Next 24 hours: Recession fears and geopolitical tension

Today’s report: Dollar lower, stocks lower

US economic data was softer on Monday, fueling those fears of recession and opening more downside pressure on the US Dollar given the implication that this will keep the Fed from raising rates more aggressively.

Wake-up call

- USD selling

- BOE week

- Fed repricing

- RBA decision

- oil slump

- macro flows

- Stocks vulnerable

- Dealers report

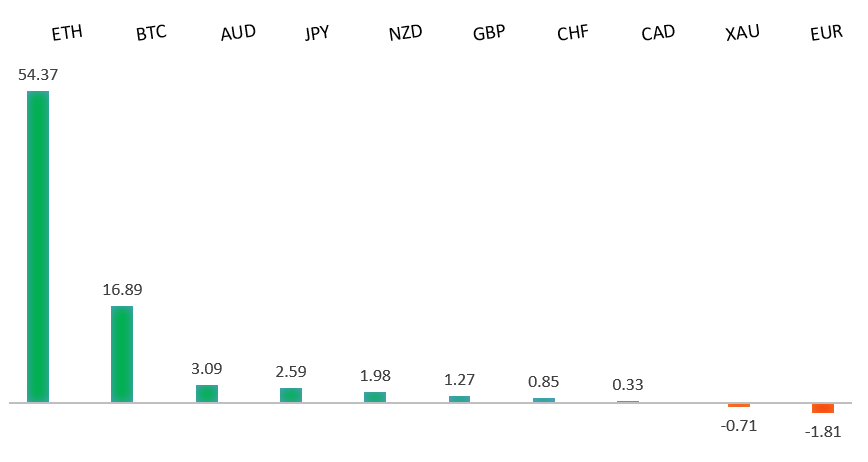

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- Big Oil’s Changing Priorities, L. Denning, Bloomberg (August 1, 2022)

- Could Protectionism Make Food Insecurity Even Worse?, B. Barkin, FT (July 28, 2022)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The market has come under intense pressure in recent months, with setbacks accelerating below the critical multi-year low from 2017 at 1.0340. This sets up a test of monumental support in the form of parity. At the same time, technical studies are tracking in oversold territory, suggesting additional setbacks should be limited. Back above 1.0500 would be required to take the immediate pressure off the downside.EURUSD – fundamental overview

The Euro has been trying to make its way back to the topside over the past several sessions. Soft German retail sales and on the whole discouraging PMI reads across the zone haven't helped the Euro's cause, though we have seen plenty of support on broad based US Dollar selling. Recession fears and geopolitical risk have been behind a lot of this latest wave of Dollar outflows. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.EURUSD - Technical charts in detail

GBPUSD – technical overview

The market continues to be exceptionally well supported on dips below 1.2000. Unless we see a monthly close below 1.2000, we expect this to continue to be the case. Look for this latest break back above 1.2200 to strengthen the case for the establishment of a meaningful base.GBPUSD – fundamental overview

The Pound continues to show signs of wanting to recover, with the currency extending the recovery to its highest levels in more than a month. A lot of the flow has been attributed to broad based US Dollar selling, though we have also seen demand in anticipation of a hawkish leaning BOE communication later this week. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.USDJPY – technical overview

Technical studies are in the process of unwinding, with scope for additional correction in the days and weeks ahead. Look for additional upside from here to be well capped. Next key support comes in at 131.49.USDJPY – fundamental overview

We've seen a resurgence in demand for the Yen in recent sessions. Most of this price action comes from position adjusting from shorter-term accounts following a massive decline in the Yen. There has also been a round of position adjusting in favor of the Yen on hotter Japan inflation data, and as the market reprices Fed rate hike expectations in the aftermath of last week's FOMC decision and softer US GDP. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.AUDUSD – technical overview

Overall pressure remains on the downside and conditions remain quite choppy. A break back above 0.7070 would be required at a minimum to take the immediate pressure off the downside. Until then, scope exists for deeper setbacks towards 0.6500.AUDUSD – fundamental overview

The Australian Dollar ran higher in Monday trade, extending its recovery, mostly on the back of broad based US Dollar outflows. Aussie markets were thin on account of a holiday closure. We also saw some Aussie demand ahead of today's anticipated RBA decision. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.USDCAD – technical overview

A recent surge back above 1.3000 signals an end to a period of bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.3500 area. Setbacks should be very well supported down into the 1.2500 area.USDCAD – fundamental overview

Monday trading volumes were thinner in the Canadian Dollar on account of a holiday closure. But this didn't stop the Canadian Dollar from selling off on a sharp pullback in the price of oil and lower stocks. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.NZDUSD – technical overview

Overall pressure remains on the downside and conditions remain quite choppy. A break back above 0.6400 would be required to force a shift in the structure and suggest we are seeing a more significant bullish reversal. Until then, scope exists for fresh yearly lows and a retest of the major psychological barrier at 0.6000.NZDUSD – fundamental overview

The New Zealand Dollar has been better bid of late, getting help from US Dollar outflows and a US equities recovery post FOMC decision and softer US GDP. We've also seen demand from on the whole better than expected New Zealand data. Key standouts on Tuesday’s calendar include the RBA decision, US JOLTs job openings, and a Fed Evans speech.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. Back above 4,206 will be required at a minimum to take the immediate pressure off the downside. Next major support comes in around 3,400.US SPX 500 – fundamental overview

We've finally reached a point in the cycle where the Fed recognizes unanchored inflation expectations pose a greater downside risk than over-tightening. This is significant, as it means less investor friendly monetary policy that risks potential recession in the months ahead. And so, naturally, stocks have been under intense pressure in 2022.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1700 on a monthly close basis.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.