| ||

| 8th August 2025 | view in browser | ||

| Pound shines, Dollar dips on Fed news | ||

| Thursday’s financial markets saw notable activity, driven primarily by news surrounding the Federal Reserve and currency movements. News broke of the White House’s top pick to replace Chair Powell, boosting market confidence due to Waller’s strong track record and tariff-related economic insights. | ||

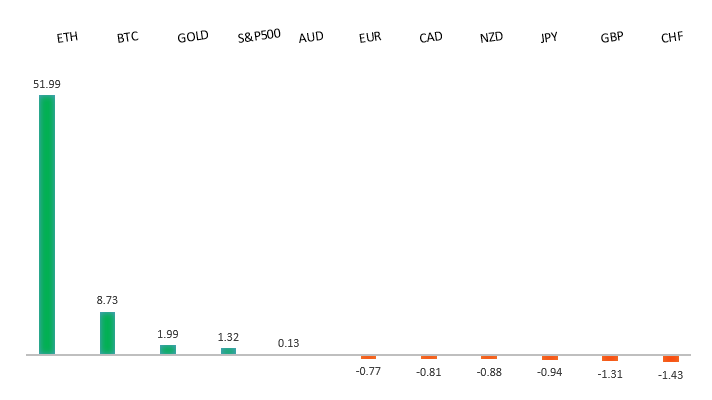

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high (1.1276) lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported ahead of 1.1000. | ||

| ||

| R2 1.1789 - 24 July high - Medium R1 1.1703 - 25 July low - Medium S1 1.1528 - 5 August low - Medium S2 1.1392 - 1 August low - Strong | ||

| EURUSD: fundamental overview | ||

| The Euro paused its recent gains against the US dollar after disappointing German economic data raised concerns about the Eurozone’s largest economy. Weak industrial production and a shrinking trade surplus suggest Germany’s manufacturing sector faces structural challenges, potentially keeping the economy near recession through Q3 2025. While the ECB is expected to hold rates steady in September, markets anticipate a Federal Reserve rate cut, which could support the Euro due to diverging central bank policies. Analysts warn that Germany’s economic struggles may lead to downward GDP revisions and increased calls for fiscal support, with markets closely watching upcoming data for signs of recovery. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58, exposing a retest of the 2023 low. Rallies should be well capped below 152.00. | ||

| ||

| R2 150.92 - 1 August high - Strong R1 149.00 - Figure - Medium S1 146.62 - 5 August low - Medium S2 145.85 - 24 July low - Strong | ||

| USDJPY: fundamental overview | ||

| The recent auction of 30-year Japanese Government Bonds showed average demand, easing concerns about long-term debt and giving the Bank of Japan room to continue reducing bond purchases, which may support the yen. However, new U.S. tariffs, stacked on top of existing ones, have raised trade uncertainties, particularly impacting Japan’s beef exports, now facing a 41.4% tariff rate, and potentially affecting automobiles. Japan’s Chief Negotiator Ryosei Akazawa is seeking clarification from the U.S. to resolve the tariff issue, which the BOJ cites as a barrier to policy normalization, with a potential rate hike expected in October. Prime Minister Ishiba faces criticism for the trade deal’s implementation, and while he resists resignation, internal Liberal Democratic Party tensions and a pending election review could lead to leadership changes by late August. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Figure - Medium R1 0.6542 - 7 August high - Medium S1 0.6419 - 1 August low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Chinese yuan strengthened to its highest level since November 2024, boosting the Australian Dollar. China’s July trade data showed robust export growth of 12.4%, despite weaker U.S. shipments, as exporters diversified to non-U.S. markets. In Australia, a strong trade surplus of A$5.365 billion in June, driven by a 6% export surge, supports economic growth despite softer domestic demand. The Reserve Bank of Australia is expected to cut rates in August, with inflation at 2.1% and unemployment rising to 4.3%, signaling room for easing, though the RBA will likely remain cautious, with further cuts depending on weaker economic data. | ||

| Suggested reading | ||

| Stock Buybacks Are Surging And That Is…Bearish?, M. Hulbert, MarketWatch (August 7, 2025) Investors Have Big Data That Markets Pre-Price, Fisher Investments (August 4, 2025) | ||