LMAX Group: the leading independent operator of institutional execution venues for FX and digital assets

As a leading player in global FX and digital assets, LMAX Group is shaping the future of capital markets. Our rapidly expanding global institutional and professional client base is a testament to our distinctive business model that delivers efficient market structure and transparent, precise, consistent execution to all market participants. LMAX Group operates three established regulated businesses – LMAX Exchange, LMAX Global and LMAX Digital.

Servicing funds, banks, asset managers, retail brokerages and buy-side institutions in over 100 countries, LMAX Group has developed a strong global presence with offices in 9 countries. The Group builds and runs its own high performance, ultra-low latency global exchange infrastructure, which includes matching engines in London, New York, Tokyo and Singapore.

Strategic vision – David Mercer, CEO

Our vision is to build the leading cross-asset marketplace. We are proud of our distinctive model and unique positioning – all based on our core offering of global market access for all industry participants. Capital markets are at a point of transformation, and we sit at the forefront of that change.

Our diversified business mix delivers consistent revenue streams, ensures the resilience of our financial performance in all market cycles and enables us to lead the way for growth and profitability metrics within the industry. We consistently strive for greater diversification of our business model, be that geographic or product, and continuously invest in our product, technology and talent.

Strategic goals

- Build the leading cross-asset marketplace

- Drive industry innovation in robust, secure, exchange technology

- Invest in people – attract, develop and retain the best talent

- Broaden global reach with a cross-border strategy

We remain confident that with the ongoing evolution of the markets in which we operate and our enduring commitment to invest in future growth, we are on track to achieve our strategic objectives, whilst continuing to deliver an optimal experience for our global client base.

