|

|

11 April 2024 Is the market finally waking up to the value proposition? |

| LMAX Digital performance |

|

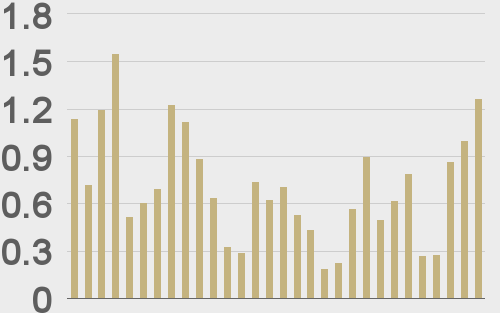

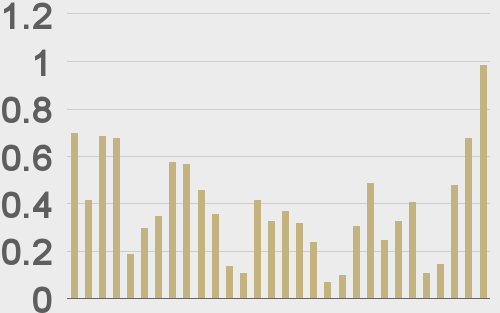

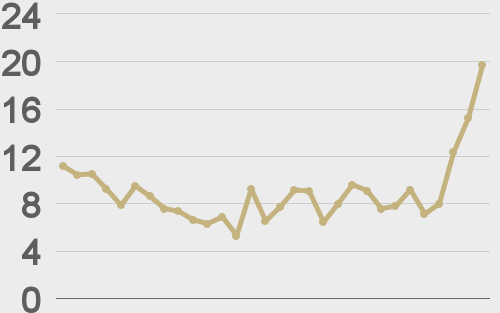

LMAX Digital volumes have been getting stronger and stronger by the day this week. Total notional volume for Wednesday came in at $1.3 billion, 77% above 30-day average volume. Bitcoin volume printed $988 million on Wednesday, 156% above 30-day average volume. Ether volume came in at $168 million, 18% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,154 and average position size for ether at $4,694. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,115 and $190 respectively. |

| Latest industry news |

|

The big takeaway into Thursday is just how resilient bitcoin and crypto assets have been overall in the face of a hot US CPI print that resulted in broad based US Dollar demand and risk off flow in traditional markets. There has long been an assumption of bitcoin correlating with risk assets. Indeed, bitcoin has benefitted as a risk correlated asset since inception because it is a new, emerging, maturing asset. But the reality is that the more bitcoin is adopted and the more it matures, the more it will be appreciated for what it truly is, which is a store of value asset. Look no further than bitcoin’s super attractive properties of security and scarcity. And after seeing bitcoin hold up so well on Wednesday in the aftermath of the intense risk off flow in traditional markets, we believe we’re getting a glimpse of the market getting turned on to bitcoin as a safe haven asset. We also highlighted the overall strong performance in crypto assets beyond just bitcoin. This has been even more impressive when considering the more legitimate correlation these other crypto assets share with risk sentiment. But we believe these assets are benefitting from the bitcoin bid factor, while also finding demand on the bet of the future of technology and innovation for digital assets. Of course, this isn’t to say that we won’t see more turbulence in crypto markets in 2024. We fully expect this to be the case. What we are saying is that we do expect any setbacks to continue to be exceptionally well supported for higher lows and fresh record highs. |

| LMAX Digital metrics | ||||

|

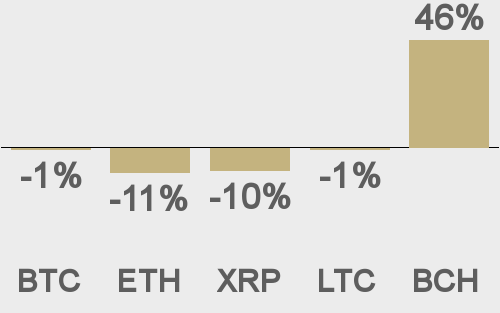

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

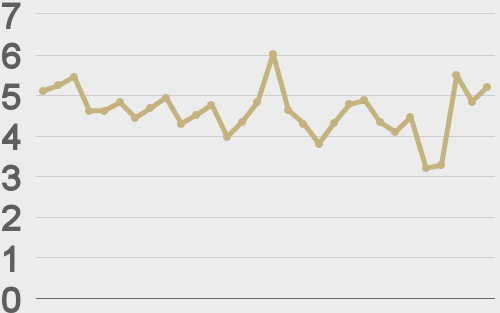

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@nishantkumar07 |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||