| ||

| 5th June 2025 | view in browser | ||

| Weak US data boosts fed cut bets, Dollar slides | ||

| Weaker-than-expected U.S. economic data, with the May ISM Services Index dropping and ADP employment rising by only 37,000 jobs, both missing forecasts, drove down bond yields and the dollar as markets anticipated a softer Federal Reserve stance on rate cuts, with 57bps of cuts priced in for 2025. | ||

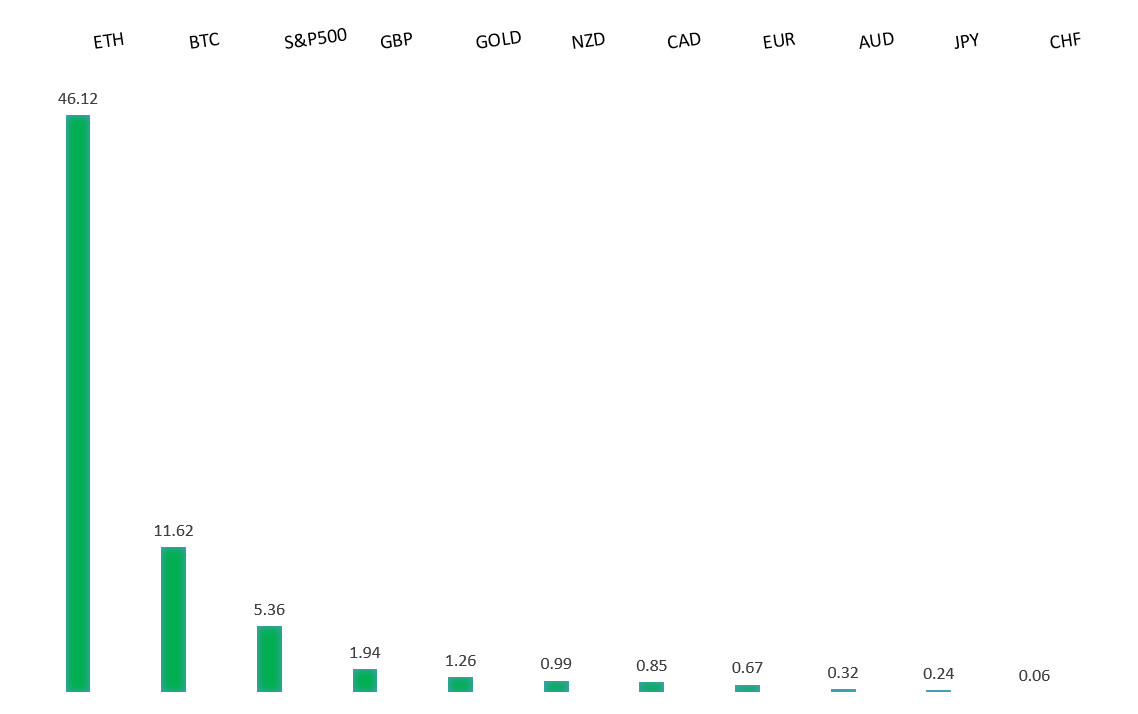

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1474 - 11 April high - Medium R1 1.1455 - 3 June high - Medium S1 1.1210 - 29 May low - Medium S2 1.1065 - 12 May low - Strong | ||

| EURUSD: fundamental overview | ||

| The European Central Bank is poised to cut its deposit rate by 25 basis points to 2% at its upcoming meeting, supported by Eurozone inflation falling to 1.9% in May, below the 2% target, and declining core inflation due to weaker services inflation. Sluggish GDP growth and trade tensions, particularly from rising U.S. tariffs, strengthen the case for further easing, with markets anticipating another 25bps cut by September, potentially bringing the rate to 1.75%, seen as the neutral zone. The ECB may downgrade its growth and inflation forecasts, and significant downward revisions could signal more cuts if inflation projections fall below 1.7% for 2026. Despite these cuts, EURUSD remains supported by a weakening dollar due to U.S. fiscal concerns and a potential Fed rate cut later in 2025, narrowing the rate differential, while optimistic EU-U.S. trade talks are tempered by concerns over new tariffs. | ||

