation at 3.8%—both above the RBA’s 2–3% target. The strong print pushed the Australian dollar and bond yields higher and led some economists to think the easing cycle may already be over. One Australian bank even warns rates could rise in 2026 if inflation stays sticky, the labor market remains tight, or productivity continues to lag. With unemployment still low, wages strong, and the new monthly CPI measure potentially distorted by seasonality, the RBA is likely to stay cautious and rely on quarterly data as it maintains a wait-and-see stance. | ||

| Suggested reading | ||

| Investors Don’t Know How Little They Know Abt Future, B. Ritholtz, The Big Picture (November 24, 2025) 8 Slides On the Future of Electricity Prices, I. Orr, Energy Bad Boys (November 15, 2025) | ||