| ||

| 3rd July 2025 | view in browser | ||

| US trade deals lift antipodean currencies | ||

| Markets ended a subdued session as attention turned to the upcoming U.S. jobs report, with the dollar retreating after a surprising ADP jobs print, far below what was expected. | ||

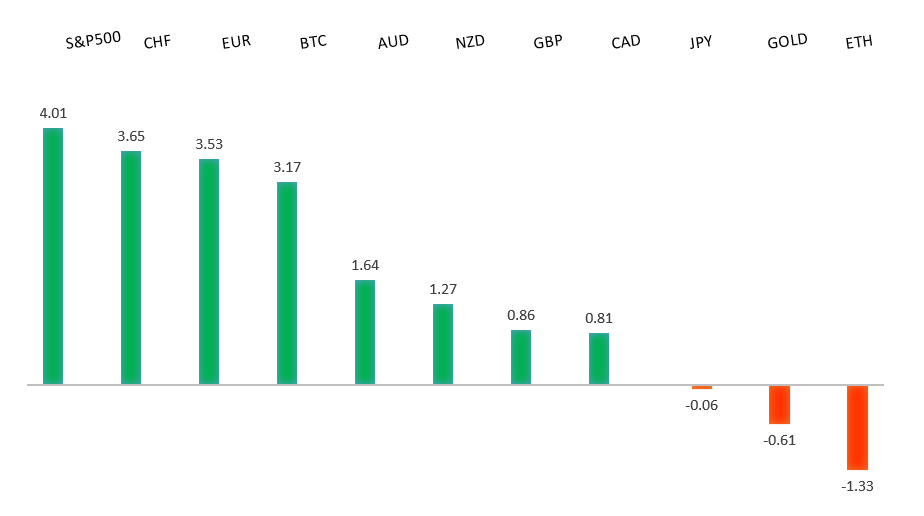

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1500. | ||

| ||

| R2 1.1900 - Figure - Medium R1 1.1830 - 1 July/2025 high - Medium S1 1.1708 - 30 June low - Medium S2 1.1654 - 26 June low - Medium | ||

| EURUSD: fundamental overview | ||

| The euro’s recent rise has paused as ECB officials, including Vice President Luis de Guindos, expressed concerns about its rapid appreciation, fearing it could hinder efforts to maintain 2% inflation, particularly if it exceeds $1.20. ECB Chief Economist Philip Lane noted a durable shift by investors toward the euro, while one major bank warned that further euro strengthening could harm Europe’s export industry, potentially justifying more rate cuts. Despite this, markets expect only one more ECB rate cut this year, and with a potential long-term dollar bear market, the euro could continue to rise, with ECB warnings likely to intensify if it reaches $1.30 or $1.40. | ||

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming weeks, exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 146.19 - 24 June high - Medium R1 145.27 - 26 June high - Medium S1 143.00 - Figure - Medium S2 142.68 - 1 July low - Medium | ||

| USDJPY: fundamental overview | ||

| A favorable trade deal could give the Bank of Japan more flexibility for a potential rate hike, but markets are skeptical about a significant increase soon, as BOJ Governor Ueda indicated at the ECB Sintra forum that Japan’s low policy rates will likely persist while inflation gradually rises. The prolonged 0.5% rate cap has led to doubts about policy normalization, weakening the yen against the dollar compared to other G10 currencies. Meanwhile, Japan faces pressure from looming U.S. tariffs under Trump, who is pushing for a trade deal by July 9 and threatening 30-35% tariffs, while Japan’s negotiator, Ryosei Akazawa, emphasizes protecting national interests ahead of a July 20 national vote. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6600 - Medium - Strong R1 0.6591 - 1 July/2025 high - Medium S1 0.6484 - 25 June low - Medium S1 0.6373 - 23 June low - Strong | ||

| AUDUSD: fundamental overview | ||

| Australia’s retail sales grew by just 0.2% month-on-month, below the expected 0.5%, signaling weaker economic momentum as consumers remain cautious despite earlier RBA rate cuts. Upcoming Household Spending data will be closely watched for further signs of reduced discretionary spending, with markets anticipating three more RBA rate cuts this year, potentially lowering the terminal rate to 2.85% or 3.10%. The Australian dollar holds steady, supported by optimism around improving US-China trade relations, easing Middle East tensions, and signs of recovery in China’s economy, Australia’s key trade partner. A potential US presidential visit to China with business leaders could further boost risk sentiment and support antipodean currencies. | ||

| Suggested reading | ||

| The Best, Most Contrarian Investment Right Now: China, J. Rimmer, MarketWat (July 1, 2025) About That ‘Worst Start on Record’ for the Dollar, Fisher Investments (July 1, 2025) | ||