Next 24 hours: Dollar bid into North American Session

Today’s report: Commodities prices and inflation

News out of the Ukraine has slowed down and investors have mostly shifted their focus to surging commodities prices and inflation. All of this carries risk that increases the burden on central banks to be needing to be more aggressive with monetary policy normalizations at a time when investors still don’t believe the global economy can withstand such adjustments.

Wake-up call

- EZ growth

- downgrades outlook

- Yield differentials

- RBA Lowe

- strike resolved

- phase out

- Stocks vulnerable

- Dealers report

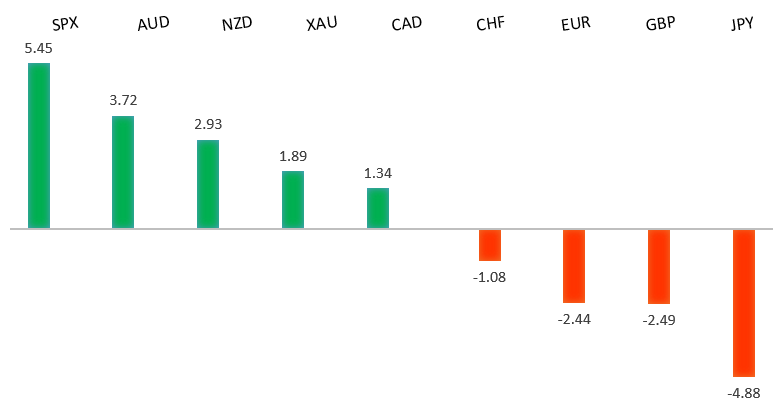

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- An Intriguing Safe Haven in the Middle of War and Pandemic, S. Ren, Bloomberg (March 23, 2022)

- The Cost of Greener Shipping, H. Dempsey, Financial Times (March 21, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The latest breakdown below 1.1100 to fresh multi-month lows now sets up the next major downside extension below 1.1000 towards the multi-year low from 2020 in the 1.0600 area. At this stage, it will take a push back above 1.1500 to force a shift in the outlook.EURUSD – fundamental overview

The Euro hasn’t been able to do much of late, with the single currency weighed down into rallies on a dovish ECB outlook. The central bank is seen resisting calls for rate hikes. ECB Villeroy has said the central bank should not overreact to the energy price volatility. Meanwhile, UBS estimates cost of extra spending resulting from the Ukraine war by EZ governments could total 2% of annual output. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market is in a correction phase in the aftermath of the run to fresh multi-month highs in 2021. At this stage, additional setbacks should be limited to the 1.3000 area ahead of the next major upside extension towards a retest and break of critical resistance in the form of the 2018 high. Back above 1.3835 takes pressure off the downside.GBPUSD – fundamental overview

UK inflation came in at its highest levels in thirty years, but this wasn't enough to support the Pound, this after the UK government downgraded the economic outlook. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.USDJPY – technical overview

The longer-term trend is neutral despite the recent run higher. Look for additional upside to be limited, with scope for a topside failure above 120.00 and bearish reversal back down towards the 100.00 area. It would take a monthly close above 120.00 to negate the outlook.USDJPY – fundamental overview

The Yen continues to get hammered to multi-month lows, with the worsening terms of trade and widening yield differentials with the US Dollar playing a major part. Moreover, the fact that stocks haven’t been hit has hard, is taking away from any Yen demand we might normally see in a risk off backdrop, further intensifying the Yen outflows. And adding more to the story is the Japanese government clearing a record budget. with additional stimulus also being considered to offset higher food and energy costs. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.AUDUSD – technical overview

At this stage, the market has found a bottom and is trying to work back to the topside. Ultimately, it will take a break back above 0.7600 to shift the focus back on the topside. A weekly close below 0.7000 will force a bearish shift.AUDUSD – fundamental overview

The Australian Dollar has held up well overall on demand for stocks and commodities, but has faced some selling pressure into this latest run higher. A lot of this coming from dovish RBA Lowe comments earlier in the week, after the central banker questioned whether inflation psychology was shifting, suggesting rates might stay lower for longer. Lowe also highlighted the decline in Aussie consumer confidence. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.USDCAD – technical overview

Finally signs of a major bottom in the works after a severe decline from the 2020 high. A recent weekly close back above 1.2500 encourages the constructive outlook and opens the door for a push back towards next critical resistance in the 1.3000 area. Any setbacks should be well supported into the 1.2200s.USDCAD – fundamental overview

The Canadian Dollar has been trying hard to recover in recent sessions on a round of strong Canada data in March including the jobs report, housing starts, manufacturing sales, existing home sales and retail sales. We're also seeing some demand creep back in on another hot Canada inflation print and as oil looks to find a bottom after a sharp correction lower. The resolution of the rail strike has only served as yet another prop. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.NZDUSD – technical overview

Setbacks have intensified in recent weeks with the market trading down to fresh multi-month lows. A recent breakdown below the 0.6700 area opens the door for a drop towards 0.6500 in the sessions ahead.NZDUSD – fundamental overview

Kiwi has moved higher in recent sessions on the back of ongoing demand for commodities prices and a resilient US equity market. The New Zealand government has also announced the phasing out of COVID restrictions. Key standouts on today’s calendar come from German, Eurozone and UK PMI reads, US durable goods and US initial jobless claims. We also get another round of scattered central bank speak.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. The latest breakdown below 4,272 opens the door for the next major downside extension towards 3,500. Back above 4,612 will be required at a minimum to take the immediate pressure off the downside.US SPX 500 – fundamental overview

With so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on easy money policy incentives and government stimulus, should no longer be as enticing to investors. Meanwhile, ongoing worry associated with coronavirus fallout, rising inflation, and geopolitical tension should weigh more heavily on investor sentiment in Q1 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1900.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about exhausted monetary policy, extended global equities, coronavirus fallout, inflation risk, and geopolitical tension. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.