|

|

19 October 2023 Fidelity files amendment to spot bitcoin ETF application |

| LMAX Digital performance |

|

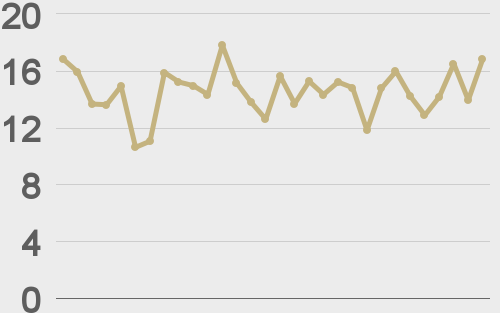

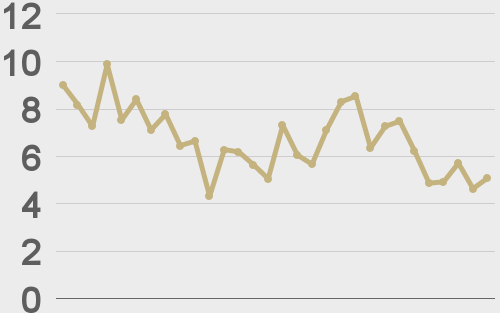

LMAX Digital volumes have been healthy all week and were up again on Wednesday. Total notional volume for Wednesday came in at $278 million, 25% above 30-day average volume. Bitcoin volume printed $201 million on Wednesday, 38% above 30-day average volume. Ether volume was however lower, coming in at $46 million, 21% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,821 and average position size for ether at $2,498. Volatility has been showing signs of picking up, but overall, continues to consolidate off August low levels. We’re looking at average daily ranges in bitcoin and ether of $719 and $42 respectively. |

| Latest industry news |

|

The tension in the Middle East has consumed global markets, with the economic calendar and other developments taking a backseat. Bitcoin has mostly been consolidating the latest run of gains, which coincided with a surge in the price of gold. The key takeaway here is that there are some very clear correlations between bitcoin and other store of value assets, something that should already be clear given bitcoin’s attractive properties. The further along we get with respect to the growth and maturity of bitcoin as a credible asset, the more we expect market participants will look to take on exposure to bitcoin as a legitimate store of value alternative in portfolios. What makes all of this even more interesting is the expected SEC approval of bitcoin spot ETFs, which should usher in a mass wave of institutional adoption. When this happens, we suspect many portfolio managers will look to diversify some of their gold exposure into bitcoin. If even a fraction of this gold exposure is converted to bitcoin, it will have a major bullish influence on the price of bitcoin. As far as developments around an SEC approval of a bitcoin ETF go, Fidelity has just come out filing an amendment to its proposed spot ETF, with the asset manager outlining how it will safeguard customer bitcoin in custody accounts, while disclosing other risks associated investment in the crypto space. |

| LMAX Digital metrics | ||||

|

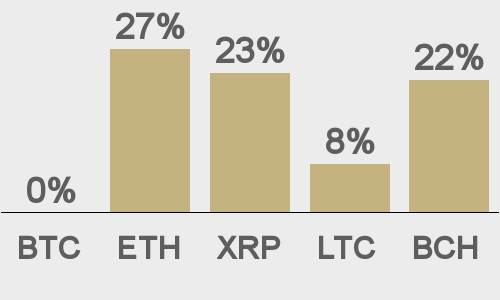

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

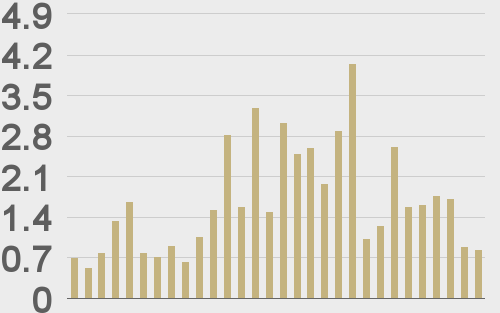

Total volumes last 30 days ($bn) |

||||

|

||||

|

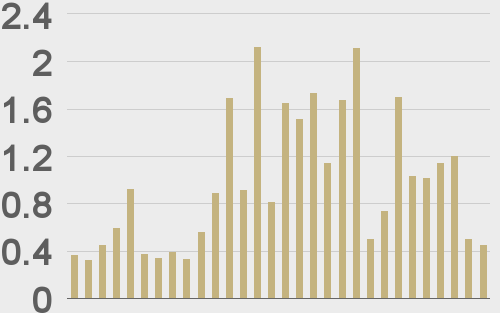

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||