LMAX Exchange operates a central limit order book model, delivering efficient market structure and transparent, precise, consistent execution to all institutional market participants.

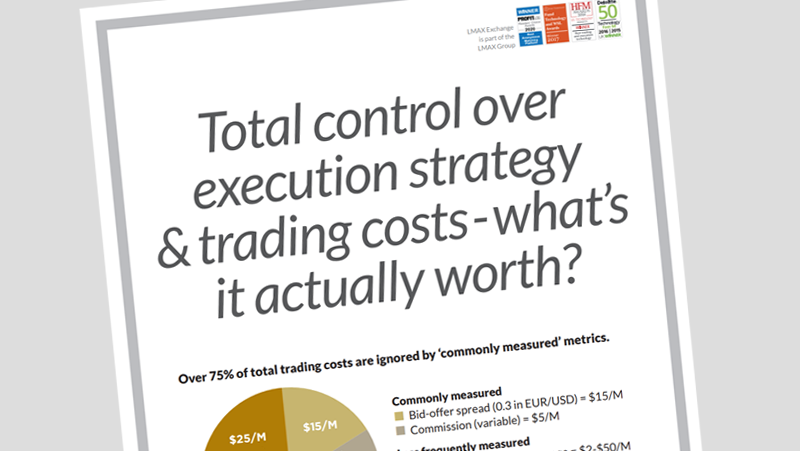

Trading on firm limit order liquidity from top tier global banks and non-banks, enables institutions to have full transparency of market dynamics and absolute control of their execution strategy and costs.

- Transparent, fair and consistent execution

- No ‘last look’ rejections and no added costs

- Optimised fill rates

- Price improvement as standard

- Control over all execution parameters & costs

- Real-time limit order liquidity market data

- Global exchange infrastructure – Equinix NY4, LD4, TY3