Pricing and connectivity solutions

Unique in the marketplace, our superior, real-time streaming FX data places speed and data quality at the forefront of decision making. We provide firm limit order liquidity and executable price data straight from the central limit order book in our London (LD4), New York (NY4), Tokyo (TY3) and Singapore (SG1) exchanges.

Spot Market Data: FX, metals, commodities, equity indices, digital assets and Asian NDFs

Frequency of updates: 1ms, 10ms, 100ms and custom update frequencies

| Available Products | Real time via FIX, Java/.net, REST API | Historical Data (for Intraday and T+1 Delivery) |

|---|---|---|

| Level 1: Top of Book (Best Bid, Best Offer, Volumes) |

Yes | Yes |

| Level 2: Depth of book, aggregated by price (entries at the same price point on the book are aggregated into a single data entry). |

Yes | Yes |

| Level 3: Disaggregate data – Snapshots of individual entries in the order book. |

No | Yes |

| ITCH: Most granular, every tick represented in this data with full depth. |

Yes | Yes |

Examples of actionable insights based on high frequency, ‘firm liquidity’ price moves to volatile market-moving events. Contact [email protected] to learn more about different use-cases.

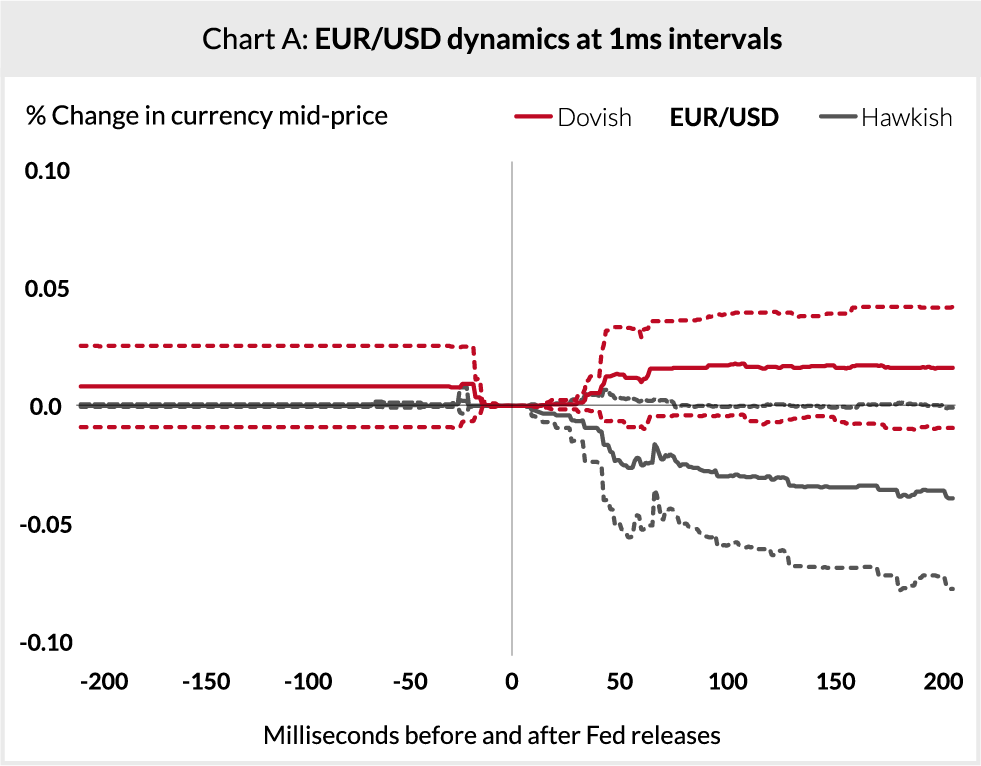

Chart A plots the median, 25th and 75th percentile EUR/USD price responses to dovish and hawkish Fed meetings, based on one million simulations.