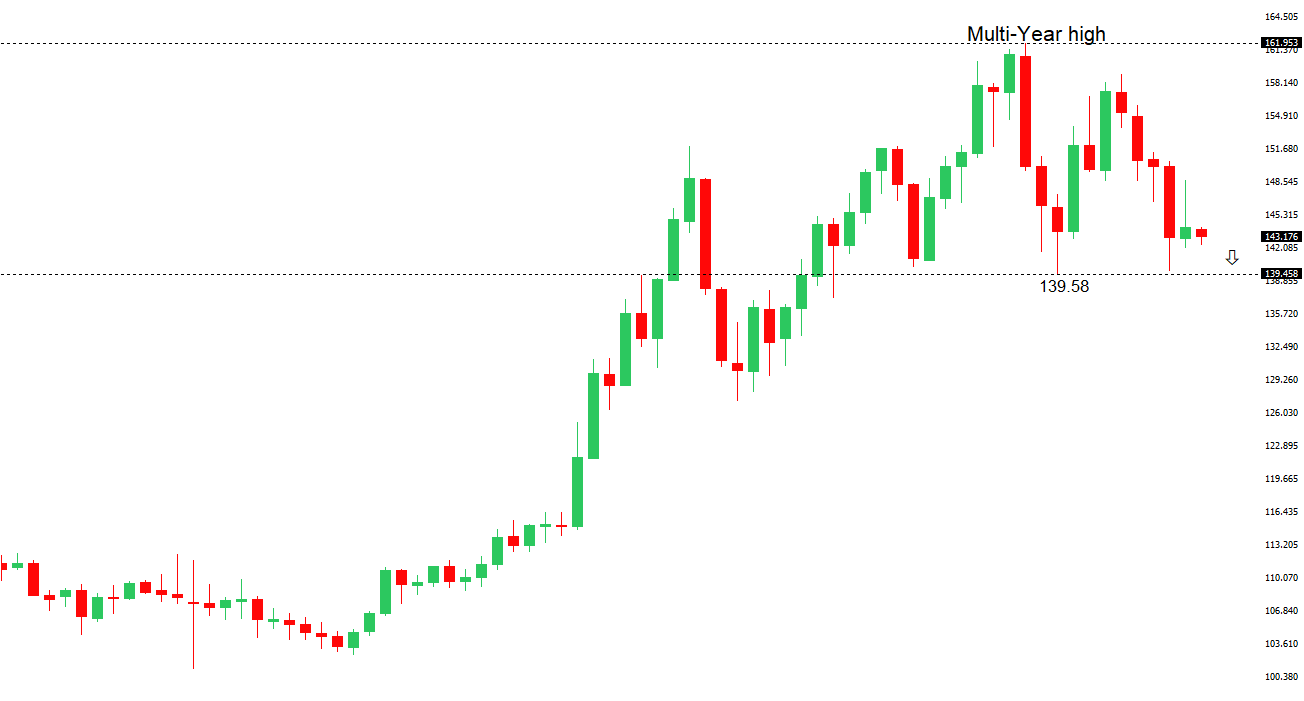

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| The Bank of Japan is signaling a shift from ultra-loose monetary policy, with Governor Ueda confirming ongoing bond purchase reductions to improve market functionality, while setting aside full provisions for expected bond transaction losses as interest rates rise. Weak demand at the latest 30-year JGB auction, with the lowest bid-to-cover ratio since 2023, suggests investor caution, potentially supporting yen strength as higher yields attract capital. Despite solid nominal wage growth of 2.3–2.6% in April, real wages fell 1.8% year-on-year, continuing a two-year decline that erodes household purchasing power and may constrain aggressive BOJ rate hikes. Analysts anticipate no rate change at the June 16-17 meeting but see a possible hike in July due to persistent inflation, with one major bank forecasting a yen appreciation of over 5% against the dollar by year-end. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6538 - 26 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Reserve Bank of Australia’s May meeting minutes revealed a dovish tilt, with some members considering a 50bps rate cut as a precaution against global trade risks and U.S. tariff hikes, though no immediate shift to expansionary policy was deemed necessary. Australia’s Q1 GDP grew a weaker-than-expected 0.2%, below the 0.4% forecast, signaling vulnerability to global trade tensions and reinforcing expectations for an RBA rate cut in July. April’s trade surplus narrowed to A$5.41 billion, below the A$6 billion forecast, driven by a sharp 2.4% drop in exports and a 1.1% rise in imports, while household spending grew a modest 0.1% month-on-month, reflecting cautious consumer behavior amid global uncertainties. The OECD’s warning of a stalling global economy due to U.S. tariffs, particularly impacting China, Australia’s key trading partner, further supports the RBA’s cautious approach. | ||

| Suggested reading | ||

| Petrobras: fuelling the future or stuck in the past?, G. Bobillot, Financial Times (June 4, 2025) An Interest Rate Freight Train Could Hit the Markets Hard, L. Lango, InvestorPlace (June 4, 2025) | ||