|

|

28 September 2023 More pushback from US lawmakers against SEC |

| LMAX Digital performance |

|

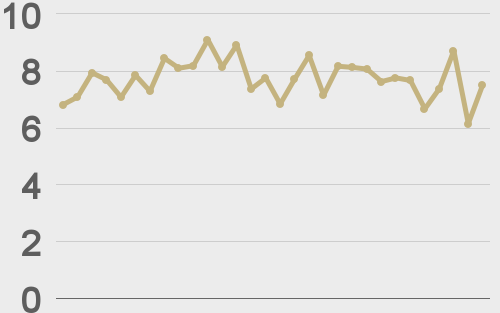

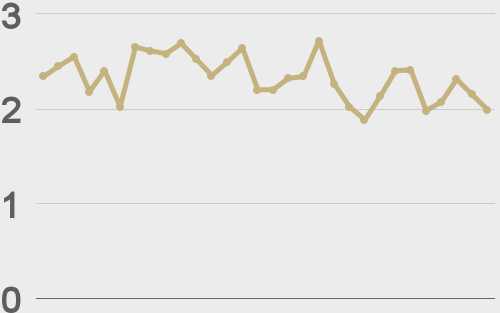

LMAX Digital volumes picked back up on Wednesday. Total notional volume for Wednesday came in at $253 million, 24% above 30-day average volume. Bitcoin volume printed $156 million on Wednesday, 16% above 30-day average volume. Ether volume came in at $72 million, 40% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,689 and average position size for ether at $2,314. Volatility is back to trending lower, towards August multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $582 and $36 respectively. |

| Latest industry news |

|

Bitcoin continues to hold up well in the face of a wave of risk off flow in global markets. We did see some selling off the Wednesday highs on the news of the SEC delaying Ark Invest and Global X’s spot bitcoin ETF applications well in advance of their deadlines. The market was discouraged by the news as it reduced the odds of an ETF approval before year end. But ultimately, there was plenty of demand into the dip, especially with US lawmakers starting to push back against the SEC, urging it to approve the spot bitcoin ETF applications. There was also optimism around an expected approval of Valkyrie’s bitcoin and ether futures ETF product. Overall, there is plenty of demand from institutional players to take on exposure to crypto assets, and the market believes it will only be a matter of time before the flood gates are opened. Looking ahead, the market will be focusing on today’s batch of US economic data which features GDP, initial jobless claims, and pending home sales. There is plenty of worry around stagflation risk, and if the economic data comes out on the softer side, it could fuel more broad based US Dollar demand and downside pressure on risk assets. As things stand, bitcoin has held up exceptionally well throughout this wave of global risk liquidation and US Dollar inflows. We suspect this could translate to a pick-up in demand, when the US Dollar starts to come back under pressure and stocks stabilize. We’re also heading into an October month which in contrast to September, has produced solid historical returns for bitcoin. |

| LMAX Digital metrics | ||||

|

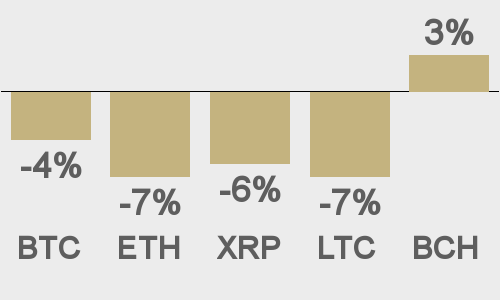

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@_GovtTracker |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||