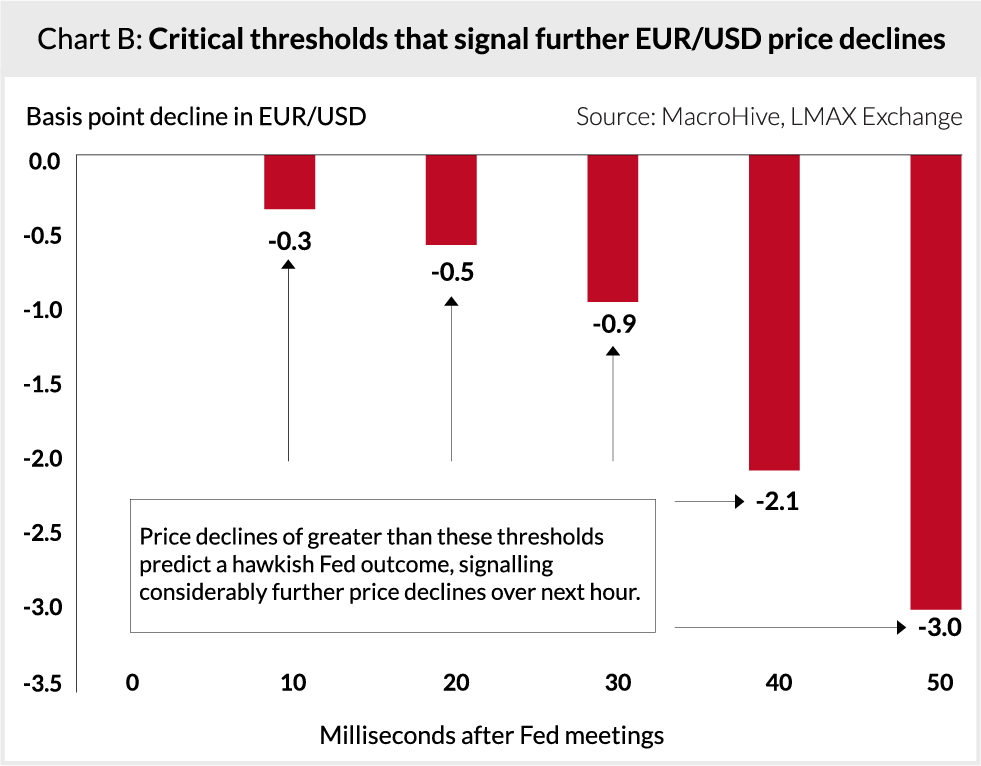

Chart B shows that price declines greater than -3bps within 0.05 seconds are excellent predictors of hawkish Fed meetings, thus allowing us to derive critical thresholds that traders can use to identify hawkish Fed meetings with greater certainty.

New market data insights report: Unlock FX market insights: trading flows and sentiment analysis – download

Quant / Flow Data from the Central Limit Order Books in our London, New York and Tokyo exchanges.

| Flow Product | Available Products | Throttling |

|---|---|---|

| Trade data | Executed trade volumes with timestamp, side, venue, and ccy. | 5 min delay for majors, 30 min for EM ccys. |

| Premium | Above Trade/Flow data aggregated every 8 hours per ccy, split by ‘Institutional Flow’ and ‘Professional Flow’ Quantity. | 8 hour aggregation, delivery immediately after 8 hours. |

| Premium Plus | The premium data with additional insights on Passive and Aggressive side, and positioning of ‘Institutional Flow’ and ‘Professional Flow’. | 8 hour aggregation, delivery immediately after 8 hours. |

For more information about our data products, please contact us at: [email protected]

Global liquidity access: algos can direct execution into one regional liquidity pool, best suited for the trade. Our presence in LD4, NY4 and TY3 allows for wider analysis on where to execute a particular trade.

Transparent benchmarking: assessing performance versus the market – the ITCH binary protocol provides complete transparency providing further insights into liquidity provision.

Transaction cost analysis: TCA has evolved into wider metrics on skew, slippage and speed of execution, impacting transaction costs. Providing the highest granularity of data, the most detailed view of these metrics can be achieved in pre-trade predictive analysis and post-trade solutions.

Valuations: real-time or EOD Valuations of FX portfolios using firm liquidity market data.

- Streaming, real-time, full order book market data

- Firm, limit order liquidity

- 250+ unique instruments

- Available to all clients, regardless of size or activity levels

- Full order book market data via FIX (4.2/4.4) or binary protocol (ITCH)

- Deep price information – top-of-book or up to 10 levels of depth (FIX)

- Orders time-stamped in microseconds, 100% exchange uptime

- Robust historic data (10+ years, 800TB) for back testing and related analysis