|

|

27 July 2022 Crypto braces for FOMC impact |

| LMAX Digital performance |

|

LMAX Digital volumes were a little softer overall on Tuesday. Total notional volume for Tuesday came in at $340 million, 12% below 30-day average volume. Bitcoin volume printed $179 million on Tuesday, 29% below 30-day average volume. Ether volume came in at $125 million, 27% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,202 and average position size for ether at 2,302. Volatility has been showing signs of picking up off yearly lows. We’re looking at average daily ranges in bitcoin and ether of $1,225 and $123 respectively. |

| Latest industry news |

|

Things have been quiet in crypto over the past few sessions, and the price action is completely understandable heading into today’s event risk. We live in a world where crypto has been very much focused on all things global macro, and so, today’s decision will likely play a part in influencing direction. As things stand, the correlation that has been working well in 2022 is the positive correlation between risk sentiment and crypto. What this means is that any market reaction to the Fed which translates to higher US equities, is a reaction that should also translate to renewed demand for crypto. For this to play out, we believe the Fed will need to deliver a rate hike of 75 basis points or lower, while communicating some form of a message that leans a little more to the accommodative side. If the Fed Chair hints at a top to rate hikes, or suggests we could see less aggressive hikes going forward, we believe this should serve to prop risk assets, and crypto by extension. If on the other hand the decision is perceived to be more hawkish leaning, by way of a 100 basis point rate hike, or a 75 basis point rate hike accompanied by a message that more rate hikes like this can be expected in the future, we suspect we should see downside pressure in stocks and a concurrent wave of downside pressure on crypto assets. |

| LMAX Digital metrics | ||||

|

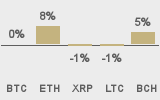

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

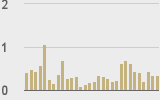

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

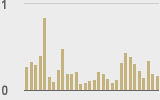

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@mdudas |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||