Next 24 hours: From one risk event to another

Today’s report: Fed continues to greenlight stocks

We come into the new week with the US Dollar trying to make a run to the topside, this perhaps in anticipation of some more talk around a taper later this week when the Fed meets. Inflation data has certainly been picking up and this could force the Fed’s hand a bit more.

Wake-up call

- German data

- BOE letdown

- traditional themes

- Lockdown expansion

- surging oil

- RBNZ pricing

- Stocks vulnerable

- Dealers report

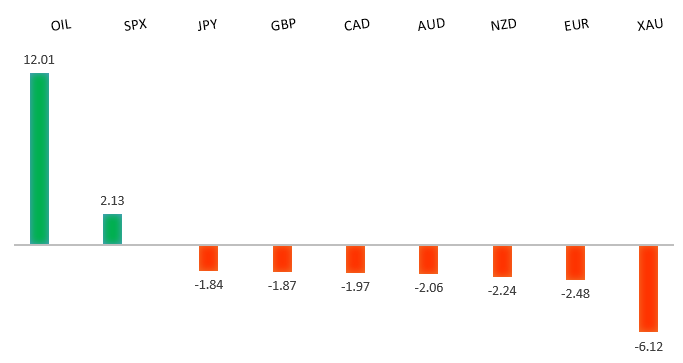

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- How to Find Meaning in Your Money, B. Sample, Bloomberg (June 27, 2021)

- Idiots, Maniacs & the Complexities of Risk, B. Carlson, AWOCS (June 24, 2021)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has been looking for a higher low since topping out in 2021 up at 1.2350. Ideally, this next higher low is sought out ahead of 1.1600 in favour of the next major upside extension back through 1.2350 and towards a retest of the 2018 high at 1.2555 further up.EURUSD – fundamental overview

The Euro tried to close out the previous week on a positive note, getting help from better than expected German Gfk consumer confidence reads, and upbeat comments from ECB de Cos, but continued to find solid offers from medium-term players into rallies. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.EURUSD - Technical charts in detail

GBPUSD – technical overview

Technical studies are in the process of consolidating from stretched levels after the push to fresh multi-month highs. This leaves room for additional consolidation, before the market considers a meaningful bullish continuation towards a retest of the 2018 high. But look for setbacks to now be very well supported into the 1.3500 area.GBPUSD – fundamental overview

The Pound still hasn't managed to shrug off the letdown from the BOE meeting, with the currency extending declines into the end of last week. UK CBI retail sales numbers were actually impressive but the hangover from the BOE decision proved to be too much. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.USDJPY – technical overview

The major pair has run into massive resistance in the form of the monthly Ichimoku cloud. This translates to a longer-term trend that is still bearish despite the latest run higher. Look for additional upside to be limited, with scope for a topside failure and bearish resumption over the coming sessions. It would take a clear break back above 113.00 to negate the outlook.USDJPY – fundamental overview

There continues to be little activity in the Yen since breaking to fresh yearly lows against the US Dollar. Look for global risk sentiment and price action in US equities to guide the direction here. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.AUDUSD – technical overview

Technical studies have turned up in recent months, after the market traded down to its lowest levels since 2003 in 2020. There is evidence of a longer-term bottom following the latest push back through 0.7000, though at this stage, there is risk for a deeper pullback to allow for shorter term studies to unwind. Setbacks should now be well supported ahead of 0.7400.AUDUSD – fundamental overview

The expansion of the Sydney lockdown has prevented the Australian Dollar from extending its recovery run. Sydney's lockdown has expanded to include 500,000 residents. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.USDCAD – technical overview

Has been in major decline since topping out in 2021 above 1.4600. At this stage, with the decline now well extended, the market is likely to find solid support into the 1.2000 area ahead of a resumption of gains. Ultimately, only a weekly close below 1.2000 would suggest otherwise. Back above 1.2500 will strengthen the outlook.USDCAD – fundamental overview

The ongoing surge in the price of OIL to fresh multi-month highs has unquestionably been a solid prop for the Canadian Dollar, with the Loonie managing to outperform against its peers on the back of this demand. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.NZDUSD – technical overview

The market has been very well supported in recent months and there is evidence of a longer-term base. Look for setbacks to hold up above 0.7100, with sights set on a run back towards the 0.7500 area.NZDUSD – fundamental overview

The New Zealand Dollar has been able to find bids on the back of a rates market that has pushed up the first RBNZ rate hike to February 2022, and on the back of a rise in residential mortgage lending. At the same time, offers have capped on medium-term sell interest. Key standouts on today’s calendar include German import prices, speeches from ECB Pannetta, ECB Guindos, BOE Haldane, Fed Williams and Fed Quarles, and Dallas Fed manufacturing.US SPX 500 – technical overview

Longer-term technical studies are looking quite exhausted and the market is showing signs of wanting to roll over after racing to another record high. Look for rallies to be well capped ahead of 4300, with a break back below 4000 to strengthen the outlook.US SPX 500 – fundamental overview

We're trading just off fresh record highs, and yet, with so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout and risk of rising inflation should weigh more heavily on investor sentiment into the second half of 2021.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs and an acceleration beyond the next major psychological barrier at 2000. Setbacks should now be well supported above 1600.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, and coronavirus fallout. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.