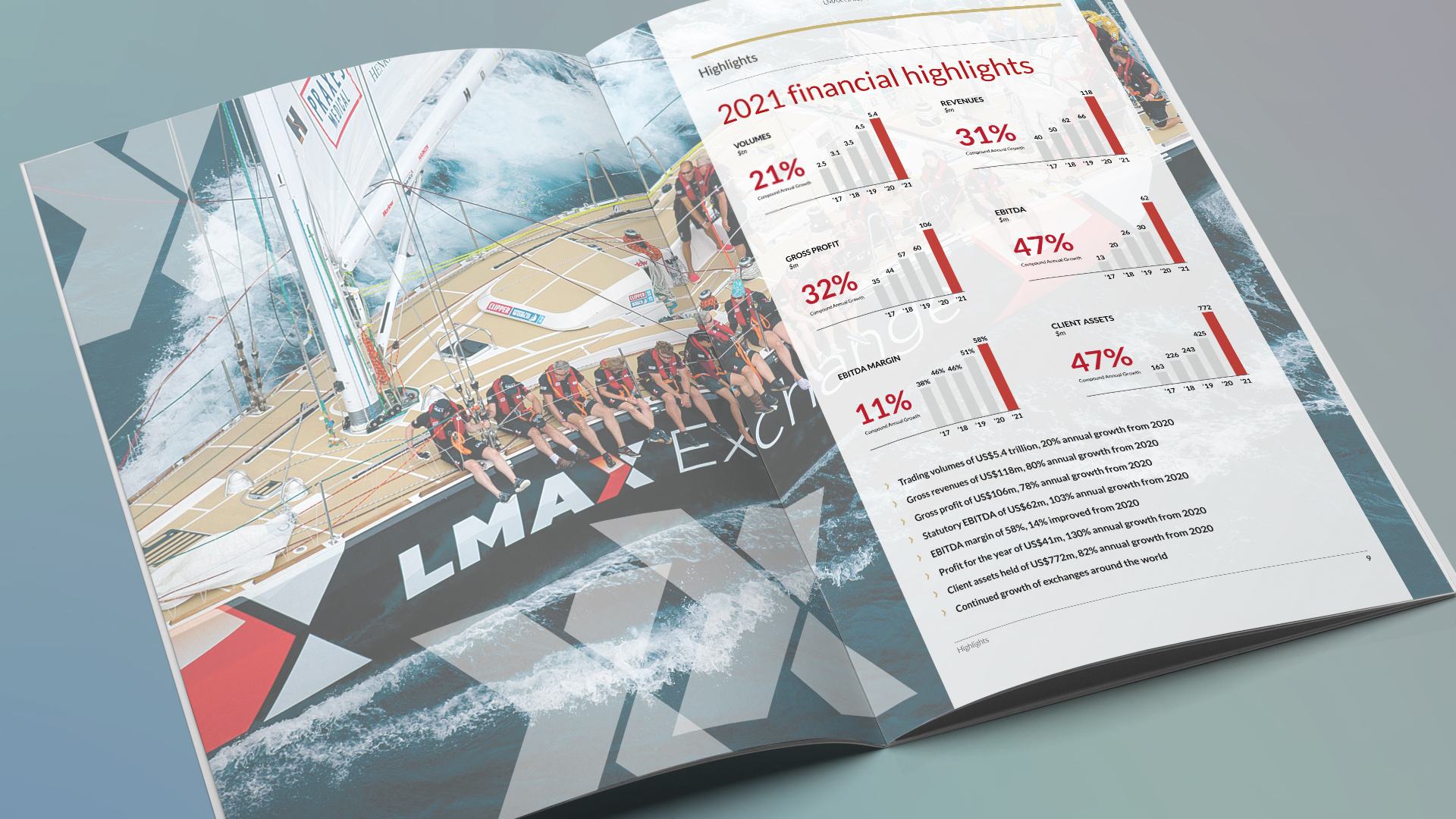

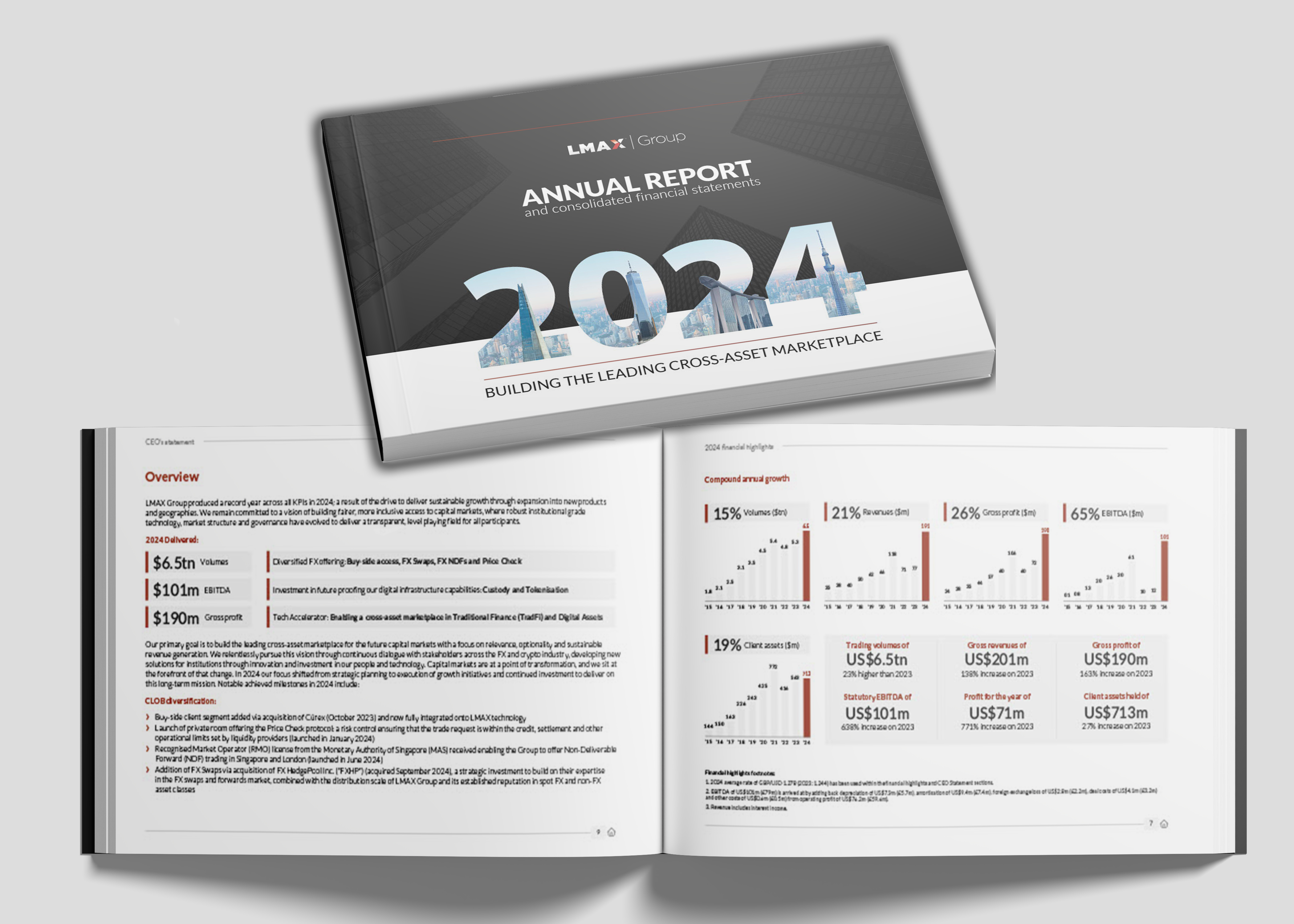

LMAX Group full year 2024 financial highlights

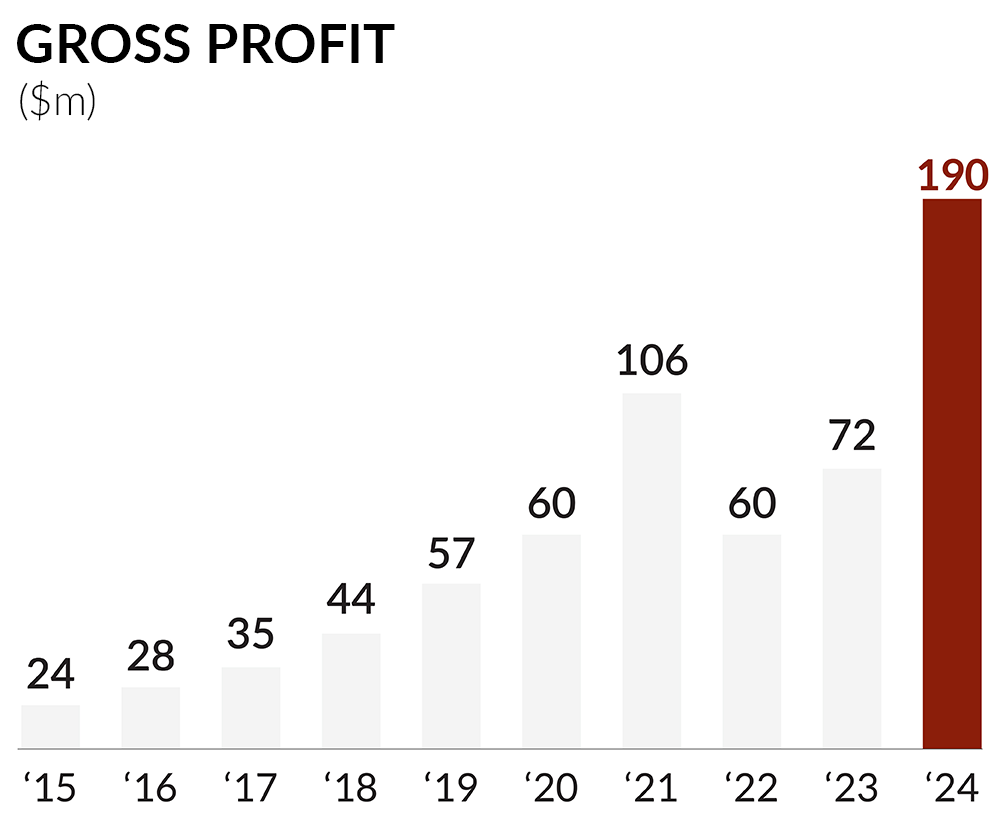

LMAX Group (or “the Group”), the leading independent operator of institutional execution venues for FX and digital assets trading, reported exceptional results across all key metrics for the full year 2024, supported by our strategy to expand and diversify by client segment, product and geography.

- Gross Profit of $190m, up 163% from 2023

- EBITDA increased by 65% to $101m

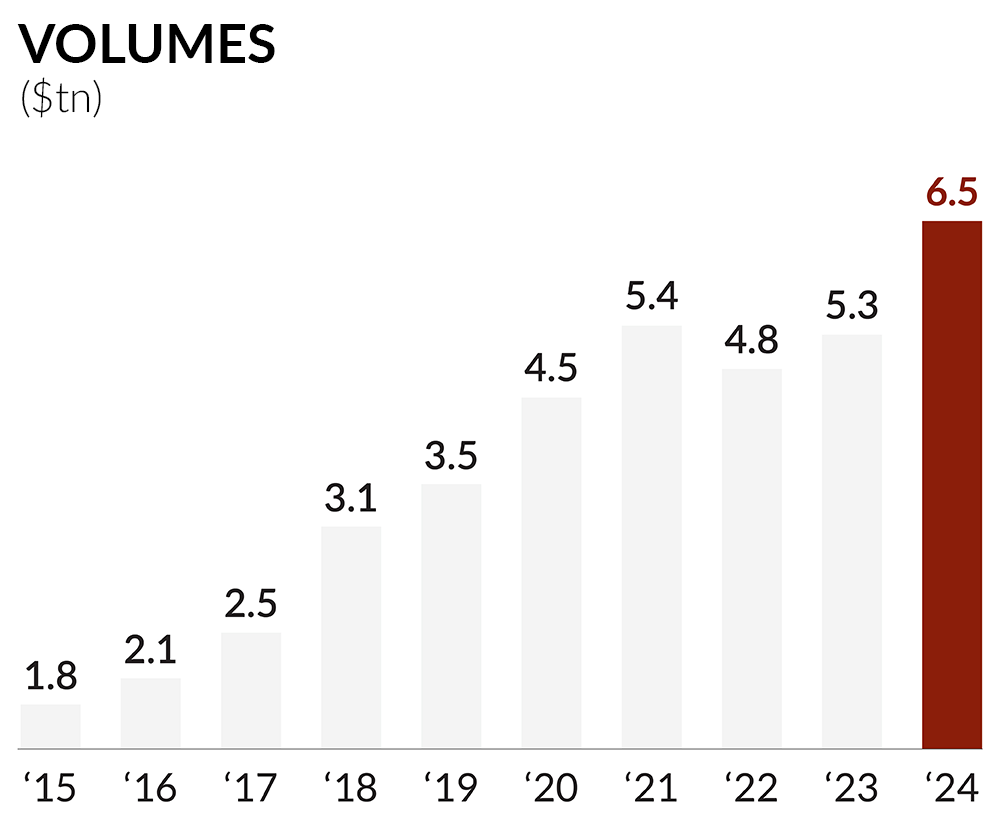

- Total Group trading volumes of $6.5trn, up 23% from 2023

- LMAX Digital volumes up 45% YoY, driven by favourable market conditions

|

|

LMAX Group Reports FY 2024 Financial Results |

Historical financial performance (2015 – 2024)

Annual Report 2024

Previous annual reports

About our businesses

LMAX Group operates leading institutional execution venues for FX and digital assets trading worldwide:

- 6 exchanges

- 4 matching centres

- 9 offices worldwide

Delivering a transparent, neutral, global marketplace for all participants

LMAX Exchange operates global institutional FX exchanges, an FCA regulated MTF and MAS regulated RMO. A central limit order book (CLOB) execution model offers streaming firm limit order liquidity from top tier banks and non-bank institutions, transparent price discovery, no ‘last look’ rejections and full control over trading strategy and costs.

LMAX Global is a leading regulated broker for FX, metals and commodities worldwide. Servicing retail brokers and professional traders, LMAX Global offers access to deep institutional FX liquidity, tight spreads and transparent, precise execution with no ‘last look’ rejections.

LMAX Digital is a leading institutional spot crypto currency exchange. Based on proven, proprietary technology from LMAX Group, LMAX Digital allows global institutions to acquire, trade and hold the most liquid digital assets – BTC, ETH, LTC, BCH, XRP, SOL, PYTH, LINK, UNI, AAVE, DOGE, RLUSD – safely and securely.