|

|

30 November 2022 Month end reflections |

| LMAX Digital performance |

|

LMAX Digital volumes continue to struggle as we get set to close out what was a difficult month for the space. Total notional volume for Tuesday came in at $200 million, 48% below 30-day average volume. Bitcoin volume printed $109 million on Tuesday, 51% below 30-day average volume. Ether volume came in at $46 million, 58% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,670 and average position size for ether at 2,418. Volatility has however slowly picked up in recent weeks, with the market pushing out from yearly and multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $645 and $72 respectively. |

| Latest industry news |

|

November was another ugly month for cryptocurrencies. Bitcoin and ether both took big hits, with bitcoin down as much as 25% and ether down as much as 32%. Most of the bearish price action came from troubles within the space, highlighted by yet another implosion, this time in the form of the FTX meltdown. FTX has certainly been the highest profile crypto meltdown to date, and as we get going in December, we believe the market will be wanting to continue to proceed with caution, as it assesses the extent of whatever ripple effect, contagion risk there still might be to the system. We think it’s worth highlighting the fact that things could have been significantly worse for the crypto space in November had equities not performed as they did. The resurgence in demand for traditional risk assets was a big help for crypto when considering how the crypto market has correlated with traditional market sentiment in 2022. The softer inflation reads out of the US had a lot to do with this turnaround in global markets, with investors feeling better about the prospect this would translate to less aggressive, more investor friendly monetary policy going forward. Whether or not this proves to be the case is an entirely different question, and one we believe is deserving of serious consideration. What’s clear is that one round of inflation data shouldn’t be enough to suggest we are seeing the top in inflation. After all, in the many years following the financial markets crisis of 2008, inflation was consistently subdued. During that time there were occasional one-offs where inflation data was above forecast. But this didn’t mean we were seeing a shift in the trend. And so, now that the trend is one where inflation is shooting higher, it would be premature to conclude the latest inflation data is indicative of peak inflation. What this means is that we could be in store for another wave of risk reduction in global markets, which in turn, could once again weigh on crypto assets. We believe it’s likely that most of the tail risk associated with the FTX implosion has been properly assessed and no longer as much of a threat as many had feared. And while we still expect some more fallout, we believe we will be getting back to a place where the focus will mostly shift back towards downside pressure on prices from global macro flow rather than from crypto specific negative drivers. Ultimately, we also believe that we are getting closer to a point where we will start to see a disconnect in the correlation of risk off in global markets translating to weakness in crypto. The longer-term value proposition of decentralized finance, bitcoin as a store of value asset and ether as the future of web3 innovation will be too difficult for market participants to ignore at such discounted valuations. As highlighted in our technical overview, we still see the potential for an additional decline in the price of bitcoin to the $10k area. But at that point, we believe the picture will start to brighten in a big way. |

| LMAX Digital metrics | ||||

|

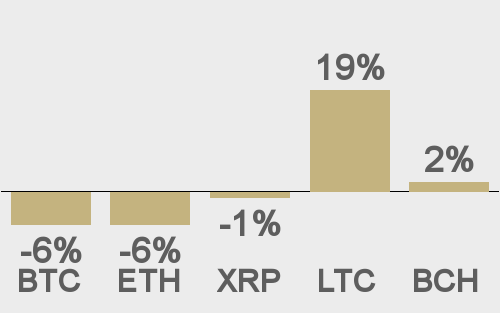

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

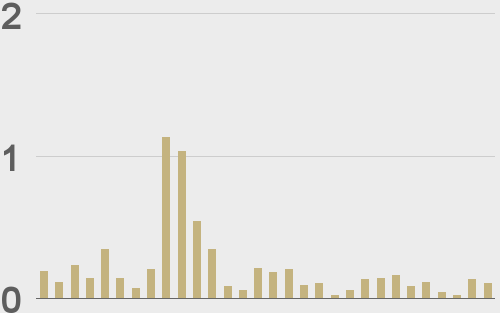

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

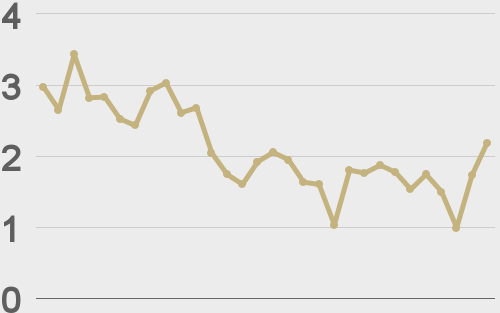

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||