|

|

13 July 2023 About correlations with traditional markets |

| LMAX Digital performance |

|

LMAX Digital volumes picked up in a healthy way on Wednesday. Total notional volume for Wednesday came in at $481 million, 33% above 30-day average volume. Bitcoin volume printed $307 million on Wednesday, 41% above 30-day average volume. Ether volume printed $135 million, 35% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,590 and average position size for ether at 2,728. Volatility has been trending lower in recent days after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $853 and $56 respectively. |

| Latest industry news |

|

In our Wednesday update, we talked about potential crypto volatility risk around the US CPI report. We highlighted the fact that there have been periods of added sensitivity to movement in traditional risk assets, and walked through how we saw things playing out. In the end, we were actually more impressed with the reaction in crypto markets than what many might think. Why? Well, we believe this correlation between crypto and risk assets is not a correlation that should hold up over time and as crypto matures, the correlation should completely break down. The idea that bitcoin should be declining in risk off markets is an idea that shouldn’t hold up when talking about a limited supply, store of value asset. In fact, one could even argue that bitcoin should decline in a risk on market reaction, as money flows out of safety assets. On Wednesday, we got a taste of this. US CPI came in soft. Traditional risk assets rallied sharply. Bitcoin sold off. And so, the correlation with risk assets did not hold up and crypto markets were left trading on their own fundamentals. This is a positive sign, if even for a moment, and sends a message that the asset class is indeed maturing. Of course, there were other reasons assigned to the sell-off in crypto. Some market participants saw crypto coming under pressure on the news a US government wallet that had seized bitcoin from the Silk Road hack had transferred 9,000 bitcoin, presumably in the interest of selling it. Whatever the case, crypto continues to hold up well on dips and has outperformed all other major asset classes in 2023. One of our biggest concerns over the coming weeks and possible months is risk associated with a meltdown in US equities. But if we start to see more price action like we saw on Wednesday, this could encourage the possibility that if we do see a massive wave of risk off flow in traditional risk assets, it may not act as a drag on crypto as it has done in the past. Who knows? Maybe we even see bitcoin rallying during the next downswing in US equities. |

| LMAX Digital metrics | ||||

|

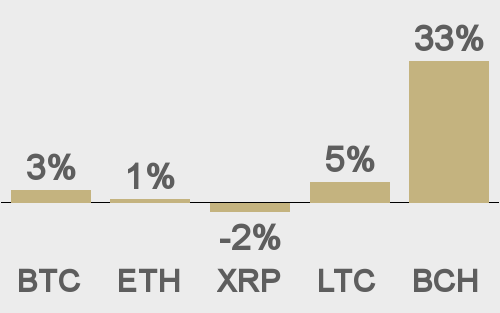

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

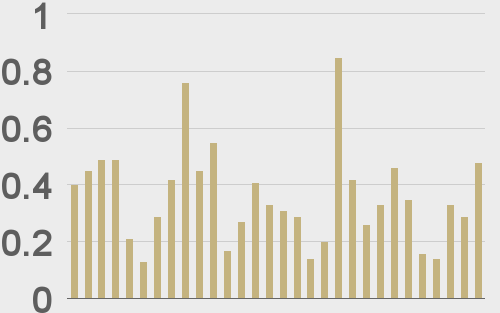

Total volumes last 30 days ($bn) |

||||

|

||||

|

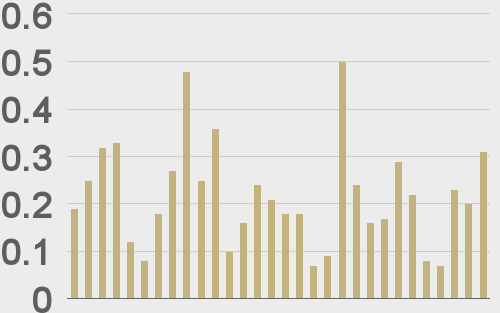

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

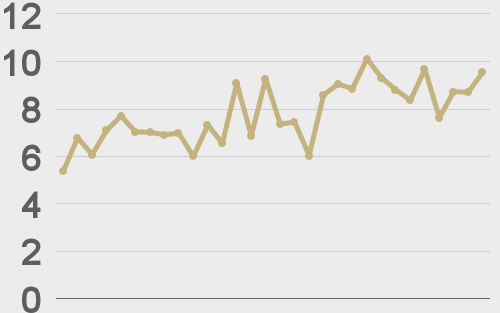

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

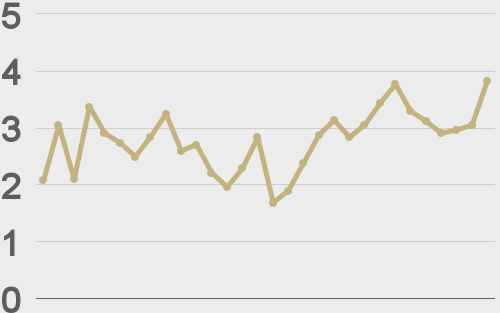

